PHL deficit across 7 administrations

Last week, the Development Budget Coordination Committee (DBCC) launched a legacy book, 50 Years in Harmony: A Historical Review of the Development Budget Coordination Committee commemorating the 50th anniversary of DBCC, which spanned from 1970 to 2020. It was held at the Department of Budget and Management (DBM) offices.

I downloaded the online copy — 321 pages — and among the contributors are DBM Undersecretary and Chief Economist Joselito R. Basilio, former DBM Ministers Jaime Laya and Alberto Romulo, National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan, former Finance Secretary Benjamin Diokno, Supreme Court Chief Justice Alexander Gesmundo, Bangko Sentral Governor Eli Remolona, and DBM Secretary Amenah Pangandaman.

Among the chapters that caught my attention was that by Mr. Diokno, “The Lifeblood of the Nation: Tax Structure, Policy and Performance in the Past 50 Years.” I like it because he summarized the fiscal performance by administration, from the old Marcos to Mr. Duterte. I include data from his two tables with this column, plus I added data from the year 2023 under President Ferdinand “Bongbong” Marcos, Jr.

Among the interesting pieces of data gleaned from these tables are the following.

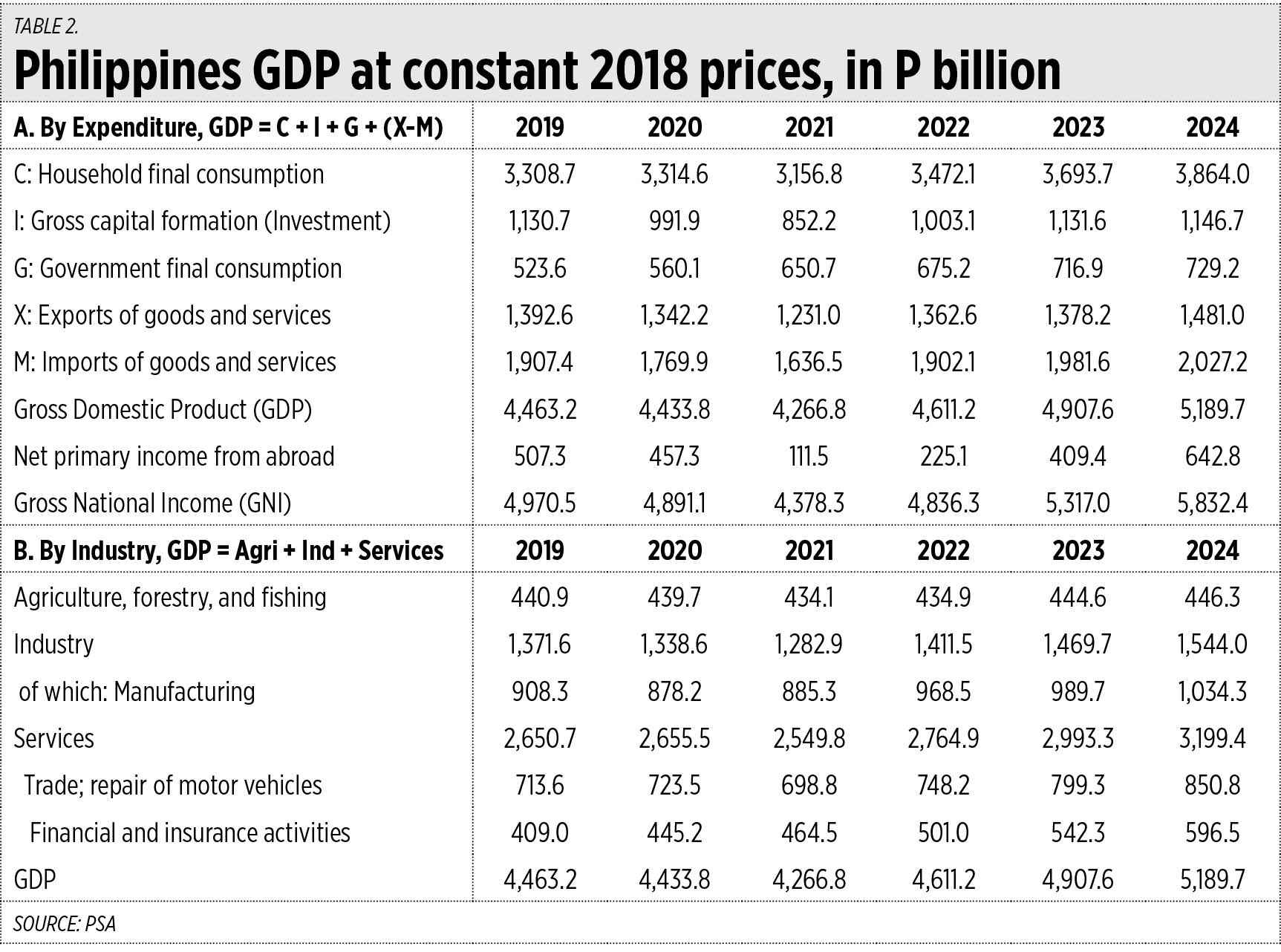

One, the Ramos administration had the highest revenues/GDP ratio at 16.4%, followed by Duterte at 15.7%.

Two, when it comes to disbursements and spending, the Duterte administration had the highest at 21% of GDP followed by Estrada at 17.6%. The current Marcos Jr. administration’s is actually the highest at 22% but this covers only one year and may decline in succeeding years.

Three, when it comes to the budget deficit, again Mr. Duterte had the deepest at -5.4% followed by Estrada at -3.5%. The current BBM administration actually had a deeper deficit in 2023 at -6.2%.

I also computed the average GDP growth by administration. The Benigno Aquino, Jr. administration had the fastest growth at 6.2%. One may infer that the optimal ratio would be revenues/GDP at 14-14.5%, disbursements at 15-16% of GDP, and a budget deficit at -1.5% of GDP, as conducive to faster economic growth (see Table 1).

Controlling spending, the deficit, and borrowings while inducing more economic growth and higher revenues are the important hallmarks of fiscal discipline and responsibility. Low borrowings lead to low interest rates and low interest payment, freeing up more public resources to fund more soft and hard infrastructure. The household and corporate sectors also benefit from low interest rates that will encourage more savings and investments.

DBM Secretary Pangandaman mentioned in her chapter in the book that “In his 2022 SONA, PBBM [President Ferdinand “Bongbong” Marcos, Jr.] cited the National Government Rightsizing Program (NGRP) as a priority legislation… to streamline the operations of different agencies of the Executive branch, rightsize their organizational structure and workforce complement, improve interoperability in government agencies, and eliminate functions, programs, and projects that are already redundant, overlapping, or no longer necessary.”

I like this. It is consistent with the pursuit of fiscal discipline and responsibility.

Meanwhile, the current DBCC is focused on attaining GDP growth targets of 6-7% in 2024, 6.5 to 7.5% in 2025, then 6.5 to 8% in 2026-2028. The deficit level remains deep at -6.2% last year, with targets of -5.6% this year, -5.2% next year, -4.7%, -4.1%, and -3.7% in 2026, 2027, and 2028 respectively.

The biggest threat to controlling the deficit and borrowings is the continuing noise about war preparations vs China over rocks that are 700-800 kms away from the shores of Metro Manila. I think we should put more trust in the Department of Foreign Affairs in resolving maritime use over disputed territories with China, Vietnam, other Asian claimants. Spending P2 trillion for the Armed Forces’ procurement alone (of submarines, battleships, and missiles) when we do not even have the funds to build more flyovers in many traffic-choke cities and municipalities in the country, is a very wasteful, and is irrational use of borrowed money.

GOLD RESERVES

Meanwhile, as the US Dollar as reserve currency is being weaponized against countries and economies that do not obey the political and military agenda of the US, more countries are slowly building up their gold reserves instead. Member countries of BRICS (Brazil, Russia, India, China, South Africa) and some aspiring members like those from the Middle East and Africa are showing slow but consistent building of their gold reserves.

The G7 member-countries except Canada have high but static levels of gold reserves: the US has 8,130 tons; Germany 3,350 tons; Italy 2,450 tons; France 2,440 tons; the UK 310 tons; Japan 765 in 2019, to 846 in 2021-2024; and Canada, none.

Thailand and Singapore are also taking this path while the Philippines reduced then recently started building up its gold reserves (see Table 2).

Last Friday saw gold prices reaching a new all-time high of $2,400+ per ounce. This is an indicator that demand is rising faster than supply, and the trend will continue so long as the US Dollar continues to be a weaponized currency to prop up its political agenda instead of promoting more trade and commerce in the world.

----------

See also:

BWorld 704, On declining inflation and unemployment, and trade with China

BWorld 705, PHL growth resilience amid a deteriorating global economy

BWorld 706, On economic growth, nuclear energy, and Meralco franchise