On a huge budget surplus and long-term privatization revenues

March 19, 2024 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/03/19/582568/on-a-huge-budget-surplus-and-long-term-privatization-revenues/

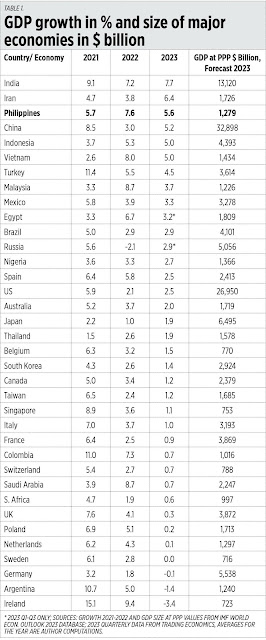

A number of good economic reports came out last week. See for instance these stories in BusinessWorld: “US firms to invest over $1B in PHL” (March 12), “PHL secures $4B in German pledges” (March 14), “Philippines’ budget surplus at $1.58B in January” (March 15), “PHL to grow 6.4% this year — Fitch” (March 15), and “GOCC subsidies down in 2023, PhilHealth top recipient” (March 17).

I checked the Bureau of the Treasury (BTr) data on the latest cash operations report (COR) of the National Government. The January 2024 data showed that the National Government (NG) experienced a budget surplus of P88 billion. That is huge. So I checked the January data of previous years — turns out that this year’s budget surplus could possibly be an all-time high and almost twice the surplus of P46 billion in January 2023.

This is largely because revenues have expanded big time, from P278 billion in January 2022 to P348 billion in January 2023 to P422 billion in January 2024. Meanwhile, government expenditures were timid at P302 billion in January 2023 to P334 billion in January 2024.

Financing or borrowing was significantly controlled, from P587 billion in January 2021 and P366 billion in January 2023, to only P118 billion in January 2024 (see Table 1).

I must extend my congratulations to Budget Secretary Amenah F. Pangandaman and Finance Secretary Ralph G. Recto. The fiscal consolidation policies are bearing fruit so far.

The rate of increase in revenues, even without a major tax hike, should stay higher than the rate of increase in expenditures. Public spending should be targeted at expanding and better infrastructure, like more provincial and barangay roads than cash subsidies. Rural infrastructure will encourage the poor to be more productive while endless subsidies will encourage more people to not work hard enough or understate their real incomes so that they can qualify for many subsidies and freebies like free tertiary education, free healthcare, free monthly cash, and so on.

One big piece of news last week was reported in the Philippine Star: “Recto revives plan to sell NAIA assets” (March 14). At the sideline of his Senate confirmation hearing last week, on March 13, Mr. Recto said that he wants to get a huge one-time revenue bump from the privatization of the assets of the Ninoy Aquino International Airport (NAIA). A brilliant and rational proposal, sir.

This column has argued in three previous articles that NAIA assets should be privatized: “NAIA privatization is good, legislated minimum wage is bad” (Feb. 20, 2024), “Financing sustained growth: NAIA privatization” (June 27, 2023), and, “NAIA closure, passenger rights, and MIAA responsibilities” (Aug. 21, 2018).

If I may add, also consider privatizing the land holdings of the Bilibid Prison in Muntinlupa City, and the Iwahig Prison in Palawan, Puerto Princesa — get the money and retire a big portion of the public debt, do not earmark it for any agency or program.

In Table 2, I attempted to quantify the potential revenue from the privatization of three government assets (NAIA, Bilibid, and Iwahig). I assumed a compounded annual growth rate (CAGR) of 10% yearly in the value of these lands. The potential revenues from the privatization of NAIA and Bilibid land would be P8.38 trillion, plus P3.81 trillion or P12.19 trillion (see Table 2).

The New Manila (Bulacan) International Airport is supposed to start initial operations by 2027 and should be fully operational by the early 2030s. So, the closure of the current NAIA is feasible and viable.

Bilibid Prison operations should be decentralized and scattered to various regions. Selling the land will help bankroll the construction of new prisons and correctional facilities in all regions of the country.

The Iwahig Penal colony is composed of four zones or districts. The central colony is made up of 14,700 hectares and there are three other zones: Sta. Lucia with 9,685 hectares, Montible with 8,000 hectares, and Inagawan with 13,000 hectares. Existing inmates of the penal colony can be moved to any of these zones.

Less public debt and lower interest payments (P429 billion in 2021, P503 billion in 2022, and P628 billion in 2023, with principal amortization not included yet) would mean that more resources can be devoted to more physical and social infrastructure for Filipinos and Philippines-based businesses and foreign investors and visitors.

Meanwhile, I want to congratulate my friends and fellow University of the Philippines School of Economics alumni, new Finance Undersecretaries Joven Balbosa and Rolly Tungpalan. Their appointments were approved by the President last week.

------------

See also:

BWorld 688, On the nuclear mission in Canada, the AP-MGen-SMC partnership, and electric cooperatives

BWorld 689, Nuclear energy to sustain Philippines’ high economic growth

BWorld 690, Why we need to grow by 8-9% yearly