https://www.bworldonline.com/opinion/2023/12/21/564876/top-10-trends-in-fiscal-program-and-illicit-trade-in-2023/

Here is this column’s take on the major events and stories on the fiscal condition and shortfalls in revenues related to illicit trade this year.

1. The revised fiscal program released by the Development Budget Coordination Committee (DBCC) last Friday, Dec. 15, showed that disbursements would rise from P5.3 trillion this year to P7.8 trillion in 2028. It should be noted that disbursements kept rising even when revenues significantly declined during the lockdown dictatorship of 2020-2021.

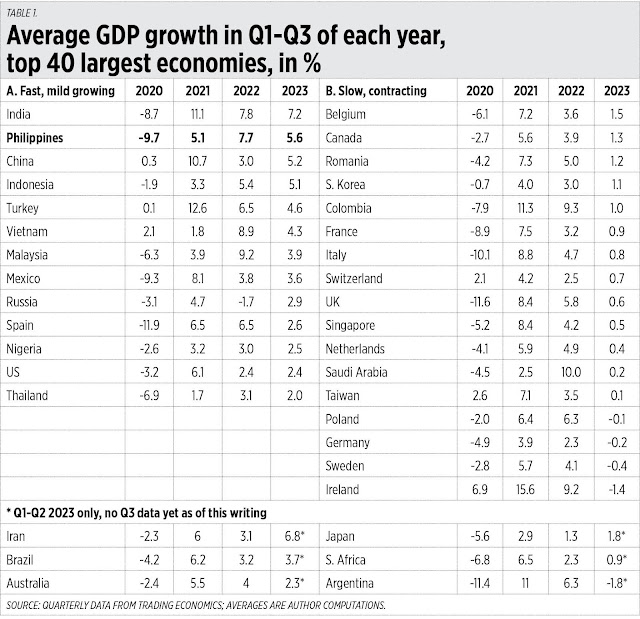

2. Revenues are rising from P3.8 trillion this year to P6.6 trillion in 2028 but they cannot cope with sustained high spending. So the budget deficit (revenues lower than spending) will remain elevated at P1.5 trillion this year to P1.2 trillion in 2028. The consolation is that the deficit as a percentage of GDP is projected to decline from 6.1% this year to 3% in 2028 (see Table 1).

Budget Secretary Amenah F. Pangandaman said “certain big spending are in various laws and we have to implement them but we are improving spending utilization and efficiency, make sure that every program, every action plan that we implement is a make-or-break for our people who are dreaming of better quality and decent lives for a better Philippines.”

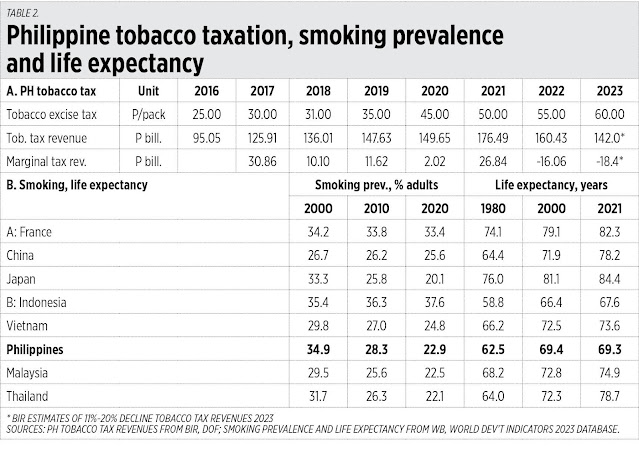

3. Lower actual revenues than potential revenues are mainly due to leakages, corruption, and product substitution. One clear example is the excise tax on tobacco, the most taxed commodity in the country. As tax rates doubled from P25/pack in 2016 to P50/pack in 2021, tax revenues initially increased then started falling in 2022 and by Bureau of Internal Revenue (BIR) estimates, would further decline in 2023 by up to 20% of 2022’s level. This means tobacco tax revenues will go from P176.5 billion in 2021 to P160.4 billion in 2022, and further down to possibly only P142 billion in 2023. Collections until October were only about P120 billion. This is due to users’ substitution of legal tobacco with illegal or smuggled tobacco, plus a shift to e-cigarettes both legal and illegal.

4. Tobacco control measures and policies were generally successful across countries in reducing smoking prevalence among adults. In the Philippines for instance, from 35% of adults in 2000, tobacco users declined to only 23% in 2020. But this applies only to legal tobacco because consumption of illegal or smuggled tobacco continues to remain high as their prices are so low compared to legal, taxed tobacco. Plus, there is the shift to e-cigarettes.

5. Life expectancy continues to rise across countries including those with high smoking incidence. Consider for example France, where smoking prevalence remained flat at 33% of adults from 2000 to 2020 but where life expectancy has increased from 74 years in 1980 to 82 years in 2021 (see Table 2). One must note that there are many other factors to human mortality and tobacco is one of them but not necessarily the main factor.

6. An expanded anti-agricultural smuggling bill is now in Congress. It will replace the old “Anti-Agricultural Smuggling Act of 2016” (RA 10845) and will cover more agricultural products including tobacco, perhaps the most lucrative smuggled products at tens of billions of pesos yearly in foregone taxes from imported tobacco alone.

7. Key legislators that championed this bill include Representatives Sandro Marcos and Margarita “Migz” Nograles who included tobacco when they filed the bill in the House, and Representatives Mark Enverga and Mika Suansing who are pushing the general Anti-Agricultural Smuggling Amendments Bill in the House. In the upper chamber, Senator Lito Lapid filed the counterpart bill in the Senate, Senator Koko Pimentel ensured the constitutionality of anti-agri smuggling bill, and Senator Cynthia Villar championed it in the Senate, with JV Ejercito as co-author.

8. Illicit trade in e-cigarettes — the case of Flava and Denkat. In a House Committee on Ways and Means public hearing last week, Dec. 12, Committee Chairperson Joey Salceda said that “Vape sale is not yet particularly classified under PSIC (Philippine Standard Industrial Classification) … The brands found in the warehouse were all registered with the BIR (RMC 93-2023), with Flava Corporation registering as a ‘manufacturer’… Flava Corporation, however, is not registered as an importer… TopKing Logistics, which supposedly billed Flava, is also an importer, not a manufacturer.”

Denkat Trading supposedly got its supply from China suppliers then sold them to Flava, and Denkat should pay the excise tax but did not. See also these reports in BusinessWorld: “E-cigarette listing, taxing sought” (Dec. 12), “British chamber backs law vs agri smuggling, 5-year EO 10 effectivity” (Dec. 14).

9. Estimated tax losses from illicit e-vapes, especially from Flava, are about P4.9 billion in 2022. Congressman Salceda said that the e-cigarettes market in the Philippines is about P13.24 billion in 2022, so the projected tax revenues should have been P5.56 billion, but the BIR collection was only P0.63 billion, or a difference of P4.9 billion.

10. The Laffer Curve — as tax rates increase, tax revenues increase initially then plateau and decrease later — is real and actually happening in the taxation of tobacco and other “sin” products. People simply shift to illegal products that are much cheaper.

The rule of law is still ignored on a large scale in the country. Manufacturers and traders are bringing in unregistered products from abroad and selling them openly here, health warnings are not displayed, and tax rates are not paid so government revenues decline.

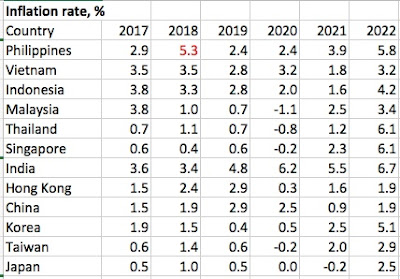

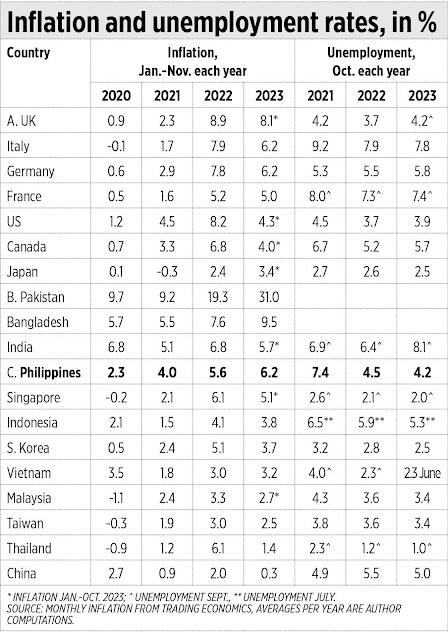

We should have fast and sustained growth, the denominator (GDP size) should keep expanding so that when the numerators — budget deficit, public debt, etc. — rise slower than the rise in denominator, our deficit/GDP ratio or debt/GDP ratio will decline. Following the rule of law plus having more realistic lower tax rates will help plug revenue leakages and control corruption in the country.

-----------

See also:

BWorld 664, Stabilizing growth with low inflation, low unemployment rates, and more PPP investments, December 19, 2023

BWorld 665, Top 10 trends in the economics of war and global peace, December 23, 2023

BWorld 666, Top 10 news stories on power and electricity of 2023, December 26, 2023.