FDI in the Philippines and the energy mix

June 20, 2023 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/06/20/529550/fdi-in-the-philippines-and-the-energy-mix/

Last week, the government economic team held the 7th Philippine Economic Briefing (PEB) in the Singapore Fullerton Hotel. The first PEB in Singapore was held on Sept. 9, 2022 and led to investment pledges of $6.5 billion.

SOURCES OF FDI

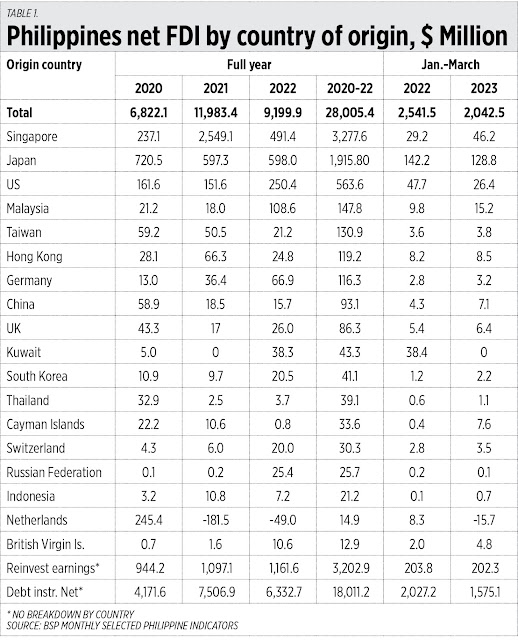

Singapore is the most appropriate place to invite more foreign direct investments (FDIs) into the Philippines because it was the country’s number one source of FDIs in 2020-2022, larger than Japan, and six times larger than the US (see Table 1).

Among the declarations made at the Singapore PEB were the following. Finance Secretary Benjamin Diokno said “this is the moment”; Budget and Management Secretary Amenah Pangandaman said “the Philippines will not only be the darling but also the Sweetheart of Asia.” Secretary Arsenio Balisacan of the National Economic and Development Authority (NEDA) said the President desires to expand opportunities and partnerships for trade and bilateral relations rapidly. Central Bank Deputy Governor Francisco Dakila, Jr. added that cash remittances, BPO revenues, FDIs, and international reserves will cushion the Philippine economy against global headwinds.

DBS Group Chief Executive Officer (CEO) Piyush Gupta said that Philippines is among the top 10 nations of interest for Singapore investors. Good.

More investment means more businesses and job creation, more modernization, less poverty, and less dependence on the state for welfare by the citizens.

Notice the big jump in 2022 FDI coming from Malaysia, Russia, Germany, Kuwait, and Switzerland, while there was a big decline in FDI coming from China, the Netherlands, and the Cayman Islands.

The Philippines and the rest of Asia should focus on trade and investments, and global and regional peace via commerce, tourism, and modernization. We should not follow Europe and the US that are fixated on endless wars.

MANY ENERGY ISSUES

There have been many energy-related issues that cropped up recently. I have arranged them into sub-topics, with all stories published in BusinessWorld and mostly written by Ashley Erika Jose, my favorite objective energy reporter.

1.) Energy Regulatory Commission (ERC) and distributors: “ERC issues 33 show-cause orders against power co-ops, distributors” (May 31), “ERC orders distributors to explain higher-than-approved power charges” (June 8).

2.) Department of Energy (DoE) and renewables: “DoE calls for fair treatment of poor countries in transition to green-energy technology” (June 6), “Energy dep’t clarifies on-grid rollout procedures for renewables” (June 6), “DoE registers P6.8B worth of investments in energy efficiency” (June 13), “DoE may impose up to P100M in fines for RPS violations” (June 14).

3.) Decarbonization and unstable energy: “Philippine fast-track decarbonization seen costing $133 billion until 2040” (June 8), “Napocor hoping to convert off-grid unit to 100% renewable” (June 11), “New power projects to stabilize electricity supply in 2-3 years” (June 12), “Gas-fired power still critical for PHL amid green-energy transition — Fitch Solutions” (June 13).

4.) Ninoy Aquino International Airport (NAIA) blackout and Meralco: “NAIA power outage caused by MServ personnel’s lapse” (June 12), “Meralco sees easing power rates as rainy season starts” (June 12).

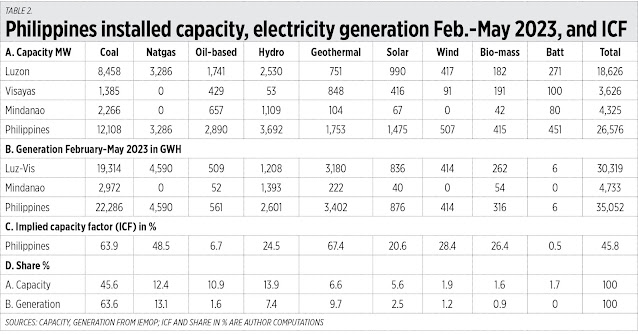

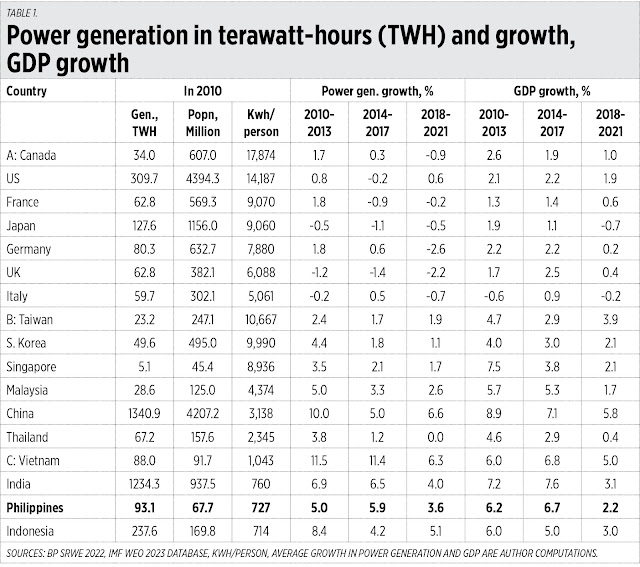

Last week, the Independent Electricity Market Operator of the Philippines (IEMOP) held a briefing. Since there is endless push to have more intermittent solar and wind power in the national grid, I used the IEMOP data and computed the implied capacity factor (ICF) of all energy sources — fossil fuels, conventional renewables, and intermittent renewables — to see where we can really get energy security and stability. Here are the results.

One, for the period February-May 2023, the average capacity factor — actual generation over potential generation capacity — for the Philippines overall is only 46%.

Two, geothermal has the highest ICF — it produced 67% of its potential capacity, meaning the other 33% of power plants were on maintenance shutdown or unscheduled, prolonged maintenance. Coal came in second with 64%, third was natural gas with 48.5%.

Three, hydro has a low ICF of only 24.5% because February-May is within the non-rainy season. Solar on average has an ICF of only about 15%, but those months already in the dry, generally sunny season so it reached 21%. Oil-based plants are used only as occasional peaking plants and are not running regularly.

Four, coal’s share in installed capacity is only 46% of the total but it contributed 64% in actual electricity generation. In contrast, solar and wind have a 7.5% combined share in installed capacity but contributed only 3.7% of actual electricity generation (see Table 2).

So, the intermittent sources are not dependable, are not reliable for electricity users and it will be dangerous if they dominate the grid. All those “decarbonization” efforts, which are very expensive and subsidy-dependent, will only lead to degrowth and blackout economics.

The half-hour blackout at the NAIA on June 9 was an accident. MServ, which is a wholly owned subsidiary of Meralco, was doing a comprehensive technical audit to improve NAIA Terminal 3’s electrical system following the outage that hit the terminal on May 1. It was a pro-bono effort by Meralco, at no cost to NAIA or the airport passengers. An MServ worker accidentally left grounding conductors attached to a piece of electrical equipment during a testing activity, which triggered an electrical fault that subsequently caused the power interruption of NAIA Terminal 3.

Meralco Spokesman Joe Zaldariaga quickly issued a statement explaining what happened and humbly made the public apology. I saw and read the press statement; the apology was sincere. No alibi, no blame game. They tried to help — for free — improve the airport’s electrical system, then an accident happened. Good move, Mr. Zaldariaga.

On a related note, I support the privatization of NAIA operations. Make it more professional and less political. There is no “market failure” in airport operation, even ownership. If a private airport frequently conks out, then passengers and airlines will avoid it and the private owner and operator will lose money.

-----------------

See also:

BWorld 611, Declining inflation and Germany’s energiewende, June 24, 2023

BWorld 612, Financing growth, fiscal discipline and Maharlika fund, June 28, 2023

BWorld 613, Financing sustained growth: Tax reforms, June 29, 2023.