Power generation mix and fiscal irresponsibility

September 21, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/09/21/546837/power-generation-mix-and-fiscal-irresponsibility/

Last week the Independent Electricity Market Operator of the Philippines (IEMOP) released the market operations highlights for the August 2023 Wholesale electricity spot market (WESM) results. The power supply in the Luzon grid was rising while demand was falling that month, leading to high reserve margins and hence, lower prices — only P4.12/kWh for the September billing from an average of P5.54/kWh in June and July. Good.

POWER GENERATION MIX

The generation mix shows the continued important role of coal power to avoid blackouts nationwide. The average coal use for June to August was about 61% of total power generation, while the favored intermittent solar and wind combined contributed only about 2.8% of total generation (see Table 1).

Among the recent developments in the energy sector as published in BusinessWorld and reported by Sheldeen Joy Talavera were: “Electricity spot prices fall in Luzon, Visayas in early September” (Sept. 14); “DoE signals annual review of power firms’ use of energy storage systems” (Sept. 14); “Meralco plans to invest in electric cooperatives” (Sept. 15); “NGCP secures regulatory nod on ancillary services” (Sept. 15); “DoE wants reserve power spot market to start commercial operations by Dec.” (Sept. 17); “Energy dep’t preparing airlines for sustainable fuel phase-in by 2027” (Sept. 18); and, “DoE floats scheme allowing proponents to identify potential biomass, WTE sites” (Sept. 19).

The good news is that private distribution utilities (DUs) like Meralco will invest in, and I hope someday will take over, the operation of electricity distribution in many provinces. Electric cooperatives are non-corporate entities monitored and even pampered by a political body, the National Electrification Administration (NEA). Private corporate DUs on the other hand are strictly monitored by the Securities and Exchange Commission (SEC).

RICE PRICES AND SOLAR FARMS

About high rice prices, not yet on the radar of public discourse is the role of many solar farms. Currently, thousands of hectares of agricultural lands — including rice farms — have been converted or are soon to be converted into solar farms. The average yield or productivity of Philippine rice is 4.1 tons/hectare per year, 4.5 tons/hectare for irrigated lands, and 3.3 tons/hectare for non-irrigated lands.

Solar land requirements on average are around 1.3 hectares/MW. So, a 200-MW solar plant will require about 260 hectares of land, or about 1,066 tons (4.1 tons/hectare x 260 hectares) of rice which will be gone from Philippine annual production, permanently.

To lower rice prices, our rice land should expand and/or yield per hectare must rise significantly. With the continued reduction of rice land partly due to conversion to solar farms, we can expect that future rice prices will remain elevated.

FISCAL IRRESPONSIBILITY AND RISING 10-YEAR GOVERNMENT BONDS

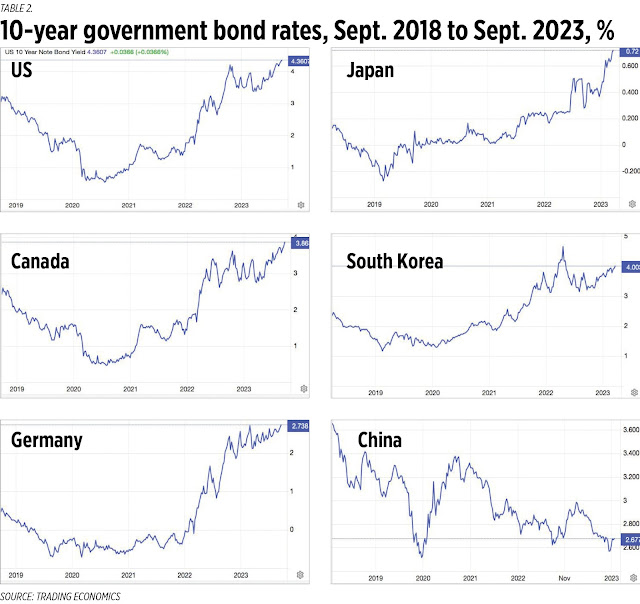

Meanwhile, the US and industrial West continue with their fiscal irresponsibility through profligate overspending and high borrowings. US 10-year government bonds are now at a 16-year high while Japan’s are at a 10-year high. China so far is avoiding this trend (see Table 2).

High government bond rates mean high annual interest payment for those borrowings. We should rein in public spending and borrowings whenever possible while encouraging more businesses and job creation that pay various taxes to the government.

The military and uniformed personnel (MUP) pension reform bill passed by the House of Representatives has institutionalized that system as a major deficit generator yearly, a big and burdensome cost for taxpayers yearly. No thanks to the hard lobbying by the MUP camps, and no thanks to various professional and business organizations that were so brave to publicly criticize the Maharlika Fund as a public finance issue, but which are so silent or too cowardly to speak up on the MUP pension which is a much, much bigger public finance issue. I have little respect for them.

---------------

See also:

BWorld 638, Global Philippines: The successful FIBA hosting in Manila and the OGP Summit, Sept. 24, 2023

BWorld 639, Energy realism: Why we need more coal, gas and nuclear power plants, September 28, 2023

BWorld 640, Financing growth: PEB in Qatar and UAE, mining tax, and liberalized wage setting, Sept. 29, 2023.

No comments:

Post a Comment