* My column in

BusinessWorld, May 20, 2020.

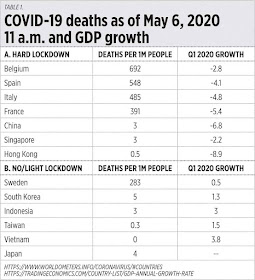

The hard lockdown countries experienced deep economic

contraction in their GDP in first quarter (Q1) of 2020: France -5.4%, Italy

-4.8%, Spain -4.1%, Belgium -2.8%, Germany -2.3%, and UK -1.6%. In Asia, the

hard lockdowners and their contractions are: Hong Kong -8.9%, China -6.8%,

Singapore -2.2%, Thailand -1.8%, and the Philippines -0.2%.

Japan is not a hard lockdown country but it still

experienced a contraction of -2% because it was already contracting in the

previous quarter with -0.7%. Japan is now technically in an economic recession.

The most adversely affected countries in Asia are China

and the Philippines. From high growth of 6%+ in Q4 2019, they just went

negative the next quarter.

The Department of Finance (DoF) showed sensitivity to the

plight of many losing businesses. It has tweaked the CITIRA (Corporate Income

Tax and Incentives Reform Act) bill, changed it to CREATE (Corporate Recovery

and Tax Incentives for Enterprises Act) bill with the following tax

adjustments, among others: corporate income tax (CIT) cut from 30% to 25% by

July this year; applicability of net operating loss carry over (NOLCO) extended

from the current three years to five years; the 5% gross income earned (GIE)

transition has been prolonged from two to seven years to four to nine years.

These are perhaps the deepest tax cuts the Philippines

ever experienced. Bravo, DoF.

Now some sectors want to push very parochial interests

and want to penalize Philippine businesses with more expensive energy which

will be passed on to consumers.

HB 2184 or the “Low carbon economy bill,” authored by

Deputy Speaker and Antique Representative Loren Legarda, plans to penalize

fossil fuel energy and establish the emission Cap-and-Trade System in the

industry and commercial sectors to reduce greenhouse gas emissions. The bill

was discussed in a public hearing by the House Committee on Climate Change on

Feb. 26.

A quick survey of GDP size and coal consumption would

show that this bill is very parochial and anti-business. The Philippines’s coal

use in 2018 was only 16.3 million tons oil equivalent (mtoe), among the lowest

in Asia. The world’s four biggest economies are also among the world’s biggest

consumers of coal energy (see the table).

According to the Department of Energy (DoE) Power

Statistics 2019, the country’s total installed power capacity was 25.5

gigawatts (GW). Of this: coal was 10.4 GW (40.8%), oil-based 4.3 (16.9%),

natural gas 3.4 (13.5%), hydro 3.8 (14.9%), geothermal 1.9 (7.4%), and

solar+wind+biomass 1.7 (6.7%).

The actual electricity generation is not really

reflective of this. Out of 106.0 terawatt hours (TWH), total generation from

coal was 57.9 TWH (54.6%), natural gas 22.4 (21.1%), geothermal 10.7 (10.1%),

hydro 8.0 (7.5%), oil-based 3.7 (3.5%), and solar+wind+biomass 3.3 (3.1%).

So the power source demonized by the low-carbon,

cap-and-trade advocates, coal power, constituted only 41% of total capacity but

actually produced 55% of total electricity consumption in the country. In

contrast, the favored and pampered variable renewables solar+wind+biomass

constituted 7% of power capacity but produced only 3% of total electricity

consumption.

So this low carbon bill would want even more expensive

electricity, a more unstable power supply, and more potential blackouts because

it will restrict the already small fossil fuel capacity in the country. The

lobbyists want more subsidies and mandates, direct and indirect, to variable

renewables that by nature are intermittent and weather dependent. Adding

batteries to solve intermittency problems would add extra costs to power. And

even so, there are days and weeks that are cloudy and non-windy so there is

little or no solar and wind power produced to store in batteries.

Congress, the DoE and the public should ignore parochial

and self-serving interests to further penalize the Philippine economy, instead

of jump starting it after the downturn caused by the COVID-19 pandemic.

Expensive energy to “save the planet” — from whom and from what? From Al Gore

and the UN, from less rain and more rain, less floods and more floods, less

storms and more storms?

Let the people, let the market, decide the kind of energy

that will give them the least cost.

--------------

See also: