* BusinessWorld, May 17, 2023.

-----------

See how the multilaterals like the Asian Development Bank (ADB) and World Bank (WB) lobby in stories published in BusinessWorld this month alone: “ODA, loans not enough for climate goals — ADB” (May 4), “PHL to host Asia-Pacific conference on disaster risk reduction” (May 8), “Gov’t seeks $500-million climate risk loan from WB” (May 11), “ETM seen helping PHL accelerate transition to clean energy” (May 16).

The Energy Transition Mechanism (ETM) is an economically dangerous and blackout-friendly climate loan scheme concocted by the ADB to fast-track the transition from fossil fuels to renewables, especially wind-solar. Buy out then kill via early retirement of coal plants and invest more in wind-solar. As of the first quarter of 2023, coal contributed 61% of total electricity generation in the Philippines, while wind and solar combined contributed only 4%. See how blackout-prone the Philippines will be if such a dangerous and economically suicidal policy is enforced.

THE CLINTEL REPORT

Last week, on May 9, the Climate Intelligence Foundation (Clintel), an Amsterdam-based independent think tank founded in 2019 by emeritus professor of geophysics Guus Berkhout and science journalist Marcel Crok, released its new report: “The Frozen Climate Views of the IPCC: An analysis of AR6.”

It is a 180-page date-heavy report that tears into the UN Intergovernmental Panel on Climate Change’s (IPCC) recently published 6th Assessment Report (AR6). Simply put, the Clintel Report showed in many charts and graphs that the IPCC AR6 is focused on “dangerous anthropogenic climate change,” ignores natural climate change, leans on extreme emissions scenarios, and cherry picks the time periods and the literature to make climate change appear “dangerous.”

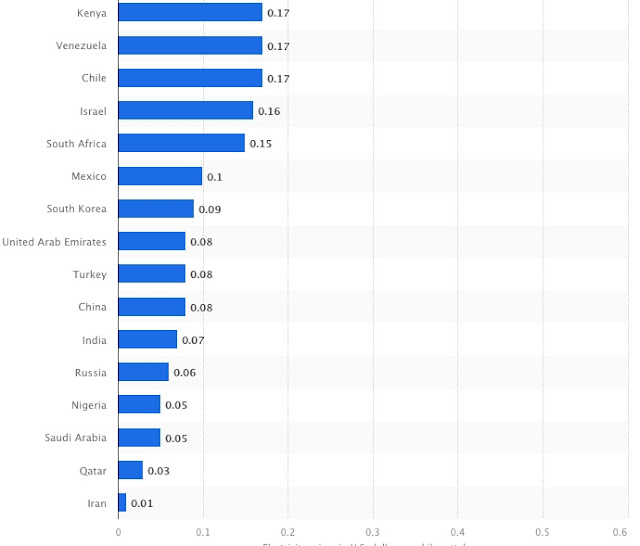

Among the important data of the report is this chart showing that weather-related losses as share of global GDP is actually falling, not rising.

The report can be downloaded free at https://clintel.org/download-ipcc-book-report-2023/.

THE PPP ACT

The Public-Private Partnership (PPP) Act was passed in the House of Representatives last December: House Bill 6527, “An Act Providing for the Enabling Environment to Foster the Growth of Public-Private Partnerships for Infrastructure and Other Development Projects.”

There are six versions of the PPP bill in the Senate, and on April 18, the Senate Committee on Public Works conducted a public hearing on the subject.

The PPP Act is a quick win for the government and the public because it will expand infrastructure projects around the country at little or no cost to taxpayers because the private sector proponents will shoulder the bulk of financial, technical, and engineering costs.

The President will deliver his second State of the Nation Address (SONA) in two months. In his first SONA last July, President Ferdinand Marcos, Jr. mentioned that the PPP Act aims to address three things: ambiguities in the existing law, bottlenecks and challenges affecting the implementation of the PPP Program, and lack of a competitive and enabling environment for PPPs.

So, the PPP Act, when enacted as a law, will unify the fragmented legal framework and improve governance of PPPs to improve doing business and protect the consumers. Currently, there are different legal frameworks for PPPs, each with their own requirements and processes: the Build-Operate-Transfer (BOT) Law, the Joint Venture (JV) guidelines of the National Economic and Development Authority (better known as NEDA), local PPP and JV ordinances, and guidelines issued by other agencies with special charters.

The proposed PPP Act will address bottlenecks in the PPP process. The approval thresholds of the current BOT Law have not been amended since 1994, so the PPP Act will increase the approval threshold for national PPP projects, making the approval process streamlined and more efficient. The proposed approval thresholds for national PPP Projects are seen in the table in this story.

The autonomy of local government units (LGUs) in the approval of local PPP projects is recognized and preserved by the PPP Act. Some mechanisms should be ready to ensure coordination in investment programming between the National Government and LGUs. These include cases where: 1.) there are proposed National Government undertakings for approval by NEDA’s Investment Coordination Committee, or, 2.) the local PPP project affects national development or master plans and projects, so an endorsement from the National Government through local development councils shall be required.

The tight fiscal condition of the National Government at a time when public demand for more modern, bigger infrastructure projects keeps rising should help the Senate in fast-tracking the enactment of this bill into a law.

---------------

See also:

BWorld 602, Declining inflation and the budget deficit, May 13, 2023

BWorld 603, The NGCP wall: Transmission problem blamed as generation problem, May 14, 2023

BWorld 604, The Philippines had fastest GDP growth in the world in Q1, May 25, 2023.