Chatting with some friends recently over priority measures we can do if we have the political power to do so, among the few policies we chose was low and flat income tax, leading to the ultimate abolition of income tax as the economy slowly adjusts to a small and limited -- but not zero -- government.

Digging further in my other notes outside of this blog, I found four papers I wrote in 2006-2007. Posting them below.

--------

(1) Flat tax is beautiful

May 9, 2006

Multiple rates and high personal income tax system in general, is distortionary and anti-entrepreneurship; it is confiscatory and it encourages cheating; and lots of cheating do happen as discussed in a paper that I and a friend, Rodolfo "Ozone" Azanza, co-authored entitled, "Flat is beautiful: Proving the feasibility of a 10% flat personal income tax in the Philippines".

The current personal income tax system in the Philippines is composed of 7 tiers, from 5% to 32%. The top rate of 32% applies to taxable income (net of exemptions) of more than P500,000/year (or US$8,930/year at P56/$). For the first P500,000 annual income, government will get 25%; incomes above this level, government will get 32%. While p500,000 per year may be big in 1997 when the tax reform law was made, these days it is not. The series of oil price hikes, the high inflation and interest rates, the increasing government fees and consumption taxes like the VAT hike, not to mention the high cost of corruptions in government, have chopped the real value of the people’s income.

So-called "progressive taxation" (the higher your income, the higher the percentage that will be taken by the state) is anti-entrepreneurial and hence, regressive. It is regressive because it penalizes hard work and performance.

Out of 32.3 million employed Filipinos as of April 2005, we just considered a 20 million gainfully employed Filipinos as potential tax base. We did not consider anymore the 8.4 million underemployed, and a few million working overseas and those employed in multilateral and foreign aid institutions, and foreign embassies in the country, them who are not subjected to automatic withholding taxes. From our computation, only about 1.8 million individuals are implied to have paid personal taxes to generate the Bureau of Internal Revenue’s (BIR) target of P107 billion ($1.7 billion at P56/$) in 2005. Now, if we assume 3 million individuals who paid personal income tax, potential collections this year should have been P178 billion, not P107, implying tax evasion of around P71 billion. The higher the tax base to be assumed (4 million, 5 million, and so on), the bigger the tax evasion to be seen.

We therefore propose a 10% flat personal income tax with no exemptions, for annual incomes above P40,000. The beauty and advantages of a flat tax system are as follows:

(1) It is easier to administer and compute since there are no exemptions allowed.

(2) It promotes fairness between the taxed individuals and those who are exempted, like the highly-paid employees and consultants of foreign aid institutions.

(3) In absolute amount, the rich still pays higher than the poor and thus, it is not regressive.

(4) It respects hard work and encourages entrepreneurship as fixed-income earners can save the de-facto “pay rise” from the tax cut.

(5) It will help expand collections from consumption-based taxes like VAT as savings from tax cuts is spent on more household needs.

(6) It will help reduce brain drain as take-home pay of employees planning to work abroad will be larger, while some foreigners who dislike high income taxes in their home countries will be attracted to come and work in the Philippines.

Finally; the proposal will reduce tax evasion. In general, the decision whether to pay the “right” taxes or evade paying them can be modeled as:

Tendency to evade taxes = high tax rates + perception of corruption and wastes in government – cost of bribing tax authorities – probability of being caught – severity of penalties if caught.

From the computations we derived, the tax base need to increase from around 3 million to only 4.3 million individuals paying personal income tax to generate the “revenue-neutral” BIR-projected collections of P107 billion in 2005, and around 5 million individuals to generate the projected collections of P124 billion in 2006. Again, this higher tax base is not impossible to assume since we are looking at 20 million potential individual tax filers, out of the 32+ million employed Filipinos. In short, a low and flat tax rate with high tax base will generate revenue-neutral, if not larger revenue collection, result.

To summarize, a flat 10% personal income tax system in the Philippines is feasible for the following reasons First, it will be attractive to the taxpayers given its respect for hard work and performance, is simpler to compute and comply with, resulting in a much larger tax base. Second, our computations shows a revenue-neutral, even higher revenue results, compared with actual and projected collections under the current multiple, high tax rates system. Third, potential entrepreneurial and economic growth will be large as millions of fixed-income earners burdened by high withholding taxes will have bigger take-home income, and bigger savings for their future investment projects. Finally, income tax cut coupled with cut in government bureaucracy results in a society that emphasizes greater personal freedom and responsibility, and lesser state taxation and welfarism.

1 Comment:

Bruce in Iloilo said...

Fighting corruption-- that is the biggest argument in favor a flat tax. The simpler government is the less corruption there is. The less choices that bureaucrats have to make, and the less those choices matter, the less they will be bribed.

No deductions to allow or disallow? No corruption.

No higher brackets into which you can be placed? No corruption.

Corruption should be a top concern on any government policy and that means a simpler, flater tax code.

--------

(2) Why income taxes can be abolished, VAT as main revenue source

May 11, 2006

Economic activities by productive individuals and enterprises always (a) create jobs, and (b) expand production of food, housing, clothing, transportation, other human needs. Hence, productive economic activities already serve welfare functions to society, and they should not be penalized with income taxes and bureaucratic licenses, permits and other paper work.

Income taxes (personal income, corporate income, franchise, inheritance and bequests, donations, and so on) can be abolished and consumption-based taxes, particularly value added tax or VAT, excise tax, among others, can be retained – even increased – to finance a small and limited government. If income taxes can be abolished, VAT can be increased up to 15% (from the current 10% in the Philippines, 12% by 2006), with agriculture products in their raw form as the only exempted sector; ie, all products and services, from hair cut to shoes, from medical check up to cars, will be covered by VAT.

A rich household that does not pay income taxes will still pay huge amount of taxes to the government. It will have 2 or more cars, so it will pay lots of VAT and excise tax on fuel products, pay annual vehicle registration tax, pay lots of VAT for the tires, spare parts, other accessories. A rich household will also have a bigger house, so it will pay lots of VAT in housing construction materials, furniture and appliances, for its big electricity, water and telephone bills.

A poor household will have no or one old car, so it pays no or little VAT and excise tax on petroleum products; it will have a small house, so it will pay small VAT for its few appliances and furniture, small electricity, water and telephone bills, and so on. The more-consumption, more-taxes principle, not only enables just and equal application of tax laws to all households, rich and poor alike, but also retains the “progressive” objectives of tax collections (ie, more taxes from richer individuals and households).

Will the national government’s revenue program be not adversely affected?

No. The World Bank’s estimate of informal sector (aka “underground economy”) of the Philippines is 43% of GDP. This is high relative to other Asian economies and other dynamic countries in the world. The main culprit for the high incidence of informal sector is the high and multiple taxes and fees, the many permits and licenses to secure, the many forms and paper work to fill up, with various government agencies, both national and local government units. So, abolition of income taxes, simplification of the remaining consumption-based taxes, reduction of bureaucratic red tape, would drastically reduce the incentives for people and businesses to remain in the informal sector.

To make some rough estimates of revenue performance under this proposal, I make two assumptions: First, reduction from 43% to 20%, of the share of informal economy to gross domestic product (GDP). And second, faster GDP growth of 15% to 20% nominal growth (vs. current 10% on average). GDP, by the way, is also computed as the sum of the gross value added (GVA) of agriculture, industries, and services. Or:

GDP = GVA Agri + GVA Industry + GVA Services

Projected GDP (nominal) in 2006 (under the current multiple taxes system) is around P6.1 trillion. Applying the 2 assumptions above, we shall have 80% of GDP from the formal sector (ie, 20% still in the informal sector), and around P7 trillion nominal GDP for 2007 (15% growth over 2006 GDP.

Taxable national income = (nominal GDP) x (formal economy)

= (P7 trillion) x (0.80) = P5.6 trillion

Projected collections from VAT alone = (taxable income) x (VAT rate; 15% proposal)

= (P5.6 trillion) x (0.15) = P840 billion.

But if nominal GDP growth will reach 20%, from the 2006 GDP base of P6.1 trillion, projected GDP 2007 will be P7.32 trillion. Taxable national income will be P5.86 trillion, and projected VAT collections will be P878 billion.

Projected total tax revenues from various sources (income taxes, VAT, import tax, excise tax, percentage tax, property tax, etc.) of the national government in 2006 is P874 billion. Tax collections for 2007 won't be much bigger than this.

Thus, there are many benefits to the economy, the citizens and government alike, under a regime of zero income taxes and simpler, higher VAT. Although the current policy of the Philippine government of expanding and hiking VAT while retaining the various forms of confiscatory income taxes is not healthy to the economy; it only further perpetuates unemployment and poverty.

--------

(3) Multiple tax capital of Asia

May 15, 2006

My country, sadly and unfortunately, is the "multiple tax capital of Asia".

Yes, the Philippines has the most number of business and regulatory taxes in the region, even surpassing socialist countries of China and Vietnam. Data is from the World Bank and the International Finance Corp. (IFC) which jointly published the "Doing Business in 2006: Creating Jobs"(www.doingbusiness.org, www.worldbank.org, www.ifc.org). The numbers seem scary for local businessmen.

The number of tax payments (national and local taxes) to be made in one year is 62! One can enumerate the usual taxes: corporate income tax, individual income tax withheld from officers and employees, value added tax, documentary stamp tax (there are about 2-3 dozens of documents subject to this tax), capital gains tax, dividend tax, financial transactions tax, vehicle registration tax, travel tax, import tax, excise taxes (petrol, alcohol, cigarettes, ...), final withholding tax (bank interest income, etc.), insurance premium tax, amusement tax, franchise tax, real property tax, property transfer tax, business permit tax, percentage taxes, and so on.

I think some of the dozens of other "government fees and charges" were also counted, like various government agencies' inspection fee, permit fee, registration fee, franchising and licensing fee, processing fee, clearance and certification fee, rental fee, fines and penalties fee,...

Now, these 62 various taxes imposed on medium-sized companies (average of 60 employees) would cost them some 46.4% of their gross profit. I think this cost does not include yet the salaries and travel allowances of the company staff which pays all these taxes to various national government agencies (NGAs) and local government units (LGUs). Also, the costs in hiring tax consultants (accounting, auditing, law, IT, other consulting firms).

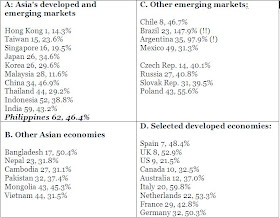

Compare the Philippines' 62 taxes to be paid in one year, that eats 46.4% of gross profit, with the number of taxes and fees imposed by governments of other countries. Figures correspond to number of business-related taxes, and taxes payable as % of their gross profit, respectively:

Now, for people who wonder why so many Filipinos would rather (i) leave and work abroad, (ii) become politicians and bureaucrats regulating and taxing other people, (iii) consultants and staff of foreign aid institutions getting high salaries and not subjected to confiscatory personal income tax, (iv) criminals protected by some "law enforcers", (v) professional and globe-trotting anti-globalist, anti-market activists, and (vi) other professions not related to entrepreneurship and business development -- this could be one of such answer.

This is not to find fault or blame all the above groups of people for their chosen profession. People respond to incentives and shy away from disincentives. If there are lots of disincentives to become entrepreneurs, people would find work and profession elsewhere. If there are lots of rewards and incentives to become tax-and-spend politicians, then many people would become politicians. Or if businessmen can save a lot if they bribe tax collectors and politicians instead of paying the "right" taxes, then many of them will do so.

Going back to the big VAT hike debate last year in the Philippines, I am wondering if those people and groups who supported the VAT hike realize how difficult it is for many companies and entrepreneurs already being slapped with more than 5 dozens of national and local taxes? It would have been easier if even if you have 5 or 6 dozens of various taxes, so long as those tax rates are small, like 10% personal and corporate income tax, 8% VAT, 0.1% doc stamp tax, P1,000/vehicle registration tax, and so on. But you have to put up with up to 32% personal income tax, 35% corporate income tax, expanded VAT that was raised to 12% (and even 14% 2-3 years from now), P2,000 to P5,000 vehicle registration tax, and so on. On top of these, there are new rounds of taxes to be invented in the coming years, like road user tax for private vehicles (on top of vehicle registration tax and petroleum tax).

--------

(4) On Zero income tax

July 22, 2007

A friend and fellow free marketer, Dr.Rene Azurin, wrote the column below in BusinessWorld newspaper last July 12, 2007. Rene teaches at the University of the Phils. College ofBusiness Administration (UP CBA), and recently wrote a book,"Stationary bandits", referring to government as the permanentbandits. I and PTU President, Mr. Vernie Atienza, were mentioned here. Inparticular, the paper that I presented last March in Makati, on the same subject.

STRATEGIC PERSPECTIVE

René B. Azurin

Zero income tax

'Zero income tax' has a nice melodic sound. It produces inme the same resonant vibrations as Toyota's 'zero defect' productionsystem and the environmentalist movement's 'zero waste' program. So,given the current hoohah over the BIR's latest failure to meet its taxcollection targets, it seems timely to propose that hard-to-collectincome taxes be now scrapped altogether and the revenue derivedtherefrom raised instead through easier-to-collect consumption taxes.This replaces a messy, susceptible-to-corruption system with asimpler, less discretionary one.

I have actually been suggesting this for many years now toany tax official who would listen so I was very glad to learn that myfriend and former graduate school classmate, Dr. Veredigno Atienza,has created an advocacy group to lobby for this to happen. The organization founded by Dr. Atienza is called the Philippine Taxpayers Union and it is affiliated with the World Taxpayers Associations, a movement now in 42 countries that grew "out of the desire of citizens to protect themselves from the increasing tax claims of the state." Ithink that is an excellent reason for citizens to band together.Taxes, after all, are forcible impositions made by those with power onthose without it. From a historical perspective, these are qualitatively no different from the tong extorted from people by the ancient predatory bandits who called themselves kings. In fact, taxes can be effectively looked at as the goods that the productive members of the community are compelled to give up in order to support the lifestyles of a non-productive group of individuals sometimes called politicos....

In a recent forum organized by Dr. Atienza, PTUSecretary-General Bienvenido Oplas Jr. presented a paper arguing for the abolition of income taxes and making consumption taxes the main source of government revenue. Principally, he argued that income tax collection is "very bureaucratic, discretionary, costly, and corruption-prone… (because) people do not want to divulge their true income… (and it is) cheaper to hire good accountants and lawyers and bribe revenue collectors than pay the full income tax liability." Additionally, Oplas argued that individuals and enterprises that engage in economic activities – by producing goods, services, and jobs– "already serve welfare functions in society… and they should not be penalized with income taxes and bureaucratic licenses and permits."

I agree completely. Taxes based on consumption are simpler to administer since these are collected from merchants and businesses which constitute a far smaller number than the number of individua ltaxpayers. Consumption taxes are also inherently fairer. The more you consume, the more taxes you pay. Moreover, this is more consistent with individual freedom because it allows each consumer to spend all that he earns in a manner that maximizes his satisfaction while still generating for the government the required amounts to fund support services. To address social welfare concerns, consumption tax rates can be set higher for non-essentials like cars and condos, and lower for essentials like food and medicine. Certain basic commodities like rice and galunggong can even be exempt from any consumption taxes whatsoever....

One might also argue however, as PTU does, that scrapping income taxeswill actually expand the total tax base and therefore allow a desiredtax take to be raised with not too high an increase in the prevailingrates of existing consumption-based taxes. The argument made is that zero income taxes will stimulate business investment, generate greatereconomic activity, and bring currently underground businesses (theso-called informal economy) out into the open. This can mean increased government revenues even with lower taxes per taxpayer. And there will be less corruption. In the end, this translates into faster growth for the economy as a whole.

So, citizens, let us band together and support this initiative. A zero income tax system is good for all of us. But not, maybe, for somepeople in government.

-------

See also:

Part 6: Income tax and VAT trade-off, February 08, 2010

Part 7: Rene Azurin, Peter Wallace, John Mangun, August 19, 2011

No comments:

Post a Comment