* BusinessWorld, June 8, 2023.

-----------

Compared to other Asian economies over January to May, the Philippines has had the highest inflation rate, at the same level as Germany. Over the same months in 2022, India and Singapore had the highest inflation rates in Asia (see Table 1).

The main areas pulling up inflation in May were: 1.) Alcoholic beverages and tobacco, 12.3%, 2.) Restaurants and accommodation services, 8.3%, and, 3.) Food and non-alcoholic beverages, 7.4%. The first two show that people are drinking, smoking, and partying more; that people are going out more to eat and party in restaurants and hotels, and going to provincial hotels and resorts.

I think GDP growth in 2nd quarter could be high. Household consumption is 75% of GDP, so high consumption there can pull up the overall GDP level and growth.

ERRATUM

I would like to apologize to the readers for the error in transposition in headings in Table 1 of my column last week, “NGCP, low power generation, and the Maharlika Fund” (June 1). The table’s column on Population should have been for Power generation and vice versa. Sorry for that mistake and the confusion it created. Nonetheless, the column and computed kWh/person remains valid and correct. Also, the numbers on average growth in power generation and GDP remain valid and correct.

Meanwhile, here are some points about the National Grid Corp. of the Philippines (NGCP) that I did not include in my column last week.

One, the Energy Regulatory Commission (ERC) in previous administrations had issued a lot of show cause orders with penalties to private distribution utilities (DUs) and generation companies (gencos), but when it comes to the NGCP, only one has been issued, last year, with a penalty of P5 million for non-compliance with a Department of Energy circular.

Two, show cause orders for DUs and gencos have high penalties and even come with customer refunds amounting to billions of pesos. Maybe this is because the ERC does not have a group monitoring transmission, only groups for monitoring DUs and gencos. The ERC should consider having a group for monitoring transmission performance.

MORE RENEWABLES, MORE EXPENSIVE ELECTRICITY, THE CASE OF GERMANY

Germany is the biggest economy in Europe although in power generation, it is second only to Russia. But Germany is the powerhouse in renewables, the biggest in installed capacity for wind and solar — it adopted early the “energiewende” or energy transition from fossil fuels to renewables, starting around 2000. Among the policies is the imposition of EEG or Feed-in Tariff (FiT) like in the Philippines, with guaranteed high prices for intermittent renewables for 20 years.

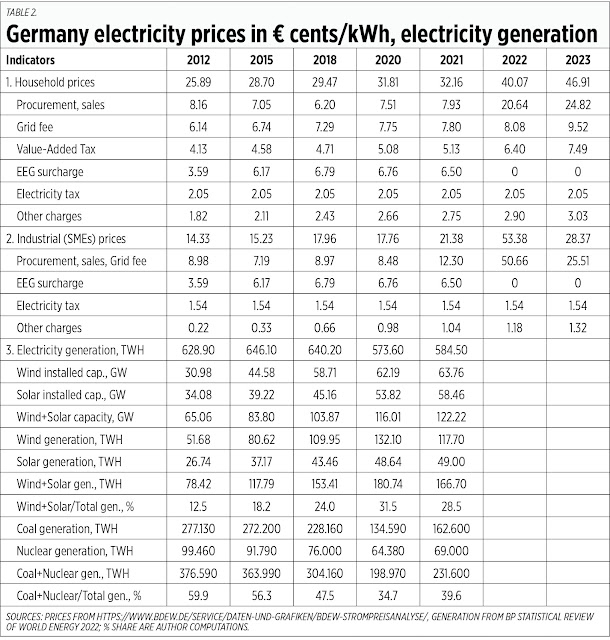

I saw data from the German Association of Energy and Water Industries (BDEW), listing electricity prices for household/residential and industrial. The trend in prices is horribly anti-consumer and anti-business. Among the culprits are: a.) high procurement for generation as Germany bought more gas from the US, Middle East, and Africa because they avoided cheap Russian gas; b.) a high EEG surcharge, which had been temporarily discontinued last year and this year as prices are almost double the 2012 level; and, c.) rising Grid fees as adding more intermittent power sources to the grid will require more costs to stabilize the grid.

Then I checked Germany’s energiewende, they added lots of wind and solar capacity — installed power in 2021 was twice the 2012 level. Power generation by wind and solar more than doubled, from 12.5% of total in 2012 to 31.5% in 2020. Meanwhile, power generation from coal plus nuclear decreased from 60% in 2012 to only 35% in 2020.

Germany saw its mistake and, in 2021, they slowly and silently raised their coal plus nuclear generation to 40% of the total (see Table 2).

There are important lesson for the Philippines and many developing countries — having more intermittent renewables and less conventional power like coal and nuclear will lead to more expensive electricity, a higher overall inflation rate, and even deindustrialization and degrowth economics.

The main reason is that intermittent sources will always require huge backup power. When the wind does not blow, when it is night, or a cloudy or rainy day and solar output is very low, backup power from fossil fuels and nuclear must be available to avoid blackouts — and this is not cheap. Consumers will have to pay double, first for intermittent sources with high prices (EEG/FiT surcharge, ancillary power for grid stability), and second, for the cost of backup power.

We should avoid deindustrialization and degrowth economics. We should focus on sustained fast growth for our people and businesses. We should stay the course of using more fossil fuels in power generation. Add nuclear power too — revive the Bataan Nuclear Power Plant (BNPP) plus add small modular reactors (SMRs) for off-grid islands and provinces.

When the Maharlika Fund is finally established, I wish that among its big-ticket projects are: getting majority control of the NGCP, doing more offshore oil-gas exploration and development, buying out many inefficient and wasteful electric cooperatives in many provinces, and going into nuclear power generation via the revival of the BNPP and setting up many SMRs in off-grid islands and provinces.

--------------

See also:

BWorld 608, The digital future, rising productivity and economic growth, June 20, 2023

BWorld 609, NGCP, low power generation, and the Maharlika Fund, June 21, 2023.

BWorld 610, Financing sustained growth: MUP pension reform, June 22, 2023.

No comments:

Post a Comment