The law of diminishing marginal utility and public policy

June 22, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/06/22/529956/the-law-of-diminishing-marginal-utility-and-public-policy/

One of the important contributions of Economics in public policy is the marginal (or extra, additional, incremental) analysis in the increase in cost and revenues, satisfaction and dissatisfaction, welfare and “diswelfare.” And this applies to both private (household, corporate, civil society) and public (national, local government) institutions.

The “law of diminishing marginal utility” means that all else being equal or constant, as consumption of a product or service increases, the marginal utility or satisfaction or happiness derived from each additional unit declines. Or, the more units of an item are used or consumed, the less satisfaction one gets from each additional unit consumed.

An example would be going to an eat-all-you-can restaurant at a fixed price. The first two plates would give high satisfaction as the person tastes more viands. The third, fourth, or fifth plates would give less satisfaction as the person might suffer indigestion and discomfort.

Here we analyze two public policies using the marginal cost and revenue analysis: legislated minimum wage hike, and legislated tobacco tax hikes.

CASE 1. RISING MINIMUM WAGE VIA LEGISLATION

As inflation rises, the clamor for a government-mandated or legislated minimum wage hike also rises. Is this a reasonable public policy response or not?

We take as an example a restaurant with several personnel (cooks, waiters, cashier, driver/shopper). The restaurant owner decides whether to have six, eight, 10, 12 or more personnel based on the projected total costs and total revenues of running the restaurant and getting the marginal or incremental costs and revenues per additional worker employed.

The marginal cost (MC) per additional worker is simply getting the difference between the total cost of having another worker. The marginal revenue (MR) per additional worker is also getting the difference between the total revenue of having another worker.

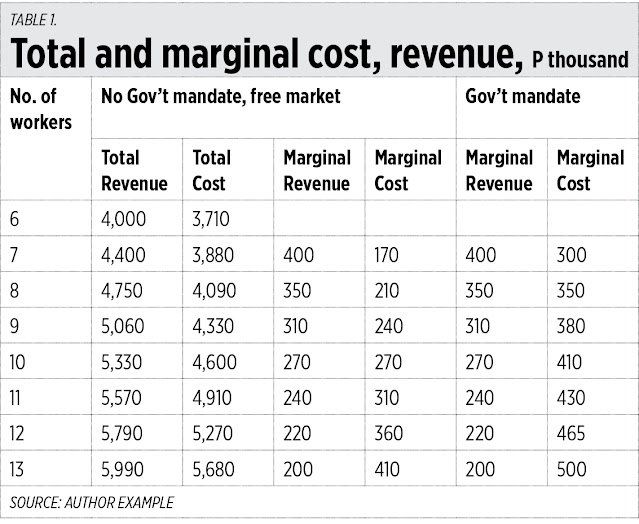

In the example below (see Table 1), if the restaurant gets only eight or nine staffers, the MR is larger than MC (MR > MC) meaning there is more revenue and profit to be made if the restaurant hires another worker, making the customers wait less time and hence be satisfied with restaurant service.

Then at the 10th worker, MR = MC at P270,000. That is also what economic theory says: profit is optimal when MR = MC. If the restaurant decides to hire an 11th worker given the same space and number of tables, MR < MC, or P240,000 vs. P310,000 respectively and the restaurant will lose money. There will be more losses if it hires a 12th and 13th employee.

When the government legislates another minimum wage hike, say from P600/day to P800/day, this raises the total costs of the restaurant and hence, the MC per worker with no assurance that total revenue and MR per worker will also rise.

We show this in another set of columns in the table. MR per worker remains constant but MC has gone up, the MR = MC situation occurs at P350,000 at the 8th worker. Meaning the restaurant must lay off two workers.

That is why a constantly rising legislated minimum wage is anti-worker, not pro-worker. It tends to reduce demand for labor as entrepreneurs use more technology and machines and hire more skilled workers, one staffer who can do the job of three to five workers and pay that staffer twice or thrice the prevailing minimum wage.

The real minimum wage is not P600/day or P800/day. The real minimum wage is zero, when no one hires a person given his/her physical, mental, educational, and other conditions. So, the unhired person must hire himself/herself via informal sector work, like being an ambulant street vendor, jeepney barker, do manual laundry, etc. where income is lower and unstable.

Variants of the law of diminishing marginal utility are the “law of diminishing marginal returns” in corporate profit, and “law of diminishing marginal tax revenue” in government. As the tax rate increases, the marginal tax revenue initially rises and after some time, declines. It happens in income tax — that is why there is not a single successful socialist economy because as industrious people’s income rises, the less is their take home pay, so many of them either work less or they continue working and under-declare their real income. Either way, the socialist government’s revenue declines, and it starts the implosion of a socialist economy, or it allows a hybrid capitalist system to survive, like what China and Vietnam are doing. Politically socialist but economically capitalist.

CASE 2: RISING TOBACCO TAX

Among the so-called “sin products” — alcohol, mining, petroleum, sugar, tobacco — the latter is the most heavily taxed. The tax hike is annual, and the tax rate alone constitutes about half of the retail price already. This year for instance, the cheapest legal cigarette is P125-P130/pack (Chesterfield, Mighty, Camel), of which P60 is excise tax alone.

Tobacco tax revenue has been steadily rising, even during the COVID-19 lockdown years 2020 and 2021. But in 2022, as the tax rate has increased to P55/pack, total tax revenue declined and thus, marginal tax revenue has turned negative by P16 billion (see Table 2).

If plotted on a graph, revenue follows a bell-shaped curve, initially rising then peaking at some point, then declining after. This was shown in this column on May 22, “The Laffer Curve of Philippine tobacco taxation.”

There are a number of reasons why this happened, but the most proximate explanation is tobacco smuggling. As legal tobacco becomes more expensive because of the higher tax, the alternative, illegal tobacco, becomes cheaper. Or, as government tobacco tax revenue declines, the smugglers and criminal groups’ income rises.

The other day I went to Ongpin St., Binondo, Manila, and I saw smuggled tobacco on sale on the sidewalk. The average retail price is P80/pack and can be bargained down to P70/pack. Which is theoretically impossible because the tax alone is already P60/pack. Some brands have no graphic warning, other brands are purely Chinese products with Chinese names and also sport no graphic warning.

The new Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui, Jr. recognizes the problem of tobacco smuggling and he started legal proceedings against certain smugglers. See these recent reports in BusinessWorld: “Government losing P500 billion to tax evasion — BIR” (Feb. 21), “Excise tax collection below target due to illegal tobacco — BIR” (May 18), “Philippine tobacco traders face P1.8-B tax complaints” (May 25).

Good move, Commissioner Lumagui. You deserve public support, especially from tax-dependent welfarist groups and sectors like the various health NGOs, consultants, and patients.

But fighting illicit trade and smuggling will not be successful if other lead implementing agencies do not do their work — the Philippine National Police, the Coast Guard, the Customs Bureau, the National Bureau of Investigation, and the LGUs.

And the tax policy itself needs review and assessment. If higher tobacco taxes lead to the decrease, not increase, in tax revenues, then a pause in the annual increase in the tax rate should be considered.

--------------

See also:

BWorld 612, Financing growth, fiscal discipline and Maharlika fund, June 28, 2023

BWorld 613, Financing sustained growth: Tax reforms, June 29, 2023

BWorld 614, FDI in the Philippines and the energy mix, June 30, 2023.

No comments:

Post a Comment