https://www.bworldonline.com/opinion/2023/11/28/560035/on-meralco-psa-bidding-and-nuclear-power-development/

We have four related energy topics here, and we go straight to them.

1. Proposed delay in Meralco 1,800 MW PSA bidding, “overcharging” allegation

About two weeks ago, Sta. Rosa Rep. Dan S. Fernandez hurled an allegation about Meralco’s “overcharging” and attacked its recent bidding for a power supply agreement (PSA). There was also a House of Representatives committee on legislative franchise hearing on these issues on Nov. 22. As background, see these recent reports in BusinessWorld by Sheldeen Joy Talavera:

“Meralco seeking speedy resolution of issues over ‘very crucial’ 1,800-megawatt capacity” (Oct. 17); “Meralco seeks bidders for 1,800-MW power supply” (Nov. 3); “Meralco forecasts 4.7% growth in energy sales volume by year-end” (Nov. 14); “Meralco baseload bid attracts interest from power providers with 3,000 MW in capacity” (Nov. 21); and “Meralco says rate setting is regulated, stringent” (Nov. 27).

I support Congressman Fernandez’s position on investigating Philippine deaths by the tens of thousands in 2021 that coincided with mass vaccination, and his position on reforming the military and uniformed personnel pension. But his ideas and understanding of electricity issues are warped and twisted. Here are his warped arguments based on a Nov. 24 press release from his office:

• The Energy Regulatory Commission (ERC) should pause, stop Meralco PSA for 1,800 MW of power supply because the conditions and terms of reference were “tailor-fitted” to certain companies and are “anti-competitive and discriminatory.” It is also a monopsony.

• The requirement that a power plant should be in commercial operation not earlier than January 2020 to May 2025 to participate in the bidding, excluding other old power plants from participating, calling it “trademarking, branding, tailor-fitting.”

Meralco answered these two points in a press release on Nov. 26:

On the first, the terms of reference is approved by the Department of Energy (DoE) before Meralco conducts the competitive selection process to ensure these are aligned with DoE requirements and standards and not “tailor-fitted” to favor select generation companies. That the ongoing selection process of Meralco is just a rebidding of a valid selection held in 2020, and the new process simply reiterated most of the provisions in the previous terms that were approved by DoE.

On the second, it is a DoE requirement to limit the long-term contract bidding to greenfield (five years before start of contract) power plants to encourage new capacities. There are six potential bidders for the upcoming competitive selection process.

From the two statements, I say that Congressman Fernandez is wrong and Meralco is correct in following the DoE guidance. There are six participants now because only six generation companies expressed interest. If 12 gencos submitted EOIs and they fit the TOR, then there would have been 12 bidders.

My suspicion is that the congressman is pushing some old power plants to participate even if they do not qualify for the terms set by the DoE. If those old plants win the competitive selection process and later conk out and cause regular blackouts, and many big investments fail to come for fear of more blackouts, will Congressman Fernandez and his favored old power plants accept responsibility? I doubt it.

Rep. Fernandez also alleged “P200 billion overcharging of customers since 2012” and that this amount should be given back to consumers.

Meralco in its Nov. 26 statement said its rates “undergo a review and confirmation process to ensure that they are fair and reasonable, just like other distributors, that it has no power to unilaterally set its own rates. All rates reflected in the electricity bills of customers are approved by the regulator following a very stringent and transparent process of public hearings.”

I encountered that “P100+ billion Meralco overcharging” earlier. See this column’s two pieces this year: “Low power supply and Meralco distribution cost” (April 3); and “More on Meralco distribution charges and energy transition” (April 17).

I will show again the disaggregation of total Meralco charges from 2012 to July 2018. The numbers show the following: One, there was no big increase in overall price, from P11/kWh in 2012 to P11.52 in 2018; two, there was no big increase in Meralco distribution, supply and metering (DSM) charges, from P2.18/kWh in 2012 to P2.28/kWh in 2018. And three, generally flat generation and transmission charges.

What can be charged as real “overcharging” is the universal charge in missionary electrification and the subsidy to customers of off-grid islands and provinces in the country — from only 12 centavos/kWh in 2012 to 44 centavos/kWh in 2018. The feed-in tariff allowance (FIT-All) or subsidies for intermittent power like wind and solar also increased during the period.

So there was no room for “overcharging” in the overall rates in the Meralco DSM. The “overcharging” by P100+ billion allegation is simply a warped, garbled and fictional narrative that is driven by politics and not by economics and actual numbers.

The Meralco competitive selection process should proceed.

2. DoE-USAID forum on “Advancing Energy Security through Championing Local Actions”

This was held on Nov. 17 at the Grand Hyatt Hotel in BGC, Taguig City. It is good that USAID is helping local government units innovate more on local energy efficiency and conservation plan and energy management. But there is one problem here — LGUs are encouraged to focus more on energy conservation and even consumption cuts, instead of expanding more power generation from more sources.

Big LGUs like the cities of Iloilo, Bacolod, Cebu and Davao should attract more big investments from both FDIs and local businesses. But if they see blackouts just around the corner due to insufficient power supply, or they must buy big generator sets and automatically raise their capex and opex and hence, the cost of business, very likely many potential investors will not come. LGUs will lose, not benefit, from this situation.

3. DoE-US cooperation on harnessing civilian nuclear power for sustainable development or “Agreement 123”

On Oct. 16, Energy Secretary Raphael Lotilla signed that bilateral agreement with the US during President Ferdinand R. Marcos, Jr.’s attendance at the APEC summit. The agreement covers not just nuclear power development but also nuclear technology application in plant breeding, livestock production, insect pest control, soil and crop management, food safety, health and medicine, and many more. Beautiful move, Secretary Lotilla.

4. Pandesal Forum on nuclear energy

On Nov. 24, I attended the Pandesal Forum on nuclear energy. The main speakers were Congressman Mark O. Cojuangco, chairman of the House special committee on nuclear energy, and Gayle Certeza, lead convenor of Alpas Pinas, a nuclear energy education and advocacy NGO. Wilson Flores was the moderator.

As background, see these recent reports in BusinessWorld: “Nuclear deal seen addressing PHL need for baseload power” (Nov. 19), “House approves bill creating nuclear regulator” (Nov. 22).

The proposed “Philippine National Nuclear Energy Safety Act” (House Bill 9293, passed on third reading) seeks to establish the Philippine Atomic Regulatory Authority, which will have “sole and exclusive jurisdiction to exercise regulatory control for the peaceful, safe and secure uses of nuclear energy and radiation sources.”

This is a beautiful bill and must become a law. It will complement DoE-US Agreement 123. I support the pivot to nuclear power development, whether large nuclear plants of 1,000 MW, or small modular reactors (SMR) of 20-40 MW, or micro modular reactors of 5 MW or less. Stable, reliable, running 24/7 at competitive prices. We need them, especially on off-grid islands. They should have SMRs so we can abolish the UC-ME someday, now at 22 centavos/kWh when it should be zero.

-------------

See also:

BWorld 657, Energizing growth via grid ‘demonopolization’ and ‘declimatism’ policies, November 26, 2023

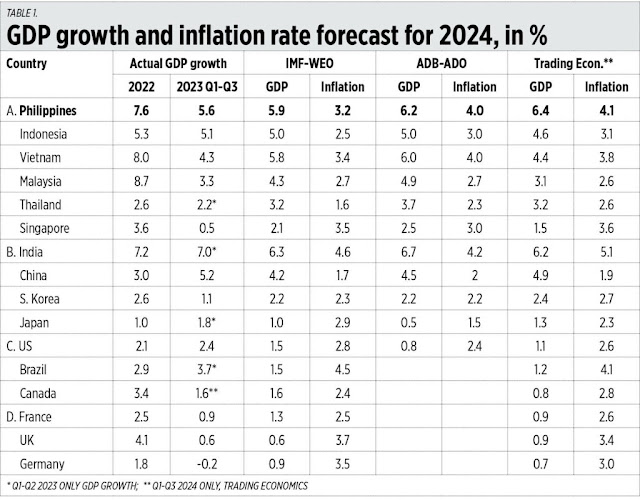

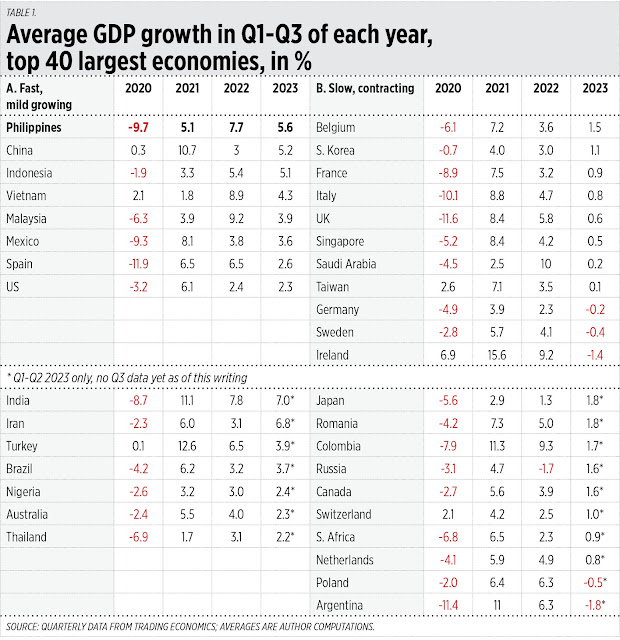

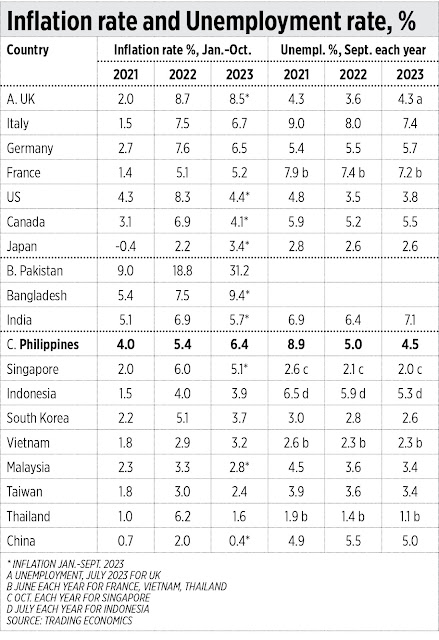

BWorld 658, Economic forecast 2024, November 27, 2023

BWorld 659, Economic forecast 2024 (Part 2), November 29, 2023.