* My column in BusinessWorld last July 18.

-------------

There were five events last week that I want to comment on.

LUCKY ME! AND FOOD SECURITY

Scrolling through corporate news of BusinessWorld, these two reports caught my attention: “Monde Nissin ends flat after Lucky Me! noodle brand recall” (July 11), and “Monde Nissin says ethylene oxide not added in noodles” (July 8).

Lucky Me! is a famous brand and my family occasionally consumes their pancit canton and other instant noodles, so I read further and found these facts.

One, ethylene oxide (EtO) is a gas used to treat and sterilize spices and other agricultural products to control microbial growth. It leaves traces in practically all food classifications like noodles, bread, tofu, soy sauce, pizza, etc. It is also used to sterilize surgical and medical equipment like personal protective equipment (PPE).

Two, Lucky Me! products manufactured in Thailand have been subject to a recall in some countries of the European Union especially Ireland, Malta, and France over concerns of high level of EtO. The EU limits it to zero parts per million (ppm).

Three, a leftist and socialist-leaning local organization lobbied the Food and Drugs Administration (FDA) to “immediately recall the products if it genuinely determined to be contaminated.”

Four, the FDA has released a statement on July 11 saying that EtO “is present in the environment, comes from various sources including plants and the heating of cooking oils… Consumption of foods containing residual EtO does not pose an acute risk to health… The United States, Canada and Singapore have assigned… EtO range 7 ppm to 50 ppm maximum residue limit (MRL). In the Philippines, EtO is allowed for gas sterilization of certain agricultural products.”

Five, Monde Nissin, manufacturer of Lucky Me! is a Philippine-based transnational food and beverages company and exports to the world many market-leading brands like Lucky Me! instant noodles, and SkyFlakes and Fita crackers. They said that EtO is not added in noodles but there are just traces when the agricultural products were treated with this gas.

Here are the respective implications of facts one to five:

One, EtO is a useful gas and should not be considered as a contaminant or pollutant gas, the public should not be scared of it.

Two, by EU standards, the EU should also recall bread, tofu, pepper, etc. with traces of EtO in their grocery shelves and have more food insecurity.

Three, the local socialists would rather see more food insecurity here, perhaps to hurt a big capitalist food manufacturer, and see more political upheavals against the new administration.

Four, the Philippines and other countries should align their MRL with the US and Singapore to help stabilize the food supply.

I checked the BusinessWorld Top 1,000 Corporations 2021 report: Monde Nissin is ranked #32 in 2020 with a gross revenue of P54.2 billion, 6.9% higher than 2019 revenues when the top 1,000 companies’ total gross revenues suffered a decline of 13.2% over 2019 level.

Five, Monde Nissin being a big food manufacturer with rising revenues despite the pandemic and lockdowns means it is a big contributor to local food security, a big job creator, and a big taxpayer.

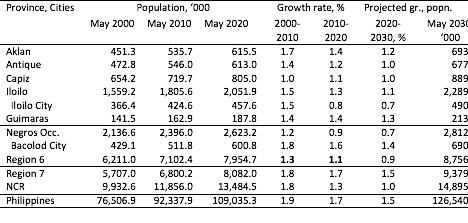

I also checked some components of the Philippines’ recent inflation rates — it turns out that ready-made food products like noodles have price increases that were nearly one-half of overall inflation (See Table 1). Thus, ample supply of those ready-made foods actually temper and control higher inflation.

The public and government agencies should junk the leftist lobby and ignore the EU’s zero tolerance for EtO. The FDA is starting from a good scientific argument in this case. We should have a better food supply, both of raw and manufactured food. We should have more food security and lower food inflation. And we should have more big Philippines transnational companies exporting more commodities to the world.

BUREAUCRACY RIGHTSIZING

On July 13 and 14, I saw two television/radio interviews of Department of Budget and Management (DBM) Secretary Amenah F. Pangandaman where she reiterated the DBM’s plan to “rightsize” the bureaucracy. According to Secretary Pangandaman, rightsizing is to “determine which among the 187 government agencies and government-owned and -controlled corporations (GOCCs) with more or less 2-million personnel, may be streamlined through merging, restructuring, or abolition.”

This is a good move by the Marcos Jr. economic team and I support it. There should be some spending cuts to reduce the need for more debt to pay old debts.

I computed the averages in government spending and GDP level every four years, computed the expenditures/GDP ratio, and compared it with average GDP growth for the same four-year period. The result seems convincing — we have faster economic growth when government spending (and borrowings) decline, and vice versa (Table 2).

Meanwhile, my friend and fellow BusinessWorld columnist Romy Bernardo wrote in his column yesterday, “A first look at the medium-term fiscal program,” that “the government’s 6.5% to 8% growth target through 2028 is rather ambitious… rather the 6-7% of the past decade pre-pandemic.”

Romy has good reasons for arguing his numbers but I think the economic team’s 6.5-8% growth targets are achievable. Partly because I believe that the US, Canada, and Europe will deteriorate economically and deindustrialize in the short and medium term, many companies there will migrate to Asia including the Philippines. It will be a supply-push investment plus demand-pull investment if we do big reforms like faster growth, reduced debt stock without resorting to high taxation, and no threats of blackouts, nor yellow and red alerts.

ELECTRICITY DEMAND AND PRICES

On July 13, I joined the media briefing of the Independent Electricity Market Operator of the Philippines (IEMOP). Their data show the following: 1.) based on peak power demand for June, the 2022 numbers are much higher than the pre-pandemic 2019 level and implies that economic recovery is indeed occurring; 2.) Customer effective spot settlement price (ESSP) this year declined in April-May and increased only in June; and, 3.) Coal share to total power generation has increased to 60% while the share of Malampaya natural gas has declined to 19%, and the share of solar + wind has shrunk to only 2.2% as the country experienced less-windy and more cloudy conditions recently (Table 3).

If we want fast and sustained economic growth, and attract more foreign investors, we should rely less on unstable, unreliable, intermittent solar-wind and have more thermal fossil fuel plants, plus nuclear power.

DIPLOMATIC TOUR

The Embassy of Poland in Manila invited me on July 13 to a press conference by Marcin Przydacz, Undersecretary of State in Polish Ministry of Foreign Affairs. Poland’s Ambassador to the Philippines, Jaroslaw Szczepankiewicz, was also there.

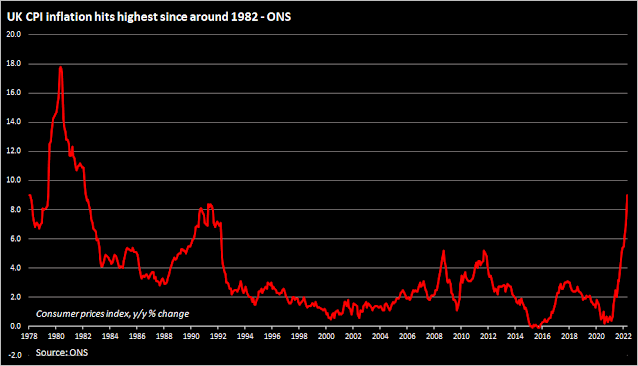

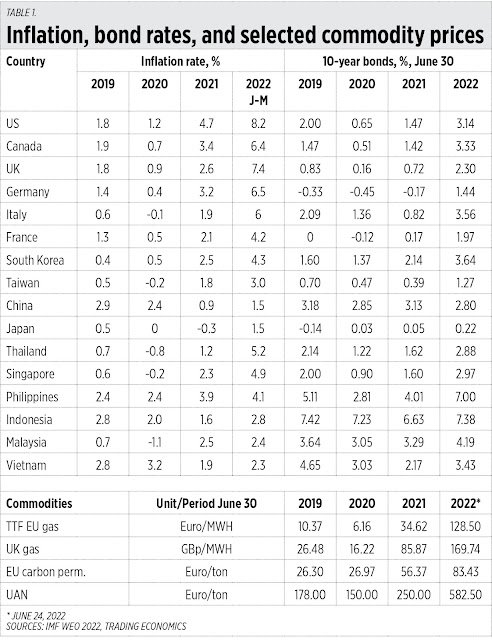

Mr. Przydacz’s tour of some ASEAN countries was meant for economic and business diplomacy, but his talk focused more on the invasion of Ukraine and why other countries like the Philippines should push back against Russia. I checked Poland’s inflation rate — it was 15.5% in June 2022, the highest since 1996 or 26 years ago.

I believe that it is the US- and EU-led economic war against Russia that has had an unlimited impact on global energy and commodity prices, and not the shooting war per se which is limited to Russia and Ukraine only. With rampaging inflation in many European economies that penalize their own citizens more and not Russia, I think Poland should focus more on business diplomacy in Asia and less on justifying politicized trade and investments.

MVP AND MPIC CONGLOMERATE

Finally, on July 14, Manuel V. Pangilinan (MVP), Chairman and President of Metro Pacific Investments Corp. (MPIC) celebrated his 76th birthday and I saw a short video clip of President Ferdinand Marcos, Jr. making a good vibes greeting to him, and a newspaper ad where key officials and business partners of MPIC gave their good wishes.

Miguel G. Belmonte, President and CEO of the PhilStar Media Group that includes BusinessWorld, said that MVP is not only his boss but also his inspiration to always give his best in his work.

Mike Toledo, Head of Government Relations and Public Affairs of MPIC, said that MVP’s commanding and purpose-driven leadership inspired the group to survive and thrive during the pandemic, and no one was left behind.

I think Mr. MVP has done a good job in further developing the Philippines’ toll roads, mining, energy, and media sectors. Consistent with my hypothesis that America and Europe will deindustrialize in the short and medium-term, Philippine conglomerates like MPIC should do more big, highly capital-intensive infrastructure projects to help attract those big companies from the west to the Philippines. Good health and more wealth, Mr. MVP.

----------------

See also:

BWorld 549, Inflation, transportation, internet, and outgoing secretaries, July 05, 2022

BWorld 550, The Bulacan Ecozone veto and Ben Diokno books, July 15, 2022

BWorld 551, The SC on Meralco rate hike, Bidenflation and Peso depreciation, July 20, 2022.