At $40 billion a year of mining exports, the sector comprising 19 percent of GDP, it is indeed a major part of the Chilean economy. It is something that the Philippines can hope to replicate.

The northern part of the country is the mining region, especially Iquique region. This Chuquicamata, I saw this in facebook being circulated as an ugly face of mining because of the huge depression in land surface, the barren soil with zero vegetation, and the sight of "natural resources being taken away by big multinational mining companies." But this is Chile government-owned mining company.

Another state-owned mining company is El Teniente. From this computer graphics, new/current mine site and future site is going deeper. It's a nice graphics.

This is a private mining project, jointly operated by BHP (Australia), RTZ (UK) and JECO (Japan). This looks shocking and "very exploitative of the planet" in the eyes of many anti-mining activists. For some entrepreneurs though, this deep hole is perfect for a future lake and resort hotel with lots of water sports facilities or even ordinary fishing -- and create lots of jobs in the process.

There are nine major private mining projects in Chile, involving investors from Australia, Canada, Chile, China, Japan and UK. Now look at the huge investments until 2017, $67 billion, wow.

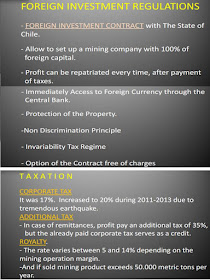

The legal regime for mining seems less complicated than in the Philippines. While the Chilean Constitution provides that the State has the absolute and exclusive dominion over the mines, the minerals may be explored and exploited with the private sector through Mining Concession. An exception to the Concession is that hydrocarbons can only be exploited by the State or Private Companies through a special Operating Contract granted by the State of Chile.

And it is the court, the judiciary, not an Executive agency like a Department or Ministry of Environment, or a Provincial or City government, that issues a mining concession, truly unique.

Obligation of the Concessionaire is simply the payment of an annual fee or tax, see below. In case of non payment, there are legal procedures for a public auction. In case there are no bids (or failure of bidding) to buy the concession, the concession is simply cancelled and the area is declared free. Cool and simple policies.

Foreigners are allowed 100 percent foreign equity, and profit can be repatriated anytime so long as taxes have been paid, really business friendly.

Corporate income tax, 20 percent vs. 30 percent in the Philippines. Ok, here are the other taxes, fees and royalties for big metallic mining companies in the Philippines. Horrible.

Environmental regulations in Chile: (a) Approval of Environmental Impact Plan, (b) Community Participation, (c) Mitigation Plan, to repair or compensate impact, and (d) Mine Closure Law in Congress.

Labor regulations, settlement of disputes: Chile is a member of International Center Settlement Investment Disputes (ICSID) in WashingtonDC. The country has signed more than 50

Bilateral Investment Agreement (BIT), with the Philippines in force since 1996. And here's a kicker: Foreigners can choose between local court or International Arbitration.

I think the DENR-MGB are aware of these policies in Chile and other countries like Australia. But the legislators and the many anti-mining activist groups are not. They need to study more, see the numbers more, before they make further political noise to further regulate and further tax the sector.

-----------

See also:

Mining 17: Palawan, Samar, Surigao and Mine Tailings, May 03, 2013

Mining 18: Nickel, Copper, Gold Production, May 09, 2013

Mining 19: Rule of Men, Not Weak State, May 13, 2013

Mining 20: Miscellaneous Comments on Mining, May 18, 2013

No comments:

Post a Comment