First year of Marcos: Assessing energy policies

July 25, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/07/25/535715/first-year-of-marcos-assessing-energy-policies/

We base this assessment on the first State of the Nation Address (SONA) of President Ferdinand R. Marcos, Jr., given on July 25, 2022. In his 2022 SONA, the President said this about the energy sector:

“Another fundamental requirement for growth and increased employment will be the availability of cheap, reliable energy… We must increase the level of energy production… We must build new power plants…. improving the mix of the energy supply between traditional and renewable sources.

“In the interim, natural gas will hold the key. We will provide investment incentives by clarifying the uncertain policy in upstream gas, particularly in the area close to Malampaya… re-examine our strategy towards building nuclear power plants in the Philippines.… allow smaller scale modular nuclear plants and other derivations thereof.

“We must expand the network of our transmission lines while examining schemes to improve the operation of our electrical cooperatives…. We will increase our use of renewable energy sources such as hydropower, geothermal power, solar, and wind.”

So, we will assess energy achievements on these seven points. The quickest way to do this exercise is to check reports in BusinessWorld this year, and I would say that all the subjects mentioned by the President have been acted upon by the Department of Energy (DoE), the Energy Regulatory Commission (ERC), and the administration-aligned legislature. See the seven points and the corresponding reports this year, mostly written by my favorite objective energy reporter, Ashley Erika Jose:

1. Build new power plants and expand energy production: “Making progress towards a Philippines powered by secured, reliable supply” (March 31), “New power projects to stabilize electricity supply in 2-3 years” (June 12).

2. Cheap, reliable energy: “Electricity spot price drops in July as power demand declines” (July 19), “No net-zero target in Philippine Energy Plan” (July 23).

3. Natural gas development near Malampaya: “Marcos signs deal extending Malampaya service contract” (May 16), “Malampaya Consortium plans to spend $600 million on SC 38 drilling” (May 16).

4. More nuclear energy: “Next Philippine Energy Plan to propose share of nuclear power” (May 23), “DoE may set 2,400 MW goal for nuclear power by 2035” (July 19).

5. Expand transmission lines: “Senators slam NGCP over poor network, keeping high gains” (May 24), “Approval of more ancillary contracts sought by NGCP” (July 18).

6. Improve electric cooperatives (EC): “ERC issues 33 show-cause orders against power co-ops, distributors” (May 31), “For a more equipped, energy-secure power industry” (June 8).

7. Expand renewables: “Green energy auction awards revised down to 3,440 MW” (July 13).

As reported in the July 19 story in BusinessWorld, the Independent Electricity Market Operator of the Philippines (IEMOP) showed that spot prices have been declining, from P7.69/kWh in the April 2023 billing and P8.83/kWh in May to P6.67 in June and P6.07 in July. Meralco also announced a huge decline in electricity prices of P0.72/kWh for July. That is good news from IEMOP and Meralco. Since coal prices have been stabilizing at below $150/ton since late May this year, electricity consumers benefit from it.

The ERC has been clamping down on many problematic EC and distribution utilities that were charging fuel pass-through costs to consumers even without supporting documents from the gencos, serving them with various show-cause orders.

Meanwhile, I saw a full-page ad by the “People 4 Power” coalition (P4P) in the Philippine Star entitled “Murang Kuryente para sa lahat: A message to President Marcos ahead SONA 2023.” It is a wish list of practically brain-dead advocacies like, a.) mandating straight energy pricing in all power contracts, b.) transitioning to 100% renewable energy with a minimum 50% by 2030, c.) turning away from coal, gas and hastening the phase out of fossil fuel plants, and, d.) rejecting nuclear energy.

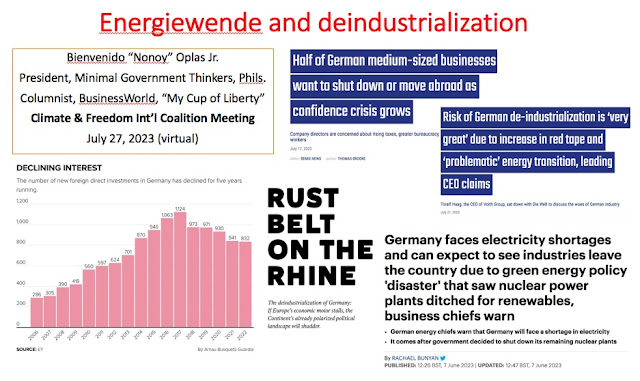

I call these “brain-dead” advocacies because they are straight socialist, dictatorial, and hallucinatory arguments. Mandatory straight energy pricing means mandatory price control, price dictatorship regardless of fluctuations in prices of energy inputs, capex, and opex. Going 100% RE, with a phase out of fossil fuels and nuclear energy is illusory. Germany started their “energiewende” or energy transition from nuclear and fossil fuels to RE since the 1970s. After five decades, the share of solar+wind to total power generation in 2022 was only 31%. Socialists and energy alarmists like P4P are advocating degrowth, deindustrialization, and blackout economics.

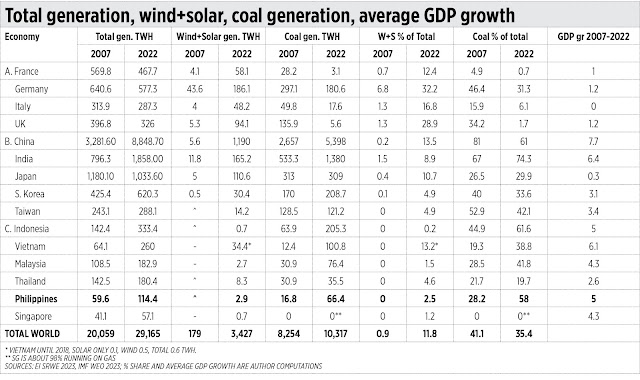

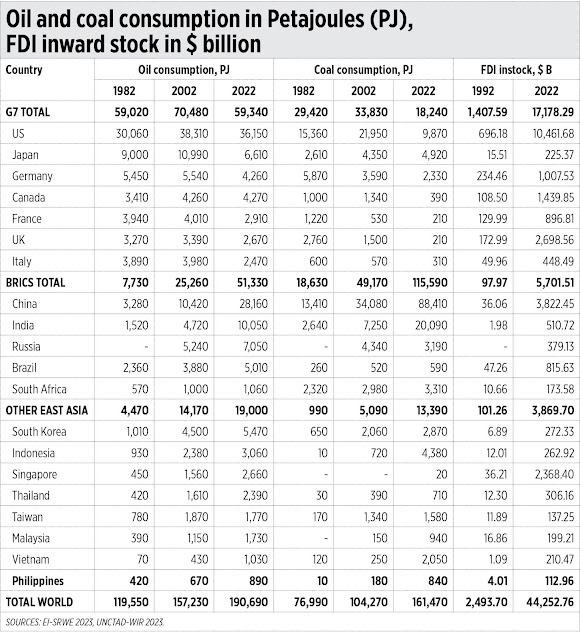

I constructed the accompanying table by comparing data over 15 years — 2007 and 2022 — from three groups of countries. In group A are the four biggest economies of Europe, in group B are the big North and South Asians, and in group C are the ASEAN-6. It also includes data from the Energy Institute’s Statistical Review of World Energy (EI-SRWE) 2023, and GDP growth from IMF World Economic Outlook (WEO) 2023.

The numbers are very clear. This is hard data, not hypothetical, fictional narratives. Here is what we found:

One, as Europe embraces and adds more wind+solar, as the share of coal to total generation declines, their overall total power generation declines, and their average GDP growth crawls between 0% and 1.2%.

Two, as big Asian nations, especially China and India, add more coal power to their mix, their total power generation expands fast, and their average GDP growth jumps high — 3.1% to 7.7%. Japan is the exception because it follows the Europeans under the influence of G7.

Three, ASEAN-6 has the same trends as group B countries — huge expansion in coal use leads to huge overall power generation and fast GDP growth, 2.6% to 6.1%.

Four, there is no real energy transition happening in the world, there is only the addition of RE to conventional energy — see the doubling of world coal generation from 8,250 TWH in 2007 to 10,300 TWH in 2022. In Europe, their “decarbonization” attempts only lead to degrowth.

From IEMOP data on power generation mix for April, May, and June 2023, we see that coal generated 64.2% of total, wind+solar combined generated only 3.4% of total. If the Philippines pushes strongly for wind+solar and the phase out of coal, there will be large-scale blackouts, and perhaps P4P leaders and groups would be in the business of selling candles and gensets.

Overall, Year 1 of the Marcos Jr. administration’s energy achievements is good. The explicit advocacy for more nuclear power, its non-commitment to illusory and brain-dead “net zero,” and protection of consumers without resorting to price dictatorship are all good policies of the administration. Congratulations, Energy Secretary Raphael Lotilla, ERC Chairperson Monalisa Dimalanta, and President Marcos Jr.

--------------

See also:

BWorld 621, Energy realism: Oil-coal consumption and NGCP’s delayed projects, July 20, 2023

BWorld 622, Year 1 of Marcos Jr.: Trade and investments, July 29, 2023

BWorld 623, Year 1 of Marcos Jr.: GDP growth and agriculture, July 29, 2023.