* BusinessWorld, June 6, 2023.

(First of four parts)

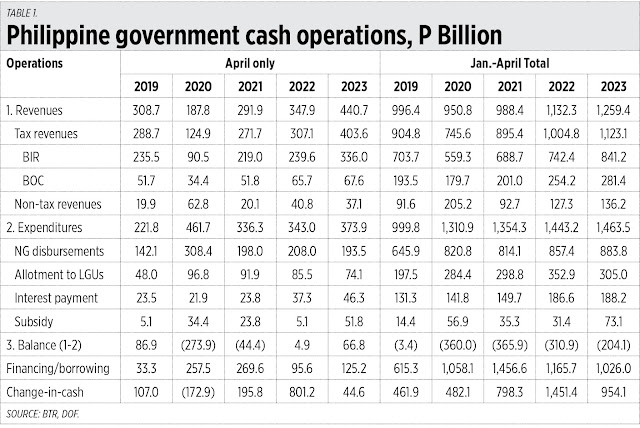

This is the first of a four-part series on the subject of financing sustained growth. We start by looking at the cash operations report as of April this year which the Bureau of the Treasury (BTr) released last week.

HIGHER REVENUES, ANOTHER BUDGET SURPLUS

The good news is that tax revenues have reached P400 billion for the first time, while expenditures have not increased by a proportional amount — so we experienced a big fiscal surplus of P67 billion in April, compared with a deficit of P274 billion in 2020.

I computed the comparable January-April totals from 2019 to 2023 — the good news is that the deficit this year is the lowest since 2020, and while borrowings are still at P1 trillion, this is lower than in 2020. National Government (NG) spending and interest payments for public debt are the highest this year (see Table 1).

So, revenues have acquired a momentum of their own as the economy expands its recovery and this is good. The immediate and medium-term goals are to significantly reduce the deficit and annual borrowings, and reduce interest payments and amortization. There must also be a significant reduction in some items of the expenditure side.

During non-crisis years (whether caused by economic issues, a virus, etc.), the government should aim to have a fiscal surplus and retire some public debt so that the debt/GDP ratio can go down to 30%, even 20%, and we can save on interest payments and get higher credit ratings. Then, when a crisis hits, the debt/GDP ratio can go up again to 40% or higher. Once a crisis is over, it is time to again retire more public debt and aim to get the debt/GDP ratio back to 30% or less. We should target more fiscal responsibility, with a government living within its means, and welfare dependents learning how to let go of subsidies and contributing to the economy someday.

MUP PENSION REFORM

The annual pension for military and uniformed personnel (MUP) remains a big and major deficit generator yearly. The full amount is taken from taxpayers because MUPs themselves make no contributions to their retirement — they keep all their salaries and bonuses monthly.

I computed government revenues, expenditures, and public debt per employed person in the Philippines, then the MUP pension burden. The bad news is that public debt per employed person has jumped from P193,000 in 2019 to P294,000 in April 2023.

Expenditures for active personnel include their a.) basic pay, b.) other compensations (combat duty pay, combat initiative pay, hazard duty pay, etc.), and, c.) other benefits (terminal leave, retirement gratuity, PhilHealth and Pag-IBIG contributions by government, etc.).

Active-duty personnel like soldiers are not just put in harm’s way, they are well protected by taxpayers with high spending on capital outlay (CO) like tanks and trucks, fighter jets and choppers, boats and battle ships, and with high maintenance and other operating expenses (MOOE) like ammunition, bombs and gasoline.

The numbers show the following.

One, for active personnel, CO + MOOE rose from P106 billion in 2019 to P145 billion this year. Their basic pay also rose consistently.

Two, the MUP pension burden per employed person has increased from P2,400 in 2019 to P3,300 in 2022, and is projected to reach P4,400 this year.

Three, the MUP pension alone over the basic pay of active-duty personnel has increased, from 63% in 2019 to 94% last year, and is projected to reach 115% this year. And pension over total expenditures for active personnel has increased from 24% in 2019 to 41% this year (see Table 2).

The economic team led by the Department of Finance (DoF) and Department of Budget and Management (DBM) recently conducted consultations with the Armed Forces of the Philippines, the Philippine Air Force, and the Presidential Security Group.

The MUPs’ optional retirement beneficiaries can choose from any of these three options: 1.) Receive all their pension benefits in one lump sum upon retirement, 2.) Get 60 months pension in advance then a monthly pension after five years, and, 3.) receive pension benefits at the age of 57.

These proposals are fine. What I am proposing to the economic team — and I hope the MUP pensioners will consider this — is that their pensions should be taxed. Currently their generous pension is tax-free. The pensioners contributed zero to the fund when they were still on active duty, and as pensioners contribute zero to it in the form of tax. Since they benefit from tax money, they should contribute to such a fund.

(To be continued.)

---------

See also:

BWorld 607, Philippines ratings upgrade, energy policies to sustain growth, June 19, 2023

BWorld 608, The digital future, rising productivity and economic growth, June 20, 2023

BWorld 609, NGCP, low power generation, and the Maharlika Fund, June 21, 2023.

No comments:

Post a Comment