Year 1 of Marcos Jr.: GDP growth and agriculture

July 20, 2023 | 12:02 am

My Cup of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/07/20/534979/year-1-of-marcos-jr-gdp-growth-and-agriculture/

(Last of 4 parts)

This column attempts to make an independent assessment of year 1 economic performance of the Marcos Jr. administration. Part 1 discussed the budget deficit and unemployment, part 2 assessed inflation and interest rates, part 3 tackled trade and investments, and this part 4 will review the overall GDP performance and the agriculture sector.Regular readers of this column will have some basic economic data when President Ferdinand Marcos, Jr. delivers his second State of the Nation Address (SONA) on Monday.

I wrote a nine-page paper for Stratbase-Albert Del Rosario Institute (ADRi) that was released yesterday, “An Assessment of the Economic Performance of the Marcos Jr. Administration During its First Year,” Stratbase-ADRi Occasional Paper, July 2023 Issue 16.07. I covered nine assessment areas there: GDP growth, agriculture, inflation rate, government borrowing rates and central bank rates, ratings upgrade, exports performance, foreign direct investment, employment, and people mobility.

I started the paper by showing that in 2022, the Philippines was the world’s 39th largest economy by GDP nominal values, or 30th largest by GDP purchasing power parity (PPP) values. And since the Philippines is the 12th largest population size in the world, then its per capita GDP is low compared with many countries, and that is the big challenge facing the administration — how to expand fast the overall size of the economy and the per capita income.

Here, I will show two of the nine areas discussed in the paper.

GDP GROWTH

As of July 14, 2023, I counted 113 countries and territories that reported their GDP growth in the first quarter (Q1) of 2023. The Philippines’ growth was 6.4% and many analysts and observers heckled it as low and slowing down. But compared with those 113 economies, our 6.4% growth was the 10th fastest, and among the major economies, the top 50 largest GDP size, ours was #1. It was a big achievement by the administration and its economic team that many sectors did not realize or recognize, for the sake of criticizing or mema.

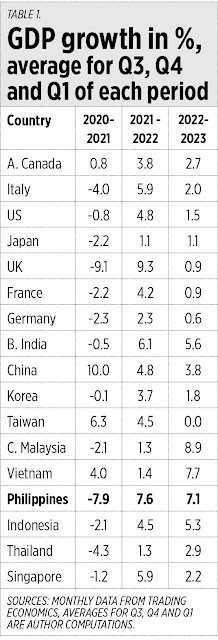

GDP performance in Q2 2023 is not yet available, so the assessment will use only the last three quarters, Q3 and Q4 of 2022 and Q1 of 2023, and compare it with the same quarters of preceding years, and with the performance of the other countries over the same period.

I grouped the countries into three: Group A for the G7 industrialized countries, Group B for the big economies of North and South Asia, and Group C for the ASEAN-6, for a total of 17 economies.

The Philippines under the Marcos Jr. administration has the third-fastest growth of 7.1% next to Malaysia’s 8.9% and Vietnam’s 7.7%. But what makes the Philippines’ growth impressive is that it was a high growth over a high base the previous year, whereas Malaysia and Vietnam have high growth over a low base the previous year.

AGRICULTURE, FISHERY AND FORESTRY (AFF)

The President remains the Agriculture secretary so this sector needs special assessment. I reviewed the gross value added (GVA) in AFF in the past three quarters, and the overall growth is 1.3% — modest enough. The quarterly growth was 2.1% in Q3 2022, -0.3% in Q4 2022, and 2.2% in Q1 2023. The last time that AFF has a growth above 2% was in Q3 2019 at 3%.

For many years, AFF growth remains muted and low, why? One explanation is the high degree of underreporting of output as these are raw products from the farms, the forest, the lakes and the sea. One proxy for real growth of the AFF sector would be the accommodation and food service activities in GDP. Raw fish from the sea, fishponds and lakes become cooked food in restaurants and hotels and their valuation is more realistic than raw food.

Accommodation and food services have an average growth of 9.5% in 2015-2019. In contrast, AFF average growth over the same period was only 1.1%. So, even assuming that half of the growth of the former is AFF, then the actual annual growth of AFF is around 4.7%, not 1.1%.

AGRICULTURE IN SONA 2022

The President mentioned in his SONA 2022 the need to adopt more modern technology and farming practices to improve output and raise productivity in the sector. Among the government measures he mentioned is to provide more financial and technical assistance to farmers and fisherfolks. Agricultural credit and farm inputs that the government will bulk purchase are fertilizers, pesticides, seeds, feeds, and fuel subsidies.

A long-term measure is value chain coordination. Research in modern farming, animal husbandry and fishery will use modern technology, plus improvements in post-production and processing. The national network of farm-to-market roads will be expanded to hasten the delivery of products to consumers.

The President did not mention or consider land consolidation, and more large-scale corporate farming in more sub-sectors. I hope he will consider this in his SONA 2023 this Monday.

SUMMARY AND CONCLUSION

From the nine areas of assessment that I covered in the Stratbase-ADRi paper, the administration performance in year 1 is as follows:

1. Good in four areas: GDP growth, ratings upgrade, low unemployment, and people mobility.

2. Modest or mild performance in four areas: interest rate, merchandise exports, FDI, and agriculture.

3. Poor performance in controlling high inflation. But as discussed there, areas where commodity inflation is high actually point to high consumer demand for “less necessities” like alcohol, beverage and tobacco, and accommodation/hotel services. In this case, high consumer confidence will just prod other sectors to expand production and hence, high overall GDP growth in the coming quarters and years.

The first year of the Marcos Jr. administration, therefore, is off to a good start, with more jobs and businesses for Filipinos and foreigners doing business here.

----------

See also:

BWorld 620, Year 1 of Marcos Jr.: Inflation and interest rates, July 18, 2023

BWorld 621, Energy realism: Oil-coal consumption and NGCP’s delayed projects, July 20, 2023

BWorld 622, Year 1 of Marcos Jr.: Trade and investments, July 29, 2023.

No comments:

Post a Comment