The rush for “net zero” emissions and decarbonization is evident in Europe while many Asian countries are not so enamored with this rush. I have put together a chart showing how the United Kingdom and Spain are in a mad rush towards decarbonization by ditching their coal consumption, compared to China’s more considered conversion and Vietnam’s rejection of decarbonization.

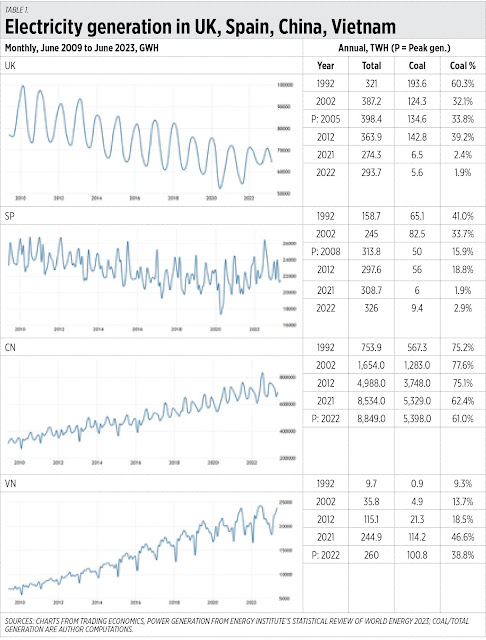

The percentage of coal/total power generation from 1992 to 2022 are as follows: UK, 60% to 2%; Spain, 41% to 3%; China, 75% to 61%; and Vietnam, 9% to 39%. As countries reduce their coal consumption, their overall power generation either declines or flatlines (See Table 1).

To cover more countries, I added Germany and France to the “rush-to-net-zero” decarbonization countries, and India and the Philippines to the “no-rush” decarbonization countries. The coal/total generation of these countries for 1992 to 2022 are as follows: Germany, 55.1% to 31.3%; France, 8.1% to 0.7%; India, 68% to 74.3%; and the Philippines, 6.9% to 59.6%.

In Table 2 one sees their average economic performance from 1983 to 2019, up to the first half of 2023. The UK, Spain, Germany, and France are generally crawling with just 1% to 3%. In contrast, China, Vietnam, India, and the Philippines were humming along with 3% to 11%, except for the Philippines’ 1% average growth in the 1980s to the early 1990s. This can be explained by the political upheavals in the mid-1980s, the coup attempts in the late ’80s, and severe blackouts plus a volcanic eruption and a major earthquake in 1990-92.

The rush to decarbonization of G7 industrialized countries simply leads to their piecemeal path to deindustrialization.

Of course, there are many reasons and factors why countries grow slowly or fast, but the fast expansion of total power generation is a big factor. Many big investments will not come to a country that suffers from frequent blackouts and has expensive electricity.

There were a number of interesting and beautiful reports in the energy sector recently. See these reports in BusinessWorld written by my favorite energy reporter, Ashley Erika O. Jose:

“No net-zero target in Philippine Energy Plan” (July 23), “NGCP fully committed to completing projects” (July 26), “Energy dep’t counting on extra 8,000 MW in capacity by 2028” (July 26), “RE transition won’t happen ‘overnight’ — DoE” (July 30), “Meralco seeks replacement power for San Miguel’s terminated supply deal” (Aug. 2), “Meralco looks at nuclear power as long-term solution” (Aug. 3), “AboitizPower in talks with US nuclear supplier” (Aug. 10), “August power rates down on lower generation charge” (Aug. 10), “ERC suspends order allowing NGCP to pass on franchise tax” (Aug. 10).

I particularly like the reports on “No net-zero target,” that Meralco and Aboitiz Power are looking into setting up nuclear power plants someday, and the Energy Regulatory Commission’s (ERC) suspension of the National Grid Corp. of the Philippines’ (NGCP) practice of passing their franchise tax on to the consumers.

Coal remains the single biggest power insurance of the Philippines against frequent blackouts and underdevelopment. Existing coal plants should expand, from Luzon to the Visayas to Mindanao.

On nuclear power, France used generate 75% of its total power from nuclear plants, resulting in an ample and cheap supply of electricity. It had very bright and beautiful lights at night, a huge amount of electricity to export to neighbors in Europe, and no nuclear accidents. Then they embraced net zero with an exit plan for many of its nuclear plants. Then energy prices and overall inflation started rising. The Philippines should embark on nuclear power generation, including the revival of the Bataan Nuclear Power Plant, and setting up small modular reactors (SMRs) for big island-provinces.

Regarding the new ERC order to the NGCP, I think this is the first time that the ERC had the courage to issue that kind of order. The NGCP is levied with a 3% franchise tax in lieu of corporate income tax and other taxes and this should not be passed through to the consumers. Consumers pay extra on top of capex and high profit of NGCP — they should not pay for the franchise tax. Bravo, ERC.

See also the previous columns on “energy realism” series: “Energy realism: Raising consumption and economic growth” (Part 1, June 29), “Energy realism: G7, BRICS, and other big Asian economies” (Part 2, July 6), and, “Energy realism: Oil-coal consumption and NGCP’s delayed projects” (Part 3, July 13).

-------------

See also:

BWorld 628, Inflation deceleration, G7 deindustrialization, and deficit reduction, August 24, 2023

BWorld 629, On ratings upgrades and the budget of state universities, August 25, 2023

BWorld 630, GDP growth resilience, and the finance and budget lecture at the PDE reunion, August 26, 2023.

No comments:

Post a Comment