* BusinessWorld, April 19, 2023.

-------------

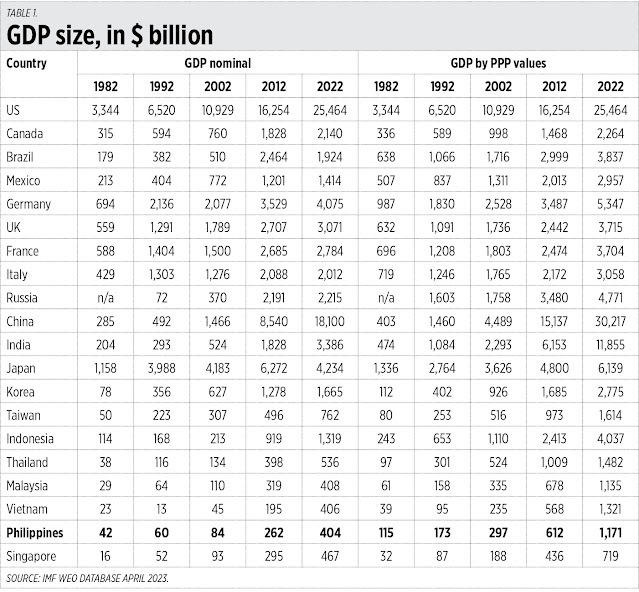

Also last week, the IMF released the World Economic Outlook (WEO) 2023. I was curious about the economic expansion of the Philippines and other countries over the past four decades, so I checked the database and got the excel file.

I show here different countries’ gross domestic product (GDP) size, both nominal (current GDP values in national currency multiplied by average exchange rate with the US$) and by purchasing power parity (PPP) values, which attempts to remove price level differences of goods and services between countries.

In PPP values of GDP, China overtook the US in 2016 with $18.7 billion. Indonesia overtook Italy in 2011 with $2.23 billion, then France in 2019 with $3.33 billion. And Vietnam had overtaken the Philippines in 2018 with $936 million. Nonetheless, the Philippines has expanded its GDP-PPP tenfold from 1982 to 2022 (see Table 1).

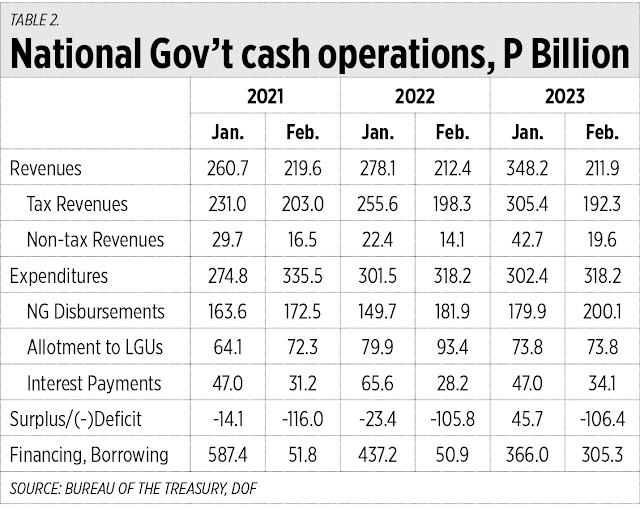

A FISCAL SURPLUS

On the fiscal side, the Department of Finance (DoF) and Department of Budget and Management (DBM) labor hard to raise revenues without creating new taxes, and limit spending somewhere because other sectors just keep expanding their share of the annual budget. In particular, the local government units (LGUs), which have higher revenue share after the implementation of the Mandanas ruling, and the military and uniformed personnel (MUP) pension that just keeps expanding, now about P160 billion/year from taxpayers because the previous and current personnel contribute zero to this fund.

Every January, the DoF secures big borrowings to help finance expenditures in the first quarter. Last January, it raised $3 billion from its second global bond offering under the Marcos Jr. administration. Target borrowings for 2023 is P2.21 trillion.

Also last January, the DBM had a good accomplishment — it controlled spending to the January 2022 level while revenues have expanded, resulting in a fiscal surplus of P46 billion (see Table 2). Congratulations, DBM.

Consider also these recent reports in BusinessWorld: “Budget gap widens in February as revenue collections decline” (April 4), “DBM calls on agencies to prioritize infrastructure, human capital, food security in budget proposals” (April 5), “DBM releases P43B for senior citizen health insurance” (April 11), “Gross borrowings jump in Feb.” (April 17).

ABOLISH OR RECALL EO 12

There is an ongoing noisy lobby that says hybrid cars, e-motorcycles, and e-tricycles should be tax-free too under an expanded Executive Order No. 12 (EO 12), signed by the President last January. For me this is shameless for three reasons.

One, EO 12 itself is wrong in the first place. Those electric vehicles (EVs) — e-cars, e-buses, e-trucks will also add to traffic congestion and road depreciation but contribute zero or little for road maintenance because they are imported tax free.

Two, there is a continuing fiscal burden with high public debt, high annual deficit and borrowings, and high pressure to raise taxes somewhere — and yet many rich sectors want to contribute zero for their vehicles. A small sedan worth P0.5 million is taxed, but e-cars — which should cost at least P1.5 million — hybrid cars — at least P1.2 million — will not be taxed. That is lousy.

Three, the rule of law should prevail. The law applies equally to unequal people, unequal businesses and vehicles. If certain cars should be tax-free, then all cars should be tax-free too. Otherwise, all cars, EVs or gasoline, should be taxed.

The DoF should either ignore or oppose this new lobby to expand tax-free favoritism to hybrid cars and e-tricycles. Or the DoF should convince the President to pull out, to recall EO 12. All cars, all trucks, all motorcycles must either pay taxes, or pay nothing. No exemptions.

----------------

See also:

BWorld 594, Philippines to offer more investor returns than Europe, April 18, 2023

BWorld 595, Cancer spending and the budget, April 19, 2023

BWorld 596, More on Meralco distribution charges and energy transition, April 20, 2023.