* My article in BusinessWorld last January 9.

----------------

1. World oil demand will reach 102 million barrels per day (mbpd).

Data from the Organization of the Petroleum Exporting Countries (OPEC) show that world oil demand was 100.18 mbpd in 2019, 91.16 mbpd in 2020, and 97.01 mbpd in 2021. OPEC projects 99.56 mbpd in 2022, and 101.77 mbpd in 2023. Big demand will come from the US and China, with a combined 36 mbpd next year.

2. World oil supply will likely reach 102 mbpd too.

The liquids supply — crude, non-gas liquids or NGLs, other non-conventional liquids — from non-OPEC countries, which include the USA, Russia, and Canada, will reach 67.1 mbpd. OPEC crude and other liquids will likely reach 35.5 mbpd, so this column predicts a world supply of 102.6 mbpd this year. All oil-producing countries except Russia are expected to have a continued rise in output (see Table 1).

3. The decline in fossil fuel (FF) consumption by rich countries will continue.

Using the data in Table 2 of this column’s “Top 10 energy stories/ideas 2022” (Dec. 19, 2022) to make projections for 2023, the USA and Canada — with a projected consumption of 223-230 petajoules (PJ) per million population — will soon be overtaken by South Korea and Taiwan with 202-214 PJ this year. Singapore will remain the most fossil-fuel intensive country in the world with about 660 PJ this year.

4. China will overtake Germany in kilowatt hours (kWh) per capita power generation.

In 2021, China saw power generation of 6,042 kWh/person while Germany had 7,026 kWh/person. This year, China will have about 8,076 kWh/person while Germany will have 7,021 kWh/person. Because China and most Asian countries will expand their fossil fuel use, their power generation per capita keeps rising, which is not happening in Germany and the industrialized west.

5. The industrialized west will slowly realize the folly of ditching fossil fuel plants and relying on intermittent power production.

Germany, the largest economy in Europe, is currently led by the politically socialist Social Democratic Party (SPD), and the ecological socialist Greens Party. Their smaller partner, the Free Democratic Party (FDP), will try to inject some sanity into economic and energy policies but both SPD and Greens ran on a strong anti-fossil fuel, anti-nuclear power platform. Such an ideology is detached from the reality of possible blackouts in winter, so Germany has begun to run their old coal power plants again to void blackouts. This trend will continue in many other industrialized countries.

6. The Philippines will finally reach 1,000 kWh/person in power generation.

From 589 kWh/person in 2000 and 982 in 2021, we should reach around 1,044 kWh/person in power generation this year — the first time that we will reach the 1,000 kWh/person mark. It should be clear that we should aspire to expand power generation in megawatt-hours (MWH), not just megawatts (MW). A 1,000 MW solar farm will have a dependable capacity of only around 180 MW, while a 1,000 MW coal or gas plant will have a dependable capacity of around 800 MW. So, power generation in 24 hours is much higher under fossil fuel plants than intermittent solar or wind power.

7. But yellow-red alerts, and near blackouts will continue this year.

Until December 2022, both the Luzon and Visayas grids experienced yellow alerts due to thin and insufficient power reserves. A lot of the incoming capacity will be from intermittents and non-power generating batteries.

The abolition of electricity price control or primary and secondary price cap (SPC) at only around P6.25/kWh will likely be discussed this year. From September-December 2022, an SPC was imposed about 60% of the time at the spot market. Such a high incidence of price control means that no new big peaking plants will provide the necessary reserves when demand is very high or supply is down significantly.

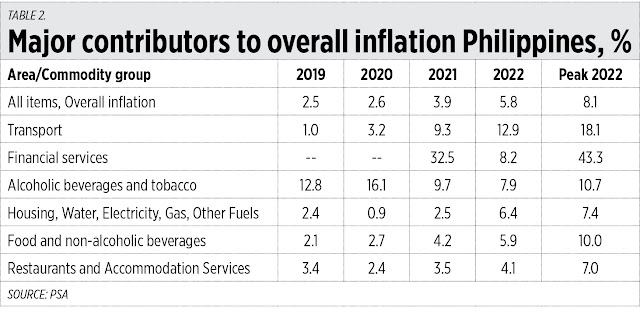

8. Carbon taxation will be re-introduced but will fail.

The first big attempt at imposing carbon taxation was back in 2017 when a former National Economic and Development Authority (NEDA) Secretary lobbied that the coal tax should rise from P10/ton to P600/ton. This was carried out in the Tax Reform for Acceleration and Inclusion (TRAIN) Law of 2017 (RA 10963) with the coal tax raised to P150/ton. As shown in Table 2, the Philippines’ fossil fuel consumption per capita is the lowest in the ASEAN 6, far behind the economic tigers of North Asia and the industrial world. Penalizing Philippine businesses and households with higher power prices via a carbon tax will only attract political and economic backlash.

9. Nuclear power will get piecemeal approval in the country.

Last December, two stories in BusinessWorld reported that: 1.) Meralco will look into small nuclear reactors, and, 2.) AboitizPower is eyeing nuclear project. Then there was a recent report, “Energy department designates RE, nuclear as 2023 priorities” (Jan. 2, 2023). Nuclear power, at least small modular reactors (SMRs), is a good long-term solution both for off-grid island provinces and the main grids.

10. Solar streetlights, solar rooftop will continue expansion.

Many electric cooperatives, protected by the National Electrification Administration (NEA), are wasteful. For instance, some friends in Central Pangasinan pay about P19/kWh under CenPelco versus the Meralco rates of P10/kWh as of the December billing. So, many rural people and barrio officials put up lots of solar street lights, solar fence lights, etc. This trend will continue in 2023 and beyond.

I got importation data from the Philippine Statistics Authority (PSA) — 2020 to October 2022. Here are the numbers for solar panels, solar lights, and lamps and lighting fittings, average per month. Volume: 9.37 tons in 2020, 8.27 tons in 2021, and 11.91 tons in 2022. Value: $25.28 million in 2020, $28.92 million in 2021, and $38.69 million in 2022.

Average monthly volume declined — 11.8% in 2021-2022, an increase of only 27% in 2022 over 2020. Since there was a large expansion in solar farms last year, it is possible that illicit/smuggled solar street lights are coming in high volumes.

Meanwhile, the first of the quarterly Ruperto P. Alonzo (RPA) lecture series sponsored by the University of the Philippines School of Economics (UPSE) Program in Development Economics (PDE) Alumni Association, will be held on Feb. 8 at the UPSE auditorium. The speaker will be Cynthia Hernandez, Executive Director of the Public-Private Partnership (PPP) Center. Ms. Hernandez will talk about 28 years of the build-operate-transfer law and the way forward. She is an engineer-economist from UP, an alumna of PDE batch 33, and a former student of Prof. RPA (RIP).

-------------

See also:

BWorld 575, The Top 10 fiscal and monetary news stories of 2022, December 31, 2022

BWorld 576, Top 10 trade and investment stories of 2022, January 6, 2023

BWorld 577, Inflation 2022 and major contributors, January 07, 2023.