Below is my article published in Business Mirror(

http://businessmirror.com.ph/) last Friday, November 9, 2007, page 10,Opinion section. Can't get the url for that day though.

Why a $100/barrel oil price and various petroleum taxes don’t mix

Bienvenido S. Oplas, Jr. *

November 7, 2007

Oil price, like the price of any other commodities and services, is driven mainly by the dynamics of supply and demand. High demand relative to supply means prices will go up. High supply relative to demand means prices will go down. And there are dozens of factors that determine both supply and demand. For instance, when millions of newly-riched Chinese and Indians, plus other people around the world buy new cars, then demand goes up. When oil producing-countries (OPEC or non-OPEC member-countries alike) pump more oil, and there are no supply disruptions (meaning no oil refinery or oil pipeline is blown up by bombs or knocked down by hurricanes), then supply goes up. But even if crude supply increases but oil pipelines are blasted, like the attack on pipelines in Yemen the other day, then supply can still go down, adding fears to oil consumers and traders, which further push prices up.

On Wednesday, world oil prices hit $97 a barrel, or just $3 away from the symbolic 3-digit level of $100 a barrel. This is partly due to the fact that despite continuing world oil price hikes in the past few months, world demand does not decline, staying at 85 million barrels a day on average.

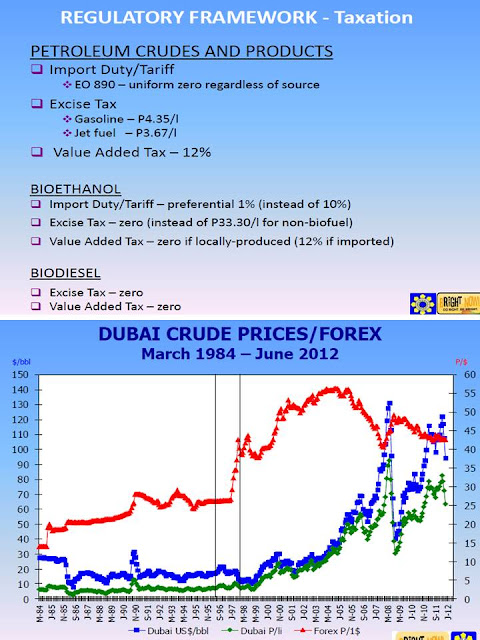

Should oil prices finally reach $100 a barrel and stabilize there for say, one month, if not rise further, then it should be the right time for governments to cut petroleum taxes. In the Philippines there are at least 3 direct taxes slapped on petroleum products -- import tax (3%), excise tax (more than P5/liter for gasoline), and value-added tax (12%). Not included here are taxes slapped on companies that refine, distribute, and sell (wholesale and retail) oil.

The Philippine government says it is lukewarm to reduce or abolish the import duties. The DOE and DOF leadership say doing so will deprive the state of some P450 million/month in revenues while the people will only save around P0.23/liter. But what if a motorist, say a taxi driver, is consuming 60 liters a day or more, that’s a savings of around P14 a day. And there are more than 35,000 taxi units in Metro Manila alone. Another way of looking at this is that if the government will abolish the import duties, then the Filipino people will have P450 million/month of additional money in their pockets.

The continued imposition of excise tax on petroleum products is a callous decision. Excise tax is slapped on so-called “public bads” – petroleum (causes pollution), tobacco and alcohol products (can cause diseases to people). But is petroleum a “public bad”? People who do not want pollution from petroleum products should ride carabaos, horses or bicycles. A few people do this, but the majority can not. The use of petroleum to power vehicles that move people and their goods and services over far away places, is as necessary as food, clothing and shelter. Thus, abolition, or at least drastic reduction, of excise tax on petroleum products should be another measure that government should consider if it is honest in saying that it cares for the people.

The 12% VAT on oil products is possibly the only tax that can be retained. A zero import tax, zero excise tax, and 12% VAT, should be the best compromise between the public and the state to cushion an ever-increasing world oil prices without depleting the state’s coffers.

-------

I got 3 comments from 3 friends on my article above.

(1) From a friend working in Saudi Arabia, Lorrie Gallego. He wrote:

”You are correct Noy, Reduce taxes, reduce the number of congressmen, reduce the number of government employees!

”On supply and demand stats on oil, I remember between 1982 and 1985 Saudi Arabia was producing about 2.3 million barrels of oil per day. The price of crude at that time was ranging from 14 to 19 dollars per barrel. Now Saudi Arabia is producing around 9.5 million barrels per day and the price of oil is almost 100 dollars per BBL. In the last two years the world demand (or actual consumption) for oil remains around 84 million BBLs per day, but the price of oil went up from around $60 two years a go to near $100 now. Parang hindi proportionate ang price increase sa increase ng demand.

”Saudi Arabia's target production is 12 million barrels per day by 2009, and other middle east countries are drilling more oil wells too to increase their share of the oil supply. But I will predict that it will not take another decade before oil price will cross the 150 dollar per barrel mark.”

(2) From Ron:

“Noy, how about substituting petrol with nat gas or other 'green' alternatives? seems that phils do not consider this. jakarta has been using nat gas in some public transport, particularly their controversial busway system.”

(3) From Wyn:

“Then your point is to reduce if not eliminate big government taxes on petroleum. While this would be an immediate salve to our economic problems, i disagree. :) For the reason that fossil fuels are a fixed and diminishing resource. We can argue about when "the oil will run out", but run out it will.

Given that, i'd tend to support heavy penalization (thru taxes) of use of petroleum. Sure, it's *very* painful in the short run, but either we learn to curb our "oil appetite" gradually, or get a really rude shock sometime in the future.

Despite its immediate impact on our people, i believe that a stringent, penalizing energy regime is the way to go. It will teach us to pay attention to the (non-renewable) energy that we use and encourage development and use of renewable sources.”

Below are my reply to them.

(1) For Lorrie:

Thanks Lorrie for the additional information. Yes, $100 a barrel might be "expensive" for some people, especially the car owners. But other people who have never driven a car all their lives, they have been riding horses or bicycles only (like the millions of Chinese and Indians), now own a car, so what if the price of oil is $130 a barrel or more? The freedom of moving anywhere one wants to, along with his family and/or friends, can be priceless. Besides, they don't intend to use their car everyday, they can take the public transpo or their bicycles for their weekdays use. But on weekends or holidays or on special occasions, they need their car to tour their family, relatives or friends.

So it's not so much the price of oil as a result of supply-demand dynamics that's the issue. It's the hypocrisy of oil taxes, because the government that says it wants to help the price of oil "affordable" to the people, is the same institution that makes the commodity more expensive.

As I have argued in my paper, a 12% VAT on oil and leaving import tax and excise tax at zero should be fair to both the state and the Filipino consumers. But listen to what government officials will say -- they will not forego collections from import tax and excise tax, because they need the money to "help the people". So you can see the hypocrisy.

(2) To Ron:

Substitution is always a possibility under a free market environment. For instance, I contract a consulting work with A Consulting, Inc., I'm not happy with the outcome, so I go to (substitute you with) B Consulting, Inc., simple. Problem is no matter what substitute you make -- green substitute, brown substitute, black or pink substitute, if the mentality in government is "tax and tax and tax", the price of whatever substitute to petroleum or other "non-green" commodities will still go up much higher than the equilibrium price of that commodity if plain supply-demand dynamics was left alone.

(3) To Wyn:

My point in advocating the drastic cut, if not abolition, of import tax and excise tax on petroleum products, while retaining the value-added tax on the same, is because Malacanang, the DOE, DSWD, Congress, and every bleeding heart policy-makers and NGOs in this country say they care for the people who complain of high oil prices. So they think of various measures to "cushion" the impact of high world oil prices. In short, everyone in the above-mentioned category think of the price of oil, and not so much about oil depletion (or "peak oil") in the long-term.

So, if high oil prices is the main problem, as those guys have defined it, then one solution to bring down oil prices is those tax cuts on oil products. They can retain the excise tax on beer, wine, gin and brandy, cigarettes and tobacco, fine, but they should cut the excise tax on oil products.

I have anticipated earlier that some guys who trumpet too much about global warming and energy conservation would come forward and say that one solution to reduce global warming (and oil conservation) is the retention, if not the doubling, of current oil taxes. And I don't like that scenario. If governments want to encourage substitutes to petroleum products, those "green" energy, they don't have to trumpet cute slogans. They just abolish (or at least drastically reduce) all direct taxes and regulations to companies that develop wind energy, solar energy, nat-gas, geothermal, hydro, other "renewable" energy sources. But have we heard any government in the world brave enough to do this? So far, it's 100-100, or 587-587, nada, nothing.

* See also