Economic forecast 2024

November 21, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/11/21/558623/economic-forecast-2024/

Only six weeks to go and the year 2024 will be with us. Many people, especially entrepreneurs, are curious about two issues: 1.) What is the economic outlook, the business environment, for the new year? And, b.), what sectors should they invest in more, and where to pull back?

FORECAST 2024

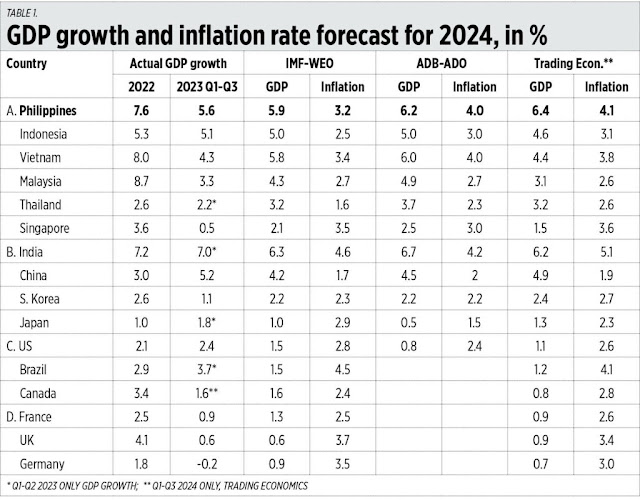

I checked the latest forecast by the International Monetary Fund (IMF), its World Economic Outlook (WEO) October 2023, the Asian Development Outlook (ADO) September 2023 of the Asian Development Bank (ADB), and Trading Economics as of November 2023.

For Table 1, I put countries together into four groups: Group A is the ASEAN-6, Group B contains the large Asian economies, Group C has the largest economies of North and South America, and Group D is made up of the largest economies in Europe. The economic performances of most countries, especially in Europe and the ASEAN-6, have been worse this year than last year.

For 2024, the IMF foresees mild growth recovery in the ASEAN-6, South Korea, France, and Germany. And it sees modest inflation rates of only 1.7% to 4.6%.

The ADB has similar forecast numbers as the IMF, except in the US where it sees only 0.8% growth in 2024 vs the IMF’s 1.5%. And Trading Economics has a low growth forecast for the ASEAN-6, except for the Philippines where it sees high growth of 6.4% next year (see Table 1).

Of the three sources, I believe that Trading Economics has a more realistic forecast than the IMF and ADB — it sees growth of 6.4% for the Philippines. We should keep the growth target of 6.5% to 8%.

Singapore is currently crawling with growth of just 0.5% this year. Recently it pivoted to degrowth economics via high carbon tax — it will raise the current $5/ton to $25/ton in 2024-2025, and up to $45/ton in 2026-2027, and $50-80/ton by 2030. This is a degrowth and deindustrialization policy.

I also checked two other sources, the Budget of Expenditures and Sources of Financing (BESF) 2024 submitted by the economic team to Congress in August 2023, and the forecast by the Bank of Philippine Islands (BPI) in November 2023.

The BESF targets GDP growth of 6.5% to 8% in 2024, BPI sees growth at 6.2%. The BESF targets inflation to be 2% to 4%, while BPI sees it at 3.6%. The BESF targets a US dollar/Philippine peso exchange rate of P53 to P57 per dollar while BPI sees a P53.80 rate.

Tomorrow, Nov. 22, I will go to three big fora. One is the BusinessWorld Economic Forum (BWEF) 2023 with the theme, “Forecast 2024” at the Grand Hyatt Hotel in BGC, Taguig City. There is also the Stratbase’s “Pilipinas Conference 2023” at The Peninsula Hotel in Makati. Then the quarterly membership meeting of the Out-of-Home Advertising Association of the Philippines (OHAAP) in Valle Verde Country Club in Pasig City, where I will give a talk: “Economic Forecast 2024.”

The BWEF will have the regional or country heads of the three multilaterals — the ADB, the IMF, and the World Bank — as its keynote speakers in the morning. Stratbase will have the government’s economic team, the Secretaries of Finance, Budget, Economics/NEDA plus the Secretaries of Trade and Transportation as its morning speakers.

PEB IN SAN FRANCISCO

Last week, on Nov. 15, President Ferdinand Marcos, Jr., and the government’s economic and infrastructure teams held another Philippine Economic Briefing (PEB) in the US, this time at the Ritz-Carlton Hotel in San Francisco, California. The President told business leaders, investors, and bankers there that “A wealth of opportunity awaits you in the Philippines and we are ready to explore new horizons with your investments in the coming years.”

Finance Secretary Benjamin Diokno who leads the economic team said: “We have opened up the economy. We didn’t wait for the virus to subside, we opened up many sectors of the economy and the economy really is doing very well. It is one of the fastest-growing countries in the fastest-growing region in the world. So this is our moment.” Budget Secretary Amenah Pangandaman discussed the priority expenditures in line with the Philippine Development Plan 2023-2028, and key budget reforms like the government’s rightsizing program.

The economic team has targeted a reduction in the country’s budget deficit to only 3% of GDP by 2028 and public debt of 51% or lower by 2028, while sustaining high infrastructure spending of 5% to 6% of GDP yearly.

These are hard to achieve targets considering the economic damage done by the lockdown dictatorship where public debt jumped from 37% of GDP in 2019 to 57% to 58% in 2020-2021. But we must pursue these targets with the goals of reducing the deficit, the public debt, and inflation rate while sustaining fast growth.

WHERE TO INVEST

Table 2 is a breakdown of the industrial origins of the Philippines’ GDP in 2021-2023. The biggest sub-sectors are the wholesale and retail trade, repair of motor vehicles and motorcycles (WRTRMVM), and manufacturing. They both constitute 18-19% of GDP each.

The good business prospects in terms of double-digit growth for at least two years are: Accommodation and food service activities, meaning the hotels, resorts, restaurants, and bars. Next are transportation (air, land, sea) and storage, although these two have a small percentage share of total GDP. Third would be construction. The Electricity, steam, water and waste management (ESWWM) sector has a modest growth of 5-6%.

Also a good business prospect — but which comes with high political risk — is mining, both metallic and non-metallic. Gold, copper, nickel, etc. will never fade in importance but the problem is politics, there are too many political actors opposing corporate and open-pit mining. We should prioritize more prosperity via responsible resource extraction, than more poverty with “undisturbed” lands.

--------------

See also:

BWorld 655, Stabilizing growth: Declining inflation and unemployment rates, November 18, 2023

BWorld 656, Stabilizing growth of the fastest growing major economy in the world, November 19, 2023

BWorld 657, Energizing growth via grid ‘demonopolization’ and ‘declimatism’ policies, November 26, 2023.

No comments:

Post a Comment