----------

Cheap oil: an opportunity to deregulate and demonopolize the oil industry

The continued decline in global oil prices is at least

good news for many developing economies who can take advantage to grow faster. After

all, most economic activities require oil input – from buses and cars, tractors

and fishing boats, airplanes and ships, bulldozers and backhoes, oil power

plants and generator sets, and so on.

Current low prices have not been seen since six or more

years ago. Below are the charts for the last five years (left) and past month

(right) of West Texas Intermediate (WTI) crude prices.

Figure 1. Crude

oil price at WTI, last 5 years and last month ending December 26, 2014

While some big oil companies and their allied firms in

other industries are not happy with this fall, most

industries and sectors that rely on bought oil products

are relieved. People who save on their land travels because of high oil prices

can now drive and visit more places as their cost per trip has significantly

gone down. Airlines, shipping lines and bus lines should be capable of cutting

their fares as their fuel costs have

significantly declined. All these help expand the production of goods and

services, eventually fuelling economic activates.

But why have world oil prices gone down this much recently?

The quick answer could be the expansion in oil supply, much larger than the expansion

in demand for oil.

On the supply side, the huge output from US shale oil, plus

Canadian oil have swamped many oil importing countries’ inventories, and OPEC

member countries did not cut their collective output as they used to do,

retained its output at around 30 million barrels a day in order to protect

their global market share.

On the demand side, some industrial countries experienced

low or flat growth. Japan even went into a recession in 2014. Thus, their oil

demand either went flat or negative. Meanwhile cars’ fuel efficiency worldwide

is improving, meaning they can run longer stretch of roads with the same amount

of oil.

The reduction in global oil prices is also reflected in

Nepal’s local oil prices, as shown below.

Figure 2. Diesel

prices in Nepal, in US$ per liter, period ending December 22, 2014

From this writer’s limited readings of the oil sector in

Nepal, three interrelated issues stand out.

First, the oil shortage in some areas of Nepal in recent

weeks, an ironic situation since the world is awash with an over-supply of

cheap oil. The reason given was that the “fuel

supplied by Indian Oil Corporation (IOC) is not as per the standard set by

Nepal Oil Corporation… officials are undecided on whether to return them to

India or supply them in the market.” (source: Nepalupclose.com)

Second reason is state monopolization of oil trading

through the Nepal Oil Corporation (NOC). Oil prices are fixed by NOC’s board,

which is composed of officials from the Ministry of Commerce and Ministry of

Finance, among others.

Third reason could be oil supply monopoly of Indian Oil

Corporation Limited (IOCL) to NOC. IOCL is also a state-owned enterprise

of India, the biggest corporation there

and among the biggest firms in the whole world.

The first problem is temporary and not permanent, but it can

occur again in the future because it is an inter-monopoly agreement and

consumers normally have zero choice in a

game between monopolies.

The second problem is slowly being addressed when NOC introduced partial fuel price deregulation

in September 29, 2014, where “NOC… will

let oil prices go up or fall by up to two per cent two times a month.” (source:

Himalayan

Times, October 19, 2014). A better approach is to fully deregulate oil pricing, competing oil

companies and gas stations can set their

prices based on the extent and degree of competition.

The third pProblem can be addressed when the oil industry

is deregulated as competing oil companies can source their oil from other

suppliers.

These measures are easier said than done but the public

have already seen and experienced how things are working or not working under a

state monopolized oil industry.

Meanwhile, many Asian economies have experienced improvement

in energy efficiency per unit of economic output. Many of the economies that

realized high efficiency gains in the last decade had access to cheap energy.

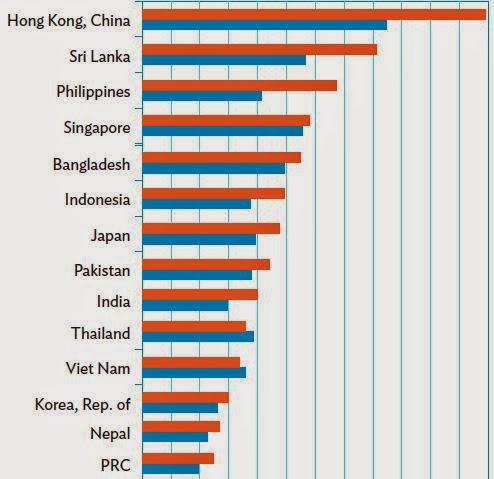

Figure 3. GDP per

unit of energy use, 2000 (blue) and 2011 (red), constant PPP $ per kilogram of

oil equivalent (HK’s level is $24)

Source: ADB, Key Indicators of Asia and the Pacific

2014.

This means that in Hong Kong in 2011, for every kilogram of

oil equivalent, its GDP rose by $24, an improvement from only $19 in 2000. In

the case of Nepal, for every kilogram of oil equivalent used in the economy,

domestic output in 2011 rose by almost $6.

Low world oil prices plus rising energy efficiency are

good combinations to implement market reforms where competition by different

players is the main regulator in protecting the public with more affordable

prices of oil and other energy products. Competing players will have wider

leeway to adjust not only to each other but also to their customers, big and

small groups alike.

See also:

Electricity and GDP Growth, April 15, 2014

Innovation, Inequality and Inclusive Growth, August 25, 2014

Investments and Inequality in Asia, October 15, 2015

Trade and Development in Asia, December 25, 2015

Two Years Writing for Business 360, January 05, 2015

No comments:

Post a Comment