* This is my article in BusinessWorld last week, May 09, 2018.

Last Monday, I discussed business competition in general

and the role of the Philippine Competition Commission (PCC).

The theme will be continued in this piece and it will

discuss electricity competition in particular, especially after I was able to

interview PCC Chairman Arsenio Balisacan, the CEO of the Philippine Electricity

Market Corp. (PEMC) and Chairman of Transition Committee Oscar Ala and PEMC

Spokesperson Atty. Nino Juan.

The Electric Power Industry Reform Act (EPIRA) of 2001 or

RA 9136 has drastically liberalized the Philippines electricity sector with at

least three important provisions: (1) deregulation and demonopolization of the

power generation sector, (2) creation of the Wholesale Electricity Spot Market

(WESM), and (3) liberalization and demonopolization of electricity distribution

via Retail Competition and Open Access (RCOA).

With these and other provisions of EPIRA, the questions

to ask, among others would be:

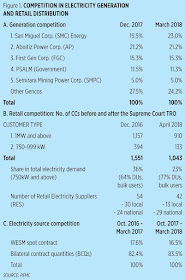

(1) Were there many private generation companies (gencos)

that entered the market competing with each other?

(2) Were there many retail electricity suppliers (RES)

that entered the market competing with each other?

(3) Were there many players, gencos and distributors,

that use the WESM spot market competition? And more importantly, (4) Have

electricity prices for consumers gone down?

The short answer is YES to all four questions.

For gencos for instance, before EPIRA, the National Power

Corp. (Napocor) was the state-owned power generation monopoly, which also

incurred huge losses and public debts for many years.

As of April 2018, there were 113 gencos in the

Luzon-Visayas grid alone and all of them are WESM participants. Excluded are

gencos in the Mindanao grid which is not part of WESM yet. Of these 113 gencos,

five players have become more efficient and more moneyed than others, except

perhaps the government-owned Power Sector Assets and Liabilities Management

Corporation (PSALM), which still owns previous Napocor-owned power plants,

mostly hydro facilities in Mindanao and the Malaya plant in Rizal.

For retail competition, the number of contestable

customers (CCs) or those with monthly peak demand of 750 KW or higher and have

the freedom to pick their own service providers — such as electric cooperatives

(ECs) and private distribution utilities (DUs) — have increased. RCOA

implementation however, has been issued an indefinite TRO by the Supreme Court

in February 2017 and this resulted in a decline in number of CCs.

Here are the numbers for comparative electricity prices

that include two types of customers, the captive market (small consumers who

must stay with their DUs or ECs) and contestable market (they can leave their

DUs or ECs and choose their own RES).

Contestable customers are able to enjoy lower average

prices, P6.91/kWh, than captive customers that pay an average price of

P7.78/kWh.

So there you see it.

Despite the noise created by certain sectors that EPIRA

and WESM are not working, which leads them to call for a return to the old

scheme of nationalization, these data show that indeed electricity competition

is working.

It is true that Philippine electricity prices in general

remain higher than most of our neighbors in the region but that is because of

other factors like (a) many taxes especially the high VAT of 12% applied in all

parts of the electricity supply chain, from generation to transmission,

distribution and supply, even the system loss; (b) many charges in our monthly

electricity bill including universal charge, system loss charge, feed-in-tariff

(FiT) for favored renewables.

The transition of PEMC, the market operator of WESM, into

a real Independent Market Operator (IMO) as explicitly specified in EPIRA may

soon become a reality.

As a result, there will be no more government energy

agencies and bureaucracies at the PEMC Board. Good work, PEMC Transition Team.

----------------

See also:

BWorld 205, Energy mix and wishful thinking, April 30, 2018

BWorld 207, Fare control and surge cap are wrong, May 10, 2018

Compare Energy Tariffs, Compare Gas and Electricity Prices Tariffs

ReplyDeleteCompare Energy Tariffs are in LLOYD ENERGY. Comparing cheap business electricity prices tariffs makes it easy.

compare energy tariffs

energy tariffs

compare electricity tariffs

compare gas and electricity tariffs

compare energy company tariffs

compare energy suppliers tariffs

compare electricity tariffs online

compare utility tariffs