Tonight, former BSP Deputy Governor Diwa Guinigundo, a fellow UPSE alumnus and fellow BusinessWorld columnist, gave a talk at Concerned Doctors and Citizens of the Philippines (CDC Ph) and he spoke on two topics.

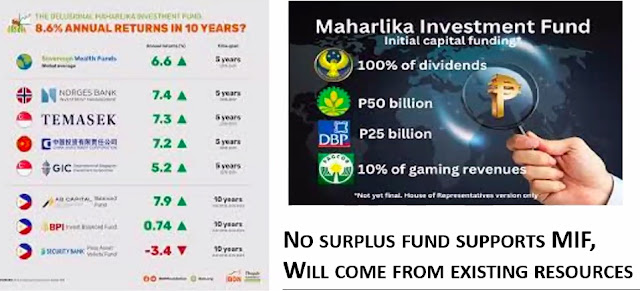

On Maharlika Fund, among the slides he showed.

Diwa said CBDCs are still fiat money-based, the value is still backed up and guaranteed by CBs to keep people's trust on the monetary system. That CBs recently raised interest rates and did other monetary tools to fight high inflation, and that people should not blame CBs policies but high inflation.

On the Maharlika Fund, I argued two points why they are useful.

1. Many big infra projects in the country were killed or hindered by politics. Like the Tampakan gold copper mining project in Mindanao, reviving the Bataan nuke power plant (BNPP), or getting majority control of NGCP, the only remaining private monopoly nationwide.

Tampakan is $5.9 B, the single biggest FDI in the PH. Killed by the provl government more than a decade ago because they do not like open pit mining.

BNPP can generate about 4,200 Gwh of electricity, bigger than the output of all wind and solar plants in the country combined, only about 2,900 Gwh.

NGCP is largely responsible for frequent yellow red alerts, not doing many important transmission projects but earning about P24 B/yr profit.

Maharlika should invest in projects like Tampakan, BNPP revival, and any political harassment from other agencies or LGUs will be minimized as they know there is govt footprint and involvement there.

2. Other SWFs abroad, rich ones like the SWFs of Norway, Saudi, UAE, China, etc. will likely come and invest seeing their counterpart here having confidence in certain big projs.

Diwa argued that there are many institutional problems in the country that should be addressed more than creating the MIF. Like corruption, high power prices.

I did not mention this as I knew that there are other questions from the audience. If we wait to have fiscal surplus, current account surplus before putting up a SWF or SIF it will not happen 100%. Why, because the legislators, the bureaucracy from national to local, the consultants, the academics and consultants, the welfare dependents, etc will just invent new spending anytime when they see new revenues are coming.

Nonetheless it was a good and informative lecture. Thanks Diwa.

No comments:

Post a Comment