* My column in BusinessWorld last Dec. 26.

-----------

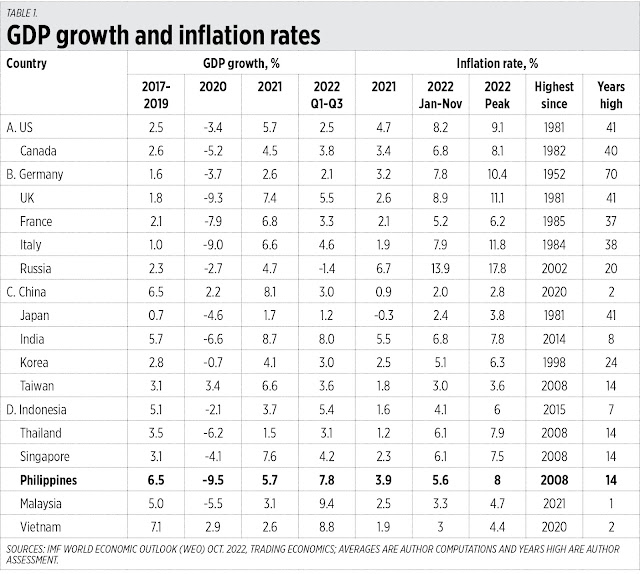

1. G7, China, and Russian growth declined significantly.

The Group of Seven (G7) industrialized countries — the United States of America (US), Canada, Japan, Germany, the United Kingdom (UK), France, Italy — renewed their growth slowdown this year after a modest recovery last year. And for the first time since 1991 or three decades ago, China this year will grow below 6%, aside from 2020’s global contraction. Russia will have another contraction as a result of the various sanctions against it after its invasion of Ukraine. But most ASEAN (Association of South East Asian Nations) countries will have faster growth this year than last year.

2. G7 countries have hit 37 to 70 years inflation rate highs.

This year, Germany has experienced the worst inflation rate since 1952. The US, UK, and Japan have hit their highest inflation rates in 41 years, while Canada, France, and Italy have had 37-to-40-year highs. Their economic sanctions against Russia and their impact on global energy prices, oil-gas-based fertilizers and industrial goods, have backfired against the G7 while Russia, the target of heavy sanctions, experienced only a 20 year high.

Asians (except Japan and South Korea) experienced inflation rates of at most 14-year highs, including the Philippines (see Table 1).

3. Public debt-to-GDP ratio remained high.

Public debt exploded in many countries in 2020-2021, and are projected to remain high in 2022. In the G7, only Germany and the UK will have a debt-to-GDP ratio of below 100%. Russia surprisingly has only 16%. Three Asians are doing well in their fiscal restraint — Taiwan, Indonesia, and Vietnam. Their debt-to-GDP ratios are below 41%.

4. Government bond rates are double or triple the 2021 levels.

This is true especially for G7 and other rich countries. I list in Table 2 the peak interest rates for 10-year bonds from 2020-2022. For Asians with already high rates in 2021 (at least 3%), the increase in 2022 is not significant.

5. There have been huge interest rate hikes by central banks to control inflation, currency depreciation worldwide.

In the US for instance, interest was only 0.5% last April, and is now 4.5%. This led to huge currency depreciation in many countries around the world as many dollar investments abroad flowed back to the US. To control further hemorrhage, other countries also raised their interest rates. Canada went from 1% last April to 4.25%, and Euro area like Germany, from zero to 2.5%. At least three Asian nations — the Philippines, Indonesia and Vietnam — have high rates at 5.5-6% (See Table 2).

6. The Philippines in the top five fastest growing economies among the world’s top 50 largest economies.

It seems that of the world’s largest economies, the fastest growing in 2022 will be Malaysia and Vietnam, to be followed by India, Bangladesh, and the Philippines. I see three factors for why this happened.

One, President Ferdinand Marcos, Jr.’s lifting of all forms of COVID-19 lockdown in the country. Two, the formation of a competent, experienced economic team led by Finance Secretary Benjamin Diokno, Bangko Sentral Governor Felipe Medalla, Economic Planning Secretary Arsenio Balisacan, and Budget Secretary Amenah Pangandaman. Three, the series of Philippine Economic Briefing investment roadshows held here and abroad — Singapore, Jakarta, New York City, and Washington DC — where the economic team explained and highlighted recent major economic reforms like the liberalization in the Public Service Act, Foreign Investment Act, and Retail Trade, and assured businesses that no major tax hikes will happen.

7. The Philippines experienced its highest inflation rate in 14 years — 8%.

Despite the series of interest rate hikes by the central bank, the inflation rate has continued its upward trend. The huge depreciation of the peso in recent months and the continued high global energy prices contributed to this. But average inflation for 2022 will only be around 5.8%.

8. The budget deficit remains above P1 trillion, while financing/borrowings will remain at P2 trillion/year.

This is the big fiscal burden created by the Duterte administration’s irrational and prolonged pandemic lockdown which led to business closures from 2020 to early 2022, its huge vaccine procurement spending and the seemingly timetable-less giving of ayuda or subsidies, plus the irrational pension program for military and uniformed personnel (MUP). The MUP, because they do not contribute to their pensions, keep all their salaries and allowances, and their bloated retirement pensions are shouldered by taxpayers once more.

9. Public debt has reached P14 trillion.

The interest payments to service this huge government debt reached P429 billion in 2021, P433 billion as of October 2022, and will likely be P520 billion by end-December (See Table 3). It is never rational and desirable for taxpayers to keep sending money to the government to sustain huge interest payment alone, endless or no timetable ayuda and welfare programs, bloated public personnel lists that need a bureaucracy rightsizing program, and the bloated MUP benefits that need drastic pension reforms.

10. The creation of a sovereign wealth fund (SWF).

The proposed Maharlika Investment Fund (MIF), a SWF act has already passed its third reading in Congress. The idea of creating a SWF is good because it forces a country/the government to find a fiscal surplus somewhere. Funding for the MIF’s capitalization should primarily come from fossil fuel and mining development like the Malampaya gas royalties (about P22 billion/year from 2019-2022), coal royalties and mining taxes, and the privatization of some government corporations like the Philippine Amusement and Gaming Corporation, better known as Pagcor. It is estimated that the privatization of Pagcor will bring the government about P350 billion — right now its annual remittance to the government is only about P15 billion a year.

---------------

See also:

BWorld 572, State assets should finance Philippine sovereign wealth fund, December 10, 2022

BWorld 573, Ten economic issues to watch, December 27, 2022

BWorld 574, Top 10 energy stories/ideas 2022, December 28, 2022.