* BusinessWorld, NGCP, low power generation, and the Maharlika Fund

June 1, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

Last week, the National Grid Corp. of the Philippines (NGCP) was a hot item. See for instance these reports in BusinessWorld, “Senate probe sought on delays in NGCP projects” (May 21), “DoE, ERC seek enhanced powers in EPIRA amendments” (May 23), “Senators slam NGCP over poor network, keeping high gains” (May 24), “NGCP says it invested P300 billion in grid since 2009” (May 25).

THE SENATE ENERGY COMMITTEE HEARING

The Senate Committee on Energy, chaired by Rafael Tulfo, conducted a public hearing on May 24. Among the resource persons, Prof. Rowaldo del Mundo of the UP College of Engineering said that “Out of 219 committed projects under the DoE (Department of Energy)-approved transmission development plan (TDP), 79 were not implemented and 49% of completed and on-going projects are delayed… Project delays are up to nine years.” Horrible NGCP.

Energy Regulatory Commission (ERC) Chairperson Monalisa Dimalanta was also a resource speaker, and she said that the NGCP has 72 delayed projects: 33 in Luzon, 19 in the Visayas, and 14 in Mindanao. And six of these 72 delayed projects are “Energy Projects of National Significance,” like the Mindanao Visayas interconnection and the Panay-Negros interconnection projects. Again, horrible NGCP.

The economic team of the Marcos Jr. administration has been going around major cities in Asia, Europe, and the US trying to attract more investors to come into the country as many economic liberalization measures have been institutionalized and legislated as new laws, like the amendment to Public Service Act, the Retail Liberalization Act, etc. But investors see and read about the frequent yellow-red alerts in the country, and the high-power rates due to the limited power supply relative to fast-rising demand, so many of them are not coming. We can call this NGCP- (or power undersupply-) instigated business uncertainty.

NGCP-INSTIGATED BUSINESS UNCERTAINTY

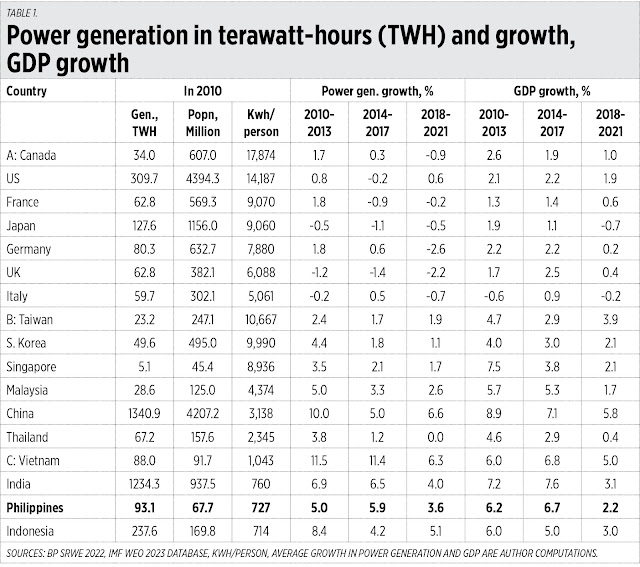

I wanted to possibly measure this uncertainty, so I constructed this table. My sources of basic data are: Power generation from the BP Statistical Review of World Energy (BP SRWE) 2022, and Population and GDP growth from the IMF World Economic Outlook (IMF WEO) 2023 database. I computed the kilowatt hour (kWh) per capita, the annual growth rate of power generation, then I averaged the generation and GDP growth rates.

I group the countries into three: Group A are the G-7 member-countries; group B are high generation Asian economies with 2,300 kWh/person and higher as of 2010; and group C are low generation Asian countries with 1,000 kWh/person and lower. The later are India, Indonesia, Philippines, and Vietnam.

I chose the year 2010 because that was the first year of operation of the NGCP and hence, the improvement in the grid stability and security, or the lack of it, would have been felt. The results are somehow revealing.

One, of the four countries in Group C, the Philippines had the slowest growth in power generation from 2010 to 2021. Some big new power plants would have started generating additional power, but with many delayed or unconstructed transmission and interconnection lines, or with the existing ones frequently conking out, this adversely affected overall generation.

Two, in average GDP growth, Vietnam and India had faster rates than the Philippines and Indonesia. I still have to quantify how many trillions of pesos of unrealized expansion in GDP were caused partly, or largely, by NGCP inefficiency. I will do so in future columns.

Three, looking at all the countries covered, those with fast growth in power generation also have fast GDP growth: China, India, Indonesia, the Philippines, and Vietnam. And countries with slow growth or a contraction in power generation also have low, anemic GDP growth: these were all the G7 countries (see Table 1).

Japan, the UK, and Italy, in particular, are slowly toying with deindustrialization and degrowth economics as they slowly unload their reliable coal, gas, and nuclear power plants, and embrace more intermittent wind and solar.

So, among the important energy policies that the Philippines and other developing countries should note are: One, power generation, especially from reliable conventional plants, should keep expanding and they should avoid adding more intermittent sources to the grid. Two, the transmission and interconnection system, especially for an archipelago like the Philippines, should keep expanding and modernizing.

Three, the electricity distribution system to end-users like households should also keep expanding and modernizing.

And, four, the government power price control like the secondary price cap (SPC) at the Wholesale Electricity Spot Market (WESM) should be scrapped or raised to a higher level. No new peaking plants and ancillary plants are being constructed because companies will not operate at a loss. The most expensive electricity is not P7/kWh or more (vs. the SPC of P6.25/kWh since around 2014). The most expensive electricity is no electricity, resulting in blackouts, and people forced to use candles, gensets, or manual fans.

MAHARLIKA INVESTMENT FUND PASSED BY THE SENATE

On the early morning of May 31, the Senate voted 19-1-1 to pass the Maharlika Investment Fund (MIF). That was almost unanimous voting by the Senate. All the economic team members, including the Bangko Sentral ng Pilipinas (BSP) Governor, are supporting it.

There seems to be no hard copy yet of the approved Senate version as of my deadline, but based on the May 30 version of the bill, Table 2 shows the proposed funding of the MIF.

These plus dividends from the Philippine Amusement and Gaming Corp. (PAGCOR) and other government gaming operators. Plus private funds.

I am wondering why Malampaya royalties are not included in the funding? This is big: P24.52 billion in 2018, P26.57 billion in 2019, P19.08 billion in 2020, P19.79 billion in 2021, P25.90 billion in 2022. Or an average of P23.17 billion a year over the last five years.

I am hoping that the bicameral conference committee will consider using Malampaya royalties for MIF funding.

Once established, I wish to see the MIF getting majority control of the only remaining private monopoly nationwide — the NGCP. Plus do more oil-gas-coal exploration and development.

---------------

See also:

BWorld 606, The Laffer Curve of Philippine tobacco taxation, June 18, 2023

BWorld 607, Philippines ratings upgrade, energy policies to sustain growth, June 19, 2023

BWorld 608, The digital future, rising productivity and economic growth, June 20, 2023.

No comments:

Post a Comment