* BusinessWorld February 6, 2023.

-----------

1. Oil and gas prices are now lower than during pre-war Ukraine. Comparing prices last week with Feb. 23, 2022 or a day before Russia invaded Ukraine, Dubai crude is $11/barrel cheaper and WTI crude is $17 cheaper. It’s the same trend for EU gas and US natural gas prices.

2. Coal prices have significantly cooled down. From a peak of $458/ton in 2022, it was down to only $245 last week. Since about 58% of total power generation in the Philippines is from coal, this is good news.

3. E-vehicle prices are rising and charging them is more expensive than using gasoline. The price of lithium, the main material in producing batteries, is higher than the pre-invasion period, twice the peak price in 2021 and six times the peak price in 2019. Electricity prices in Europe last week were about twice the peak prices in 2019. Peak prices in 2022 were 6-20 times higher than peak prices in 2019 (table 1).

4. Continuing threats of blackout, spot market price control. It has now been 32 years since the big blackouts of 1990 to 1991 in the Philippines and the possibility of occasional blackout remains. See these recent reports in BusinessWorld: “DoE expects 12 yellow alerts in Luzon grid” (Jan. 10), “Still no agreement on Ilijan gas supply — DoE” (Jan. 12), “ERC reviewing secondary price cap after DoE cites potential to unlock investment” (Feb. 1).

Government price control in the electricity spot market is wrong and should be removed. Frequent price spikes are indicators of thin reserves, and power distributors and consumers are willing to pay higher just to avoid blackouts. When price control kicks in too often, it will discourage investment in more peaking plants. The most expensive electricity is no electricity. Candles and more expensive generator sets are bad alternatives.

5. Rise in subsidies to off-grid islands and provinces. Island-provinces like Palawan, Mindoro, Masbate, Marinduque, Batanes, etc. rely on big gensets by the National Power Corp. (Napocor) small power utilities group (SPUG) and private producers. Since generation via oil gensets is expensive, off-grid consumers are subsidized by on-grid consumers through the universal charge for missionary electrification (UC-ME) in our monthly electricity bill. See these recent stories in BusinessWorld: “Napocor to cut service to SPUG areas due to high diesel prices” (Jan. 19), “Universal charge hike proposed to sustain off-grid power services” (Jan. 30).

Current UC-ME is P0.178/kWh and Napocor is asking for P0.15 more. If approved, it will become P0.328/kWh. The UC-ME should go, off-grid provinces should use small coal or gas plants or small modular reactors to have cheaper electricity and will not need subsidy. Note also in table 2 below, Napocor is earning P2-3 billion a year.

6. Obstinate San Miguel petition at ERC and CA. San Miguel Corp. units South Premiere Power Corp. and San Miguel Energy Corp., the administrators of the gas plant in Ilijan, Batangas, and the coal plant in Sual, Pangasinan, respectively, sought a rate hike at the Energy Regulatory Commission (ERC) in August. ERC rejected the petition in September. San Miguel went to the Court of Appeals (CA) the following month. Last month, the appellate court’s 13th Division gave South Premiere a writ of preliminary injunction, suspended the power supply agreement between South Premiere and Manila Electric Co. to allow them to negotiate. But the court’s 16th Division rejected a similar injunction motion from San Miguel Energy. Both cases will be consolidated at the 13th Division, and if South Premiere and Meralco agree to increase the price, it will go back to the ERC again. Terminating the power supply agreement does not seem to be the least cost for the public.

See these reports in BusinessWorld: “Meralco to start sourcing 670 MW from spot market” (Jan. 26), “ERC says court denied hold order vs its ruling in Sept.” (Jan. 27), “Competitive power rates sought after court move on supply deal” (Jan. 30) and “ERC looks to high court amid suspended power supply deal” (Feb. 6).

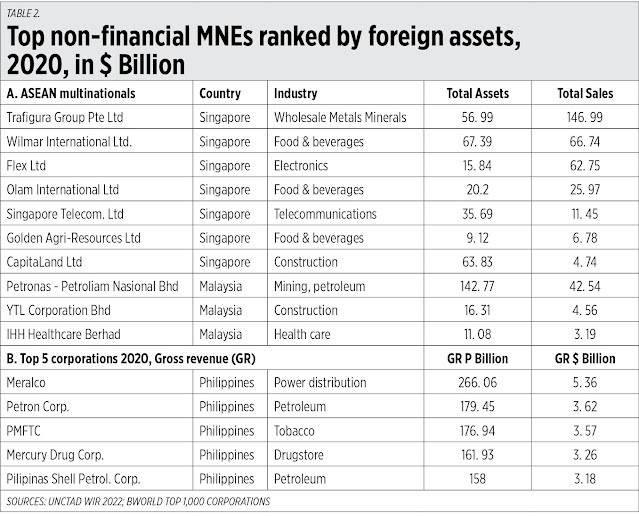

7. San Miguel Energy and South Premiere earned, not lost, in 2021. San Miguel said it had losses of P15 billion from units South Premiere and San Miguel Energy. Data from BusinessWorld’s Top 1000 Corporations in the Philippines 2022 showed they earned P5.34 billion and P4.5 billion, respectively (table 2).

Meanwhile, South Premiere or the Ilijan gas plant is on economic shutdown. So far, there seems to be no investigation for anti-competitive behavior. Ilijan must run on liquid fuel, expensive diesel and generation companies have to obey the must-offer rule in the spot market. The plants have to run.

8. NGCP was the most profitable among energy players, perhaps in the whole country. Its net income over gross revenue ratio from 2017 to 2020 averaged 45.7% (table 3). Two things here — high profitability while the country suffers from persistent yellow-red alerts yearly, up to now, and NGCP is the sole private nationwide monopoly system and network operator.

NGCP has a big asset base but must do certain investments stipulated in its franchise. The high profitability possibly comes from not investing in the committed asset base, which was the basis for its transmission rates. It’s like not having a firm contract for ancillary services that should significantly augment power reserves, and long-delayed transmission lines to avoid power congestion in certain areas and where supply is available to areas where they are needed.

There is an ongoing fourth regular review and fifth regulatory reset of NGCP at the ERC. ERC should look at these profitability figures.

9. Nuclear energy is becoming more acceptable in the Philippines. See these recent reports in BusinessWorld: “Energy dep’t designates RE, nuclear as 2023 priorities” (Jan. 2), “Philippines in nuclear push as power crisis looms” (Jan. 24). Uranium prices in the table above show they don’t swing wild unlike Europe electricity prices that rely increasingly on intermittent wind and solar power.

10. Persistent calls for expensive electricity via carbon pricing and taxation. The International Monetary Fund (IMF) is tone-deaf to the plight of Philippine businesses and households as it continues its irresponsible and corrupt lobby to impose carbon pricing and taxation in the Philippines. See this report in BusinessWorld: “IMF says carbon pricing may raise $7-B revenues” (Jan. 4).

In this period of high inflation, more expensive electricity, transportation and other commodities are the least that we should aspire for. People can’t be serious if they blame CO2 — the gas that we humans and animals exhale, the gas that plants and crops use to produce their own food via photosynthesis — as causing less and more rain, less and more flood, less and more cold, fewer and more dogs.

Meanwhile, the Ruperto P. Alonzo lecture series will kick off at 3 p.m. this Wednesday, Feb. 8 at the UP School of Economics. It is free and open to the public. The topic is “29 years of BoT law and the way forward.” The speaker will be Cynthia Hernandez, executive director of the PPP Center. The three discussants/reactors are Roderick Planta, assistant secretary for investment programming at the National Economic and Development Authority; Vaughn Montes, director at Rizal Commercial Banking Corp.; and Paul Imperial, vice-president for Structuring and Regulatory Affairs at Aboitiz InfraCapital, Inc.

--------------

See also:

BWorld 580, Ten themes in development economics (and the Ruperto Alonzo lectures), February 03, 2023

BWorld 581, 10 trends in GDP and trade in 2022 and 2023, February 09, 2023

BWorld 582, Ten things about the military and uniformed personnel pension system, February 16, 2023.