* My article in BusinessWorld last August 8.

--------------

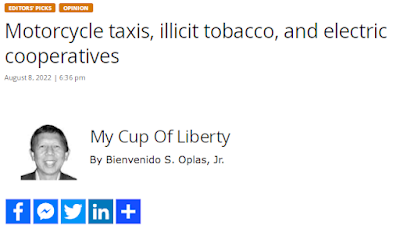

The first is high inflation driven by transport, alcoholic beverages and tobacco (ABT), and financial services.

Last Friday, the Philippine Statistics Authority (PSA) reported the July 2022 inflation rate at 6.4%, another four-year high from October 2018’s 6.9%. Transport and ABT are among the big inflation generators (Table 1).

From transport inflation of 18.1% July, the inflation rates of sub-components are:

1.) Operation of personal transport equipment, 48.1%;

2.) Passenger transport services, 7.2%;

3.) Purchase of vehicles, 1.3%;

4.) Transport services of goods, 0.3%.

MOTORCYCLE TAXIS AND LTFRB

As shown in the numbers above, the cost of operating personal transport like cars was very high, 48% in July due to higher gasoline and diesel prices.

Last week, there was this report in BusinessWorld: “Grab PHL says MOVE IT acquisition compliant with rules” (Aug. 8). This is good news.

Currently there are three motorcycle taxi (MCT) companies in the Philippines — Angkas, Joyride, and Move It. The latter is the smallest with just a few hundred drivers, while the first two have at least 15,000 drivers, the cap per player imposed by the Department of Transportation (DoTr) Technical Working Group that includes the Land Transportation Franchising Regulatory Board (LTFRB). The acquisition by Grab PHL of Move It will have many benefits for the public.

One, commuters will have more options, more convenience with three large MCT players to choose. Long lines of people queuing for a ride will be cut shorter.

Two, thousands of new drivers will be on-board — not hired as it is not an employer-employee arrangement. More drivers mean more MCTs to serve the riding public.

Three, there will be more competition as the virtual duopoly by Angkas and Joyride will be broken. So, there will be more competition in technology/apps, better services, more competitive fares, more passenger convenience and safety.

Four, traffic will ease as more people leave their cars or motorcycles at home and take public transportation. MCTs will help provide the “first mile” house-to-train/bus station, and “last mile” train/bus station-to-destination. And reverse back going home.

Five, the overall inflation rate will be tempered when inflation in transport, especially in operation of personal transportation, is reduced. And people will have more savings.

To further increase competition and passenger convenience, Transportation Secretary Jaime J. Bautista and LTFRB Chair Cheloy Velicaria-Garafil should consider removing two caps — remove the maximum number of MCT players from only three, and remove the maximum 15,000 drivers per player. At a maximum of 45,000 legal drivers, it is very likely that the number of unregistered “habal habal” drivers may be twice or more than that number nationwide. Since they are already existing, they should be onboarded via legal MCT companies, for better regulatory transparency and better passenger safety.

If the two caps are removed, it is estimated that at least one million rides daily can be served by MCTs. Secretary Bautista comes from the air transportation sector where there are no caps on flights per destination per day or per month, so he can appreciate the need to remove the caps on the number of players and vehicles in land transportation.

More restrictions mean less choices, and more suffering for the public. More competition means more choices, and less suffering for the commuters. More and faster mobility of people and goods means more economic growth, more businesses and job creation, and lower inflation.

TOBACCO TAXES AND ILLICIT TRADE

Last week, Budget Secretary Amenah F. Pangandaman reiterated that they will submit Budget 2023 to Congress on Aug. 22. The thick documents include projected tax revenues and other measures to fund the government’s huge expenditures, including sin taxes.

Eight years ago, now Finance Secretary Benjamin Diokno wrote a column, “Illicit trading of cigarettes rising” (Manila Speak, Oct. 9, 2014; reprinted in one of his four books, Through the Looking Glass, published 2020). He cited Oxford Economics’ estimates of tax losses from illicit cigarettes: P2.62 billion in 2012, and P15.60 billion in 2013. The estimated number of illicit cigarettes was 6.4 billion sticks in 2012 and 19.1 billion sticks in 2013, an almost 200% increase in just one year.

Last April, I attended a webinar organized by the National Tobacco Administration on illicit tobacco and Congressman Jericho “Koko” Nograles was one of the speakers. He shared Euromonitor’s estimates of illicit tobacco as a share of total supply: Nationwide 13%, Zambales 11.5%, Nueva Ecija 22%, Bataan 32%, Palawan 25%, Sultan Kudarat 36%, Zamboanga de Sibugay 51%, Misamis Occidental 57%, some areas of Mindanao up to 60%.

Mr. Nograles’ estimate of foregone revenues from illicit tobacco nationwide is P26 billion/year. In March 2021, Congressman Joey Salceda released his estimate of tax losses from illicit tobacco at P30 billion/year. These are huge amounts that benefit the smugglers, and criminal gangs in cahoots with some corrupt government officials, both national and local.

To verify the numbers of the two legislators, I made my own estimate, taking off from the Euromonitor estimate of 13% illicit cigarette share to total supply, meaning 87% is legal tobacco. The numbers I got range from P24 to P49 billion in 2021 alone (Table 2).

High inflation contribution of ABT (Table 1) is mainly due to the steadily rising tobacco tax: P50/pack in 2020, P55 in 2021, P60 in 2022, and 5% yearly increase starting 2023. It is safe to assume that illicit tobacco will only increase, not decrease. With cheap smuggled tobacco, there will be more smoking, not less. And there will be more money for the criminal gangs and their partner corrupt government officials, not less.

ELECTRIC COOPERATIVES AND BLACKOUT ECONOMICS

Last week, Senator Raffy Tulfo, Chairman of the Senate Committee on Energy, lambasted a number of electric cooperatives (ECs) in the country for the frequent blackouts in their franchise area. I also saw these reports in BusinessWorld: “ERC orders 3 electric cooperatives to refund nearly P294M” (May 31), “Gov’t imposes sanctions on two electric cooperatives” (June 9), and, “Tulfo threatens to summon officials of inefficient power co-ops before Senate Energy Committee” (Aug. 3).

Report number one is about Central Negros EC (Ceneco), Pangasinan I EC (Panelco I), and La Union EC (Lueco) that over-charged their customers.

Report number two is about Maguindanao EC (Magelco) and Lanao del Sur EC (Lasureco) that owe P16.7 billion to the Power Sector Assets and Liabilities Management Corp. (PSALM), a government corporation under the Department of Finance. Magelco owes P3.8 billion, Lasureco owes P12.9 billion and they have not expressed the intention to pay. So, taxpayers have shouldered their unpaid debt -— very wasteful and corrupt.

Report number three is about frequent brownouts in EC areas in provinces including Palawan, Bataan, and Davao. Later Oriental Mindoro EC was also investigated.

Five years ago, I wrote in this column, “Unstable power supply due to problematic electric cooperatives” (BusinessWorld, Feb. 8, 2017), about the Abra Electric Cooperative (ABRECO) and Albay Electric Cooperative (ALECO) that owed big amounts to the Wholesale Electricity Spot Market (WESM).

ALECO, in particular, owed P1 billion to WESM around 2010, it also owed PSALM about P2 billion. In 2014, SMC Global bought ALECO and renamed it Albay Power and Energy Corp. (APEC), and assumed its P4 billion debt. Two years later, the debt ballooned to P5.6 billion. Until now, ALECO or APEC still owe some gencos hundreds of millions of pesos.

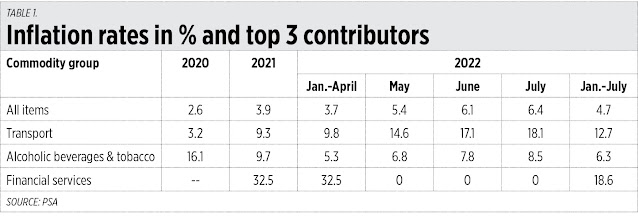

Many ECs are notorious for inefficiency, frequent blackouts and/or high electricity rates that penalize their customers. See some of those ECs and compare their rates with Meralco and the National Capital Region (Table 3).

I am sure Energy Secretary Raphael “Popo” Lotilla is doing something to address the twin problems of blackout economics and the fiscal burden of unpaid debt to PSALM and gencos by many ECs.

Finally, during the Philex Mining Corp. Stockrights Offering last week, Finance Secretary Ben Diokno, as Keynote Speaker, reiterated his support for the mining sector, especially Philex’s new gold mining project in Surigao. Metal prices can only go up, not down, as global demand for gold, copper, silver, nickel, etc. keep rising. The current high excise tax for mining output means higher revenues for the government while allowing the companies to export more and create more jobs. Good policy, Secretary Diokno.

-------------

BWorld 552, Lucky Me, bureaucracy rightsizing, electricity prices, and MPIC, July 21, 2022

BWorld 553, State of the world, state of the nation, July 27, 2022

BWorld 554, The Post-SONA Economic Briefing; FVR’s economy, August 16, 2022.