Financing growth: PEB in Qatar and UAE, mining tax, and liberalized wage setting

September 19, 2023 | 12:01 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2023/09/19/546263/financing-growth-peb-in-qatar-and-uae-mining-tax-and-liberalized-wage-setting/

(Part 3 of a series)

Last week, the Philippine economic team embarked on more economic diplomacy with two non-deal roadshows in the Middle East. The economic team is composed of Finance Secretary Benjamin Diokno, Budget Secretary Amenah Pangandaman, Economics Secretary Arsenio Balisacan, and Bangko Sentral Governor Eli Remolona. The latter was represented on this trip by Deputy Governor Francis Dakila. National Treasurer Rosalia de Leon also joined the team.

ECONOMIC DIALOGUE, PEB IN QATAR, UAE

The two major events were the “Philippine Dialogue: Economic Outlook and Opportunities” in Doha, Qatar on Sept. 10, and the “Philippine Economic Briefing” (PEB) in Dubai, United Arab Emirates (UAE) on Sept. 11-12.

Qatar and UAE are among the richest countries in the world on a per capita income basis. Their wealth largely comes from production and export of oil and gas, plus tourism and finance. So, it is a bright idea that the economic team went there to attract investors.

Qatar is the third-largest destination for overseas Filipino workers (OFWs), with more than 200,000 Filipinos working and residing there. In 2022, bilateral trade with Qatar amounted to $599.2 million, more than double 2021’s $224.5 million.

The UAE is our 6th largest source of OFW remittances, our 17th major trading partner, our 21st largest export market, and our 16th largest import supplier.

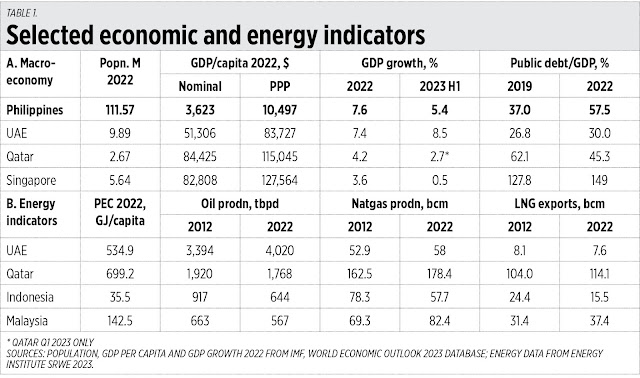

I put together a table showing some basic economic indicators of the Philippines, Qatar, and the UAE, and also Singapore where the economic team already held two PEBs. I also included basic energy indicators, plus data on Indonesia and Malaysia, the two big oil and gas producers in the ASEAN. The energy indicators are: primary energy consumption (PEC) in gigajoules per capita (GJ/capita), oil production in thousand barrels per day (tbpd), natural gas production and liquefied natural gas (LNG) exports in billion cubic meters (bcm).

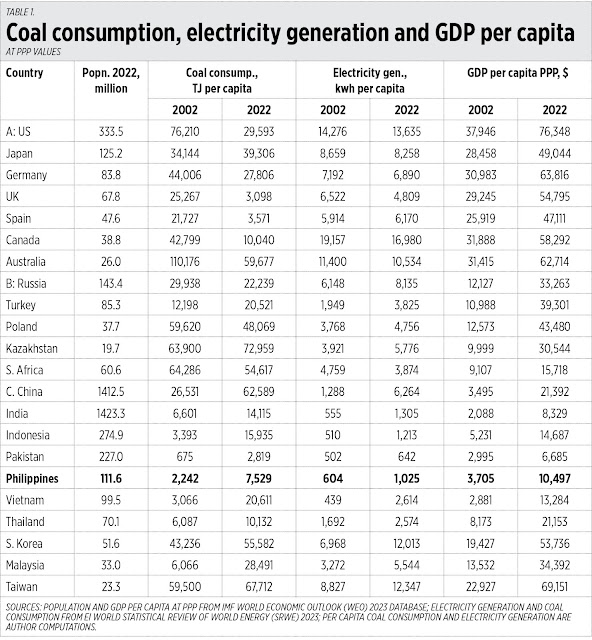

The Qatar and the UAE’s very high GDP per capita, in both nominal and purchasing power parity (PPP) values, are consistent with their huge PEC. The Philippines’ low GDP per capita is also consistent with its low PEC of only 18.2 GJ/capita vs Qatar’s 699 and UAE’s 535 GJ/capita (see Table 1).

The Philippines should aspire to be a major oil and gas producer someday. We should have more natgas fields like Malampaya, and drill for more oil offshore. Malaysia and Indonesia can share some expertise while Qatar and the UAE can put in the funding and investments to supplement local investments.

In Qatar, the economic team headed by Secretary Diokno met with the Qatar finance minister and the top executives of Qatar Cool; their sovereign wealth fund, the Qatar Investment Authority (QIA); the Qatar Insurance Co. (QIC); and the Qatar National Bank (QNB), among others.

In the UAE, the two-day roadshow included the economic team’s visits to Nasdaq Dubai, and the UAE Minister of Foreign Trade and Minister of Finance. They also met with executives of Arqaam Capital, Millennium Capital, Waha Capital, the Investment Corp. of Dubai (ICD), the Dubai Islamic Bank (DIB), the Abu Dhabi Islamic Bank (ADIB), Emirates NBD Asset Management (ENBD AM), and the Kuwait Finance House (KFH), among others.

In her speeches in Doha and Dubai, Budget Secretary Pangandaman discussed the country’s digital transformation agenda to improve public service delivery and reduce the cost of doing business in the country. As the Philippines’ only Muslim Cabinet Secretary visiting two rich Muslim countries, she highlighted that the Philippines has allocated P74.35 billion for the Bangsamoro Autonomous Region of Muslim Mindanao (BARMM) alone, to help uplift the lives of people there.

MINING PHILIPPINES 2023

The biggest annual conference of the country’s mining industry will be held this week, Sept. 19-20, at the Edsa Shangri-La Hotel. I will be one of the speakers in the last important panel of Day 2, about mining fiscal regime.

I checked how much output the industry has contributed to the country and the taxes it has paid, and the numbers are significant. In 2022, large-scale metallic mining, small-scale gold mining, and non-metallic mining like coal, had a combined output of P318 billion, and paid P44.8 billion in taxes, fees, and royalties. This is a big jump from 2021’s already high level of P233 billion in output and P40 billion in taxes (see Table 2).

If one looks at the mandatory spending for communities like the Social Development and Management Program (SDMP) or social tax, on top of the national and local government taxes and royalties, the industry pays a lot. I will discuss this and other fiscal topics on Day 2 of the conference.

WAGES ARE TIED TO PRODUCTIVITY, NOT POLITICS

Last Friday, Sept. 15, I attended a discussion on the “Proposed legislated wage increase, other economic issues, reactions by business groups” at the Pandesal Forum in Kamuning, Quezon City. The speakers were George Barcelon, President of the Philippine Chamber of Commerce and Industry (PCCI), Sergio Ortiz Luis, Jr., President of Philippine Exporters Confederation, Inc. (PhilExport), and Dr. Cecilio Pedro, President of the Federation of Filipino Chinese Chambers of Commerce and Industry, Inc. (FFCCCII). The moderator was Wilson Lee Flores.

Mr. Barcelon read the PCCI’s letter that it had sent to the Senate about another round of legislated mandatory wage hikes nationwide and noted that “rising inflation also negatively impacted businesses. Of these, 98% are micro, small and medium enterprises (MSMEs)…. these employers may have to further increase the prices of their products, reduce the number of their workers, or simply close down. Large firms which are capable of paying the wage increase only make up less than 2% of all Philippine companies.”

Good statement, sirs. As a market advocate, I believe in THREE important principles. One: Employment is a private contract between employers and employees, not between government and employees, and government should not impose their decisions and demands on employers. Two: Wages are tied to productivity, not the number of children the workers have, nor the increase in cost of living, and political pressures. And, three, wage differentiation and liberalization create more jobs and expands labor choices.

-------------

See also:

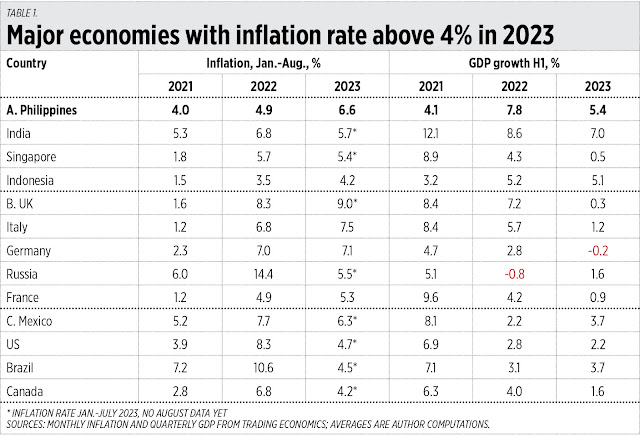

BWorld 637, High inflation with high growth, the case of the Philippines, Indonesia and India, Sept. 22, 2023

BWorld 638, Global Philippines: The successful FIBA hosting in Manila and the OGP Summit, Sept. 24, 2023

BWorld 639, Energy realism: Why we need more coal, gas and nuclear power plants, September 28, 2023.