----------

The large-scale

mining sector is probably the most taxed

sector in the country. National taxes and fees include corporate income tax,

tax on stockholders dividends (local and foreign), excise tax, value added tax (VAT), capital

gains tax, documentary stamp tax, tax on bank interest, tax on interest payment

for foreign loans, vehicle registration tax, import tax for mining equipment

and heavy machineries, royalties to

indigenous communities, mine tailing fees and occupation fees.

The large-scale

mining sector is probably the most taxed

sector in the country. National taxes and fees include corporate income tax,

tax on stockholders dividends (local and foreign), excise tax, value added tax (VAT), capital

gains tax, documentary stamp tax, tax on bank interest, tax on interest payment

for foreign loans, vehicle registration tax, import tax for mining equipment

and heavy machineries, royalties to

indigenous communities, mine tailing fees and occupation fees.

Local

taxes include community tax, business permit tax, real property tax,

registration fees, occupation fees, other taxes and fees.

In

addition, big mining companies are also expected to provide various hard and

social infrastructures to the residents and workers of the mining area, on top

of the various taxes and fees to the national and local governments.

In

contrast, the small-scale mining

enterprises are minimally taxed and

regulated.

On top of

these, there were a few recent moves by the government that expands the

taxation base of big mining companies. One is the draft scheme by the Mining

Industry Coordinating Council (MICC) through the Department of Finance and the

Department of Environment and Natural Resources where big mining companies will

be taxed twice, first on the gross revenue and second, on the end of year net

income.

The other

is the Revenue Memorandum Circular (RMC) No. 17-2013 dated February 15, 2013,

saying that companies under the Financial or Technical Assistance Agreement

(FTAA) must pay taxes throughout the duration of their contract with the

government, and not just after the cost recovery period as provided under RA

7942 or the Philippine Mining Act of 1995.

These new

revenue measures are created to further tax the sector which many people believe

is “not taxed enough” yet and hence, endangers the environment.

Let us

review how valid is this statement.

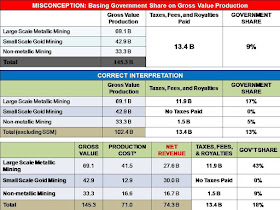

In 2010,

the different players in the mining sector paid P13.4 billion in various taxes

and fees to the government. There are different interpretations of what this

figure represents as share of the government, local and national.

The three

tables below collapsed into one image are from Dr. Artemio F. Disini, Chairman

of the Chamber of Mines of the Philippines (CMP) in his paper, Getting a

Fair Share: The Industry Perspective on Mining Taxation, presented at the Philippine

Economic Society (PES) 50th Annual Conference last November 27, 2012, held at the PICC, Manila.

I attended

that conference and the panel on mining taxation. The other speakers in the

panel were Shanaka Peiris, IMF Resident Representative to the Philippines,

Tristan Canare of the Asian Institute of Management (AIM), and Donna Gasgonia

of the UNDP.

Dr. Disini was saying that the actual contribution of the large scale metallic mining industry to the government coffers was not just 9 percent but 13 percent of gross value production, as the small scale mining (SSM) sub-sector does not pay any taxes, at least to the national government.

After

deduction of production cost, 60 percent for metallic and 50 percent for

non-metallic, the total taxes, fees and royalties paid to the government of

P11.9 billion in 2010 comprised 43

percent of the large scale mining companies’ net revenue.

This

government share of nearly P12 billion in 2010 alone and constituting nearly

one-half of big mining companies’ net revenue is big. It is hard to find other

sectors that are taxed this much.

Thus, the

statement that large scale mining is “not taxed enough” is not valid.

For one,

humanity benefits from mining because no mining and mineral products means no

modern life. From spoon and fork, nails and hammer, cellphones and laptops,

cars and airplanes, engines and buildings, all of these came from mining. A

mining expert Kennedy “Kori” Coronel aptly put it this way: “Everything that

humanity needs that cannot be grown, must be mined.”

So, a “No

to mining whatsoever” statement is a non-option. A corollary statement “tax

mining as prohibitively as possible” is next to non-option as this will drive

the legal, large and responsible mining companies and leave the country’s

mineral resources to the guerilla type small-scale mining enterprises that are

hardly taxed and regulated.

The appropriate

attitude for government and the rest of society is to keep taxation at the

minimum and go for full transparency and accountability of all mining

companies, from small to medium to large firms. Putting strict regulations and high

taxes only to large players but allowing small players that are often owned or

protected by local politicians to disobey those regulations do more harm than

good, to the environment, economy and society.

---------------

See also:

Fat-Free Econ 3: Mining and Environmentalism, March 15, 2012

Mining 3: Debates on Mining, March 17, 2012

Mining 4: EO 79 and the MICC, July 12, 2012

Mining 5: Benefits of Mining Even Without Taxes, December 09, 2012

Mining 6: Large Investments vs. Large Bureaucracies, February 19, 2013

'no to mining' po ba talaga ang sinusulong ng mga taong against the mining act of 1995?

ReplyDeletepaano naman po ang issue ng environmental justice? dahil kailangan nating mga tao ang natural resources para sa ating kaginhawaan, sisirain na natin ang mga ito?

it's good to have statistics, yet it's also good to see the real picture of what we say as 'responsible mining'. salamat po sa blog na to,

Hi, salamat sa comments. Re environmental justice, tingnan nyo na lang po ang sinulat ko about the case of Rio Tuba Nickel Mining in southern Palawan. Wala hong nasisira, walang erosion, walang mine tailings leak to the river. May 2 pictures akong pinakita doon -- Pasig River, sobrang dami ng eroded soil dinadala, wala namang mining. Rio Tuba River, may mining pero walang bahid ng soil erosion.

ReplyDeleteSo if statistics don't convince you, perhaps actual photos can. Salamat ulit,