The nuclear option for Asian industrialization

February 15, 2024 | 12:03 am

My Cup of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/02/15/575711/the-nuclear-option-for-asian-industrialization/

It was a successful forum we held last week on Feb. 8. The 2nd Ruperto P. Alonzo Memorial Lecture, “The Nuclear Option,” saw about 160 audience members filling the UP School of Economics (UPSE) auditorium. This was not counting the hundreds who tuned in via Zoom, YouTube, and Facebook.

The forum was organized and funded by the UPSE Program in Development Economics Alumni Association (PDEAA) and Philippine Center for Economic Development (PCED).

The main speaker was Energy Undersecretary Sharon Garin, and the emcee and moderator was UPSE alumnus Jay Layug, Jr., who is a Senior Partner of Divina Law. The five panelists were: geologist Dr. Carlo “Caloy” Arcilla, Director of the Philippine Nuclear Research Institute (PNRI); Froilan Savet, 1st Vice-President and Head of Networks of Meralco; Lino Bernardo, Head of Special Projects of Aboitiz Power; Paulo Pagaduan, Senior Lead of Renewable Energy and Just Transition, Asian People’s Movement for Debt and Development; and this writer.

Undersecretary Garin discussed the past, current, and future regulatory environments in the Philippines’ nuclear power development, with a best-case scenario being starting construction of the first nuclear plant by 2028, with it being operational by 2032. I hope this will materialize.

Doc Caloy explained the technical feasibility and security of nuclear energy, saying that most of the public’s fears about it are not based on actual experiences of its safety. The two engineers from the energy companies emphasized the need for power stability and reliability to solve the problem of power insecurity coming from intermittent sources. Mr. Pagaduan explained their advocacy for more renewable power sources and non-support for nuclear power. I discussed the links between nuclear power, security, and GDP growth performance of many countries.

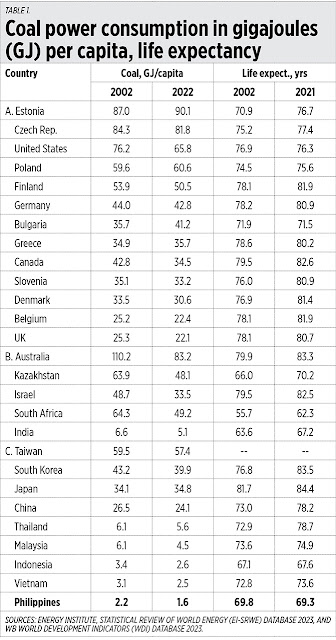

I saw some good data from the World Nuclear Association on the number and capacity of currently operational nuclear power plants by country, power plants under construction, and those planned to be built soon. I added data on actual power generation from nuclear plants over the two-decade period 2002 to 2022. In dealing with the data, I arranged the countries into three: in Group A were the Americas, in Group B the Europeans, and in Group C the Asians.

The US and Canada lead in the Americas both in operational and planned nuclear plants; France and Russia lead in Europe, but France is de-nuclearizing with no new plants being planned while Russia will keep adding new nuclear capacity, huge at 23,500 megawatts (MW).

The Asians, led by China, and with the exception of Taiwan and Japan, will keep adding more nuclear capacity.

It is interesting to note that the United Arab Emirates (UAE), an oil-gas producer and exporter, has three operational nuclear plants and will build another one. Pakistan might soon leapfrog into becoming an industrializing country with six nuclear plants operational plus one being planned. And Bangladesh is currently building two plants with a huge capacity of 2,400 MW (see the table).

Saudi Arabia has two proposed nuclear plants with a capacity of 2,900 MW. They will follow the UAE model — use nuclear power to light their roads, and export more oil gas to earn more revenues.

Other Europeans with modest nuclear power generation in 2022 were: Switzerland with 23.1 TWH; Slovakia with 15.9 TWH; Bulgaria with 16.4 TWH; Hungary with 15.8 TWH; Romania with 11.1 TWH; Slovenia with 5.6 TWH; and the Netherlands with 4.2 TWH.

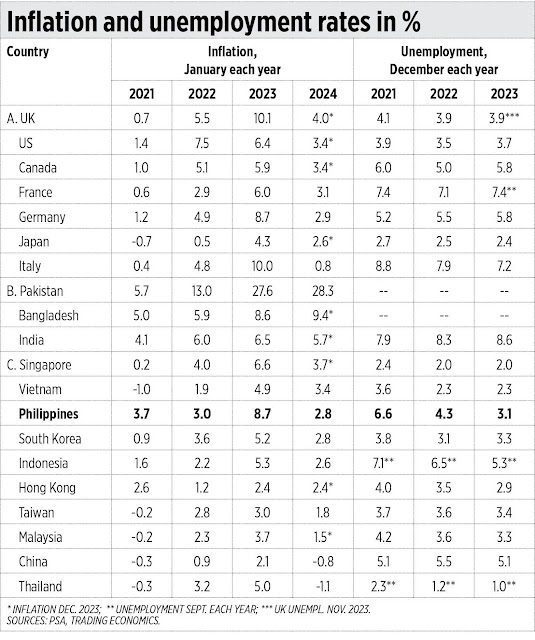

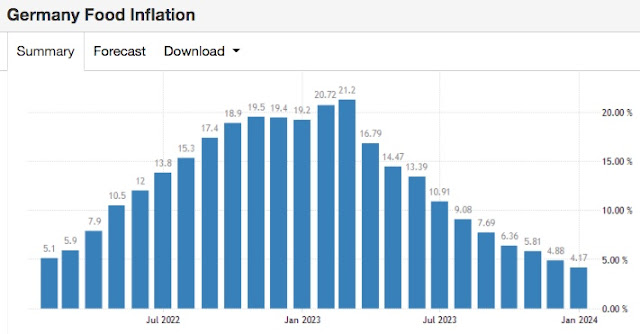

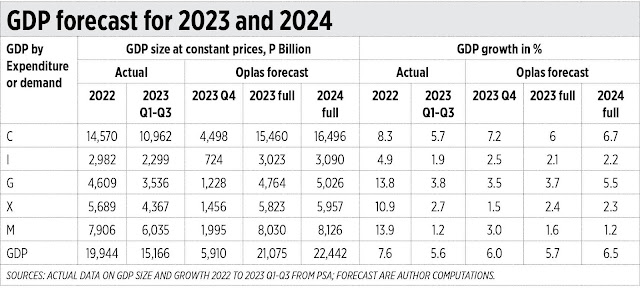

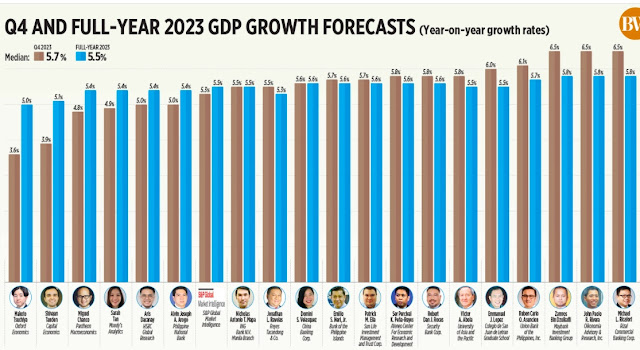

Now that the Philippine economy is growing fast, with low and declining inflation and unemployment rates, the momentum will be high and power demand will also be high over the short to long-term. Nuclear energy — cheap, stable, reliable, safe — can provide the necessary solution to high energy demand to sustain high economic growth and job creation towards the Philippines’ long-term industrialization.

Once again, I and the rest of the PDEAA board thank the three corporate sponsors of the UPSE PDEAA-PCED forum — Meralco, Aboitiz Power, and Robinsons Retail Holdings. Not for funding the forum but for donating funds for the future PDEAA room in the expanded and modernized UPSE building. Thank you, guys.

-------------

See also:

BWorld 677, Coal power and higher life expectancy, February 11, 2023

BWorld 678, Philippines has third-fastest growth among world’s top 40 largest economies, February 19, 2024

BWorld 679, Growth forecasts vs actual growth, and agriculture performance, February 20, 2024