* My article in BusinessWorld last May 9.

------------

THE LENI-KIKO MITING DE AVANCE

I attended the last campaign sortie of the Leni Robredo-Kiko Pangilinan tandem on Ayala Ave., Makati City on Saturday, May 7. I was there for about 10 hours — afternoon to midnight — and here are some of my observations.

1. It was a huge crowd — estimates range from 700,000 to one million people. Ayala is long, eight-lanes wide, with wide sidewalks, and several wide perpendicular streets, which were all filled with people.

2. There were lots of freebies — from many private volunteer groups giving free medical assistance to free ice cream, taho (street food of tofu, syrup, and sago pearls), bread, cookies, and candies, to plastic fans and even free condoms. But there were no free T-shirts and caps from the candidates — people had to buy these from ambulant shops in the area.

3. They were civilized citizens — no pushing or shoving by people when they moved in an already dense area. After the event ended, there were many groups of volunteer sweepers and cleaners. One group I saw were rich-looking Filipino-Chinese who were awkwardly sweeping, suggesting that they are not used to doing it and have helpers at home who sweep the floor for them.

4. Security was decentralized — everyone has a mobile phone so any attempt at sowing disorder will likely be recorded and perpetrators likely be apprehended. But there were a few reports of petty stealing, like lost cell phones and wallets, or perhaps people dropped them somewhere.

5. High police visibility — most were unarmed, they just held a baton. After the concert ended and shortly before midnight, I looked for the PNP (Philippine National Police) head in the rally. I was guided to Police Lt. Col. Randy Moratalla, Deputy Chief for Administration of Makati PNP. He was the highest PNP official at the time when I came. I introduced myself as a BusinessWorld columnist and wanted to congratulate them on a peaceful rally. He quickly accommodated me and said that the PNP National Capital Region Police Office (NCRPO) plus Makati police had deployed around 700 police officers that day. The high visibility of uniformed cops not carrying guns helped preserve order and trust. Good job, PNP.

6. High visibility of Ayala security — to remind people that it is not a public park and there are private properties that can be damaged if there are unruly people, like the center-island flowers and glass buildings. Thanks for the nice wide venue, Ayala Corp.

ISSUES TO PREPARE FOR

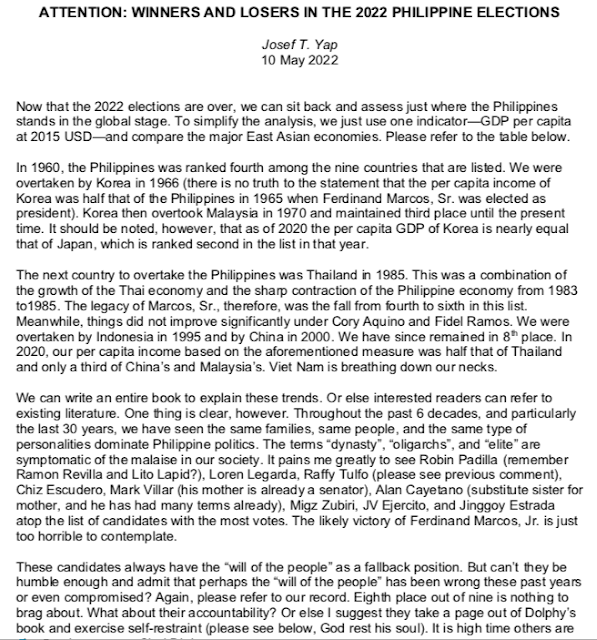

When the next administration comes in, among the high-profile economic issues they will face will be the high government spending that will require high borrowing and high taxes. The Philippines’ government spending share to GDP (G/GDP) ratio was 21.7% in 2019, and it rose to 26.8% in 2021 or a 5.2 percentage point increase in just two years. This is the second highest increase in the ASEAN-6.

Take note that this is only general or national government spending and does not include spending by local governments. If local government spending is included, we would likely be in the 32-35% of GDP level or nearly twice that of Singapore which has no local governments. Socialist Vietnam has a low G/GDP ratio of only 20%. Very likely excluded in their numbers are the spending of state-owned enterprises and banks, and local governments (Table 1).

The Philippine bureaucracy and political class, from national down to barangay level, kept receiving their salaries, allowances, and bonuses even when many people in the private sector lost their businesses, jobs, and income during the lockdowns of 2020-2021. Really unfair.

The pandemic per se cannot be blamed for this anomaly because the same virus affected Asia and the rest of the world, which had different economic outcomes because different governments have different responses. In 2020, while the Philippines had a GDP contraction of 9.6%, Vietnam grew by 2.9% and Taiwan had growth of 3.4%.

Rising government spending even if revenues are declining means increased borrowing.

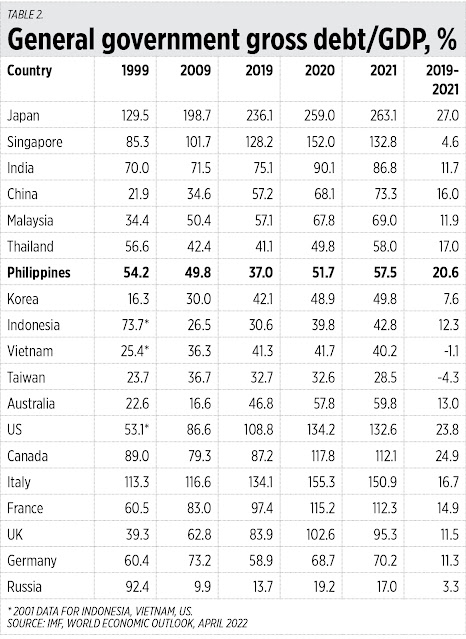

The Philippines’ gross debt/GDP ratio of 37% in 2019 rose to 57.5% in 2021 or 20.6 percentage points increase in just two years. It is the highest increase in the ASEAN-6.

Note also the huge increase in public debt of G7 countries including Japan. Only Germany in the G7 has not reached the 100% debt/GDP ratio in 2020-2021. This means those huge governments will keep borrowing huge amounts to pay old debts and push global interest rates even higher, which is not good (Table 2).

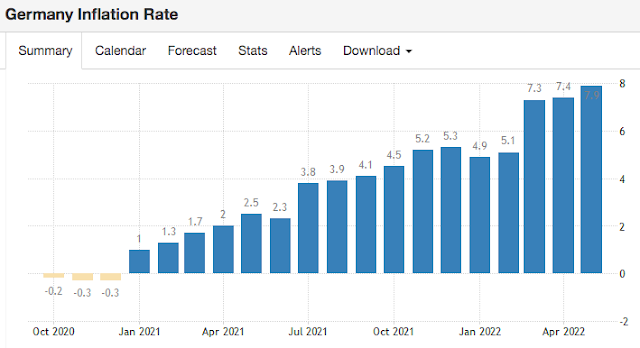

Overall, we will have more bad news than good news on the economic front. As US-EU economic sanctions against Russia expand, more commodities — from oil-gas-coal to minerals to agriculture and livestock — will be affected, supply restricted, and prices, and national and global inflation rates will further rise. Then global interest rates will further rise, and the taxes needed to pay high spending and borrowings will rise too.

There are many other economic issues to prepare for but suffice it to say that the next administration should make serious cuts in spending, cuts in borrowings, in order to limit tax hikes. Campaign promises to expand subsidies and spending should be relegated to one side as much as possible.

If spending cuts cannot be done, another option is to have large-scale privatization of government assets and enterprises, from wide lands to non-essential “services” like operating casinos and lotteries. Use privatization proceeds to retire some public debt to reduce principal and interest expenses.

-------------

BWorld 538, Energy prices and renewables-gas lobby, May 07, 2022

BWorld 539, Under scarcity: Leni service, BBM welfarism, and Isko overspending, May 11, 2022

BWorld 540, Power supply-demand in elections, nuclear energy, and transmission issues, May 30, 2022.