On economic growth, nuclear energy, and Meralco franchise

The countries that are most resolutely on the path towards “net zero,” “decarbonization,” and “denuclearization” — the UK and Germany — are also on the path towards degrowth and deindustrialization. Other European countries are on the same path towards economic suicide. Here is their GDP growth in Q1 2023, Q4 2023, and Q1 2024, respectively: Germany: 0.1%, -0.2%, -0.2%; the UK: -0.3%, -0.2%, 0.2%; Italy: 2.2%, 0.7%, 0.6%; France: 0.8%, 1.1%, 1.1%; Ireland: 1.1%, -8.7%, -0.8%; Sweden: 1.7%, -0.2%, -1.1%; and Austria: 1.8%, -1.4%, -1.3%.

Germany shut down its last nuclear power plant in April 2023 while it reduced its number of coal plants. So, it must now rely on domestic intermittent wind-solar power plus import nuclear power from France, Belgium, and Sweden to avoid blackouts.

Economic growth and security is better assured if there is energy security. Nuclear power has been an old, proven reliable energy source since the 1950s in Europe and the US. Now Europeans that started with high nuclear capacity and have “denuclearized,” like Germany and the UK, are suffering from low growth if not degrowth. Meanwhile Asian countries that ramped up their nuclear power capacity are enjoying faster growth, like China, South Korea, and India (see Table 1).

I like this observation made by Lino Bernardo, Head of Energy Transition Projects of Aboitiz Power, and among my fellow travelers from government, corporate, and local media, on the Philippines Nuclear Trade Mission to Canada last March. He said, “A national nuclear energy program can only take off once clear policies have been laid and a regulatory regime is enforced. Nuclear power has high-capacity factor and long asset life but [is] paired with high upfront capital costs. The costs of emerging nuclear technologies must come down before it becomes commercially feasible for developing countries like the Philippines, making its adoption more later than sooner. Building nuclear energy assets requires flawless execution, holistic planning from commissioning to decommissioning, and preparations on human capital development must begin as soon as possible.”

MERALCO FRANCHISE RENEWAL

House Committee on Ways and Means Chairman Joey Salceda made a good observation that “The case for renewing Meralco’s franchise is plain and simple: it has complied with the conditions of the franchise law and it is good for the economy and the consumer… At least 29 municipalities and cities and at least four provinces outside the franchise area have formally expressed interest to be served by Meralco.” See BusinessWorld’s report this week, “Lawmaker bats for Meralco service expansion, cites economic benefits” (May 14).

The Meralco franchise area covers the whole of the National Capital Region (NCR) or Metro Manila, the five provinces of Calabarzon (the whole of Cavite and Rizal, and portions of Batangas, Laguna, and Quezon), and parts of the Central Luzon region (the whole of Bulacan and parts of Pampanga).

I checked the regional breakdown of the Philippines’ GDP. The Meralco franchise area covers the top three largest economic regions of the country. Since energy is development, by assuring energy security in these areas, the company has assured their economic security. Notice the faster growth of the NCR over the national GDP in the 2003-2009 period, and faster growth of Calabarzon and Central Luzon than the national GDP in the 2010-2023 period (see Table 2)

I am from Negros Occidental. There are five electric cooperatives (ECs) there, plus three ECs in neighboring Negros Oriental, for a total of eight ECs in a single island, eight legislative franchise laws from Congress, and eight entities to be monitored by the Energy Regulatory Commission (ERC) and the public.

That Meralco delivers the efficient distribution of electricity with minimal blackouts compared to many provinces in the country should be taken by Congress as a model to consolidate those eight ECs in our island into one franchise to be administered by experienced corporate distribution utilities.

COAL AS WORKHORSE VS BLACKOUT

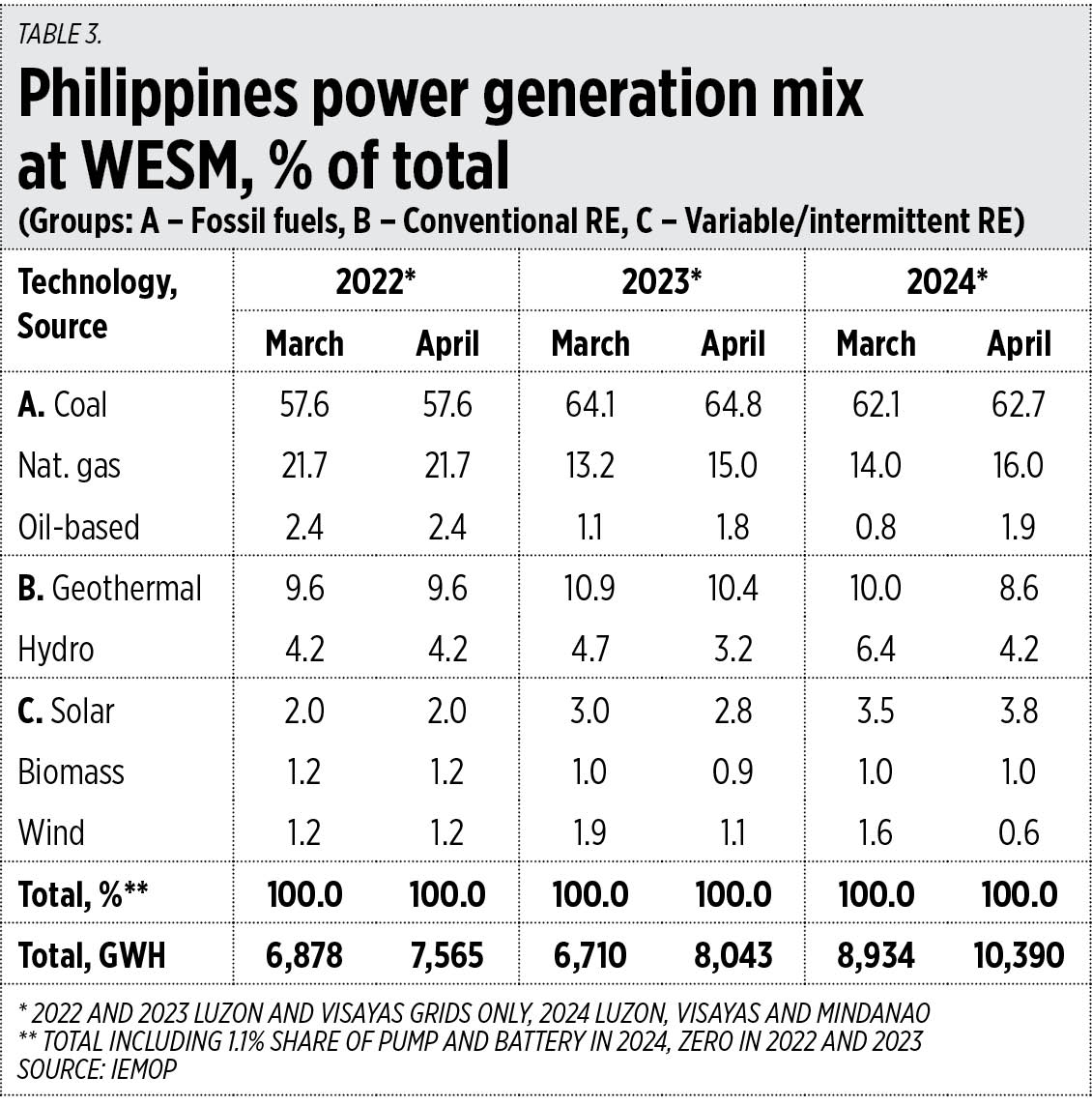

I read about some groups blaming coal plants as the “cause” of the frequent yellow-red alerts in the Philippines, especially during the hot months of March to April. Far out! They are churning out fake news. Data from the Independent Electricity Market Operator of the Philippines (IEMOP) shows that it was precisely coal power that saved the country from potential horrible blackouts this year and previous years, contributing 62% to 65% of total power generation in 2023 and 2024 (see Table 3).

But since only “brownfield” coal investments are now allowed in the Philippines, and the existing gas plants will not be sufficient to provide additional large increases in power supply in the coming years, we have to consider the use of nuclear energy in the country, from reviving or refurbishing the Bataan nuclear plant to building new small modular reactors (SMRs). Then that would assure our economic security.

See also:

BWorld 703, Six myths about thin power reserves

BWorld 704, On declining inflation and unemployment, and trade with China

No comments:

Post a Comment