On airports and attaining fiscal balance

December 17, 2024 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/12/17/641804/on-airports-and-attaining-fiscal-balance/

BUENOS AIRES — I just arrived here in the capital city of Argentina via Ethiopian Airlines. My route was: Ninoy Aquino International Airport (NAIA) to Hong Kong (HK), two hours; Hong Kong to Addis Ababa Bole airport (ADD), Ethiopia, 11 hours; Addis Ababa to Sau Paulo’s Guarulh (GRU) airport, Brazil, 12 hours with a stop to refuel; then Sau Paulo to Buenos Aires’ airport (EZE), three hours. Including the time spent waiting for flights at NAIA, HK, ADD, and GRU, the trip came to a total of about 36 hours.

This is a particularly long trip, but this is the first time that I set foot in Africa — at least the airport in Ethiopia — and my first time to set foot in South America. So, I welcome this trip with curiosity. I am here to attend meetings and lectures with leaders of free market think tanks and taxpayers’ associations from several countries around the world.

I came up with this short table to make a brief comparison of the airports I passed through over the past two days.

I arrived in the evening in HK, ADD in the early morning, GRU in the afternoon, and EZE in the evening. My quick observation of these airports is that the combined brightness at night of ADD, EZE, and possibly GRU — runways, passenger terminals, other structures — were perhaps just half as bright as the Hong Kong airport. The ADD runway is dark and not lighted enough. The same could be said perhaps for the size of passenger terminals.

About my fellow passengers, one thing I noticed was that from HK-ADD, there were plenty of African passengers. But from ADD-GRU and EZE, I think there was not a single African passenger. I hypothesize that perhaps Africans would rather do business with East Asians than South Americans. Especially now that China is now expanding its diplomatic and economic footprint in Africa, those Africans probably came from mainland China and Hong Kong.

From EZE to Buenos Aires city proper, three things surprised me when compared to Metro Manila.

One, their roads are much smoother — I did not see or feel a single pothole or bump on the road.

Two, the center island lights are much brighter than on EDSA or even the Skyway.

Three, there were very few motorcycles on the road.

The privatization of NAIA — the New NAIA Infra Corp. (NNIC) took over its operation last September — was a great development in Philippines airport modernization. The Department of Finance (DoF) got an upfront payment of P30 billion from NNIC plus P2 billion/year guaranteed payment, plus an estimated P120 billion from its 82.16% share on gross revenue excluding passenger service charges over the concession period.

NNIC will spend some P170.6 billion to modernize NAIA, increasing its airport capacity from the original 35 million passengers per annum (mppa) to 62 mppa, and increasing flight movements per hour.

LESSONS FROM ARGENTINA

On Dec. 11, Argentina’s President Javier Milei held a press conference tackling a very important issue — he said that Argentina has no budget deficit for the first time in 123 years. He explained that “The deficit was the root of all our evils — without it, there’s no debt, no emission, no inflation. Today, we have a sustained fiscal surplus, free of default, for the first time in 123 years. This historic achievement came from the greatest adjustment in history and reducing monetary emission to zero.”

It was indeed a big achievement. Many subsidies were cut and there was no major social and political backlash. President Milei’s policy is called “Unbreakable Fiscal Rule” — that the administration must cover debt interest payments before allocating further spending.

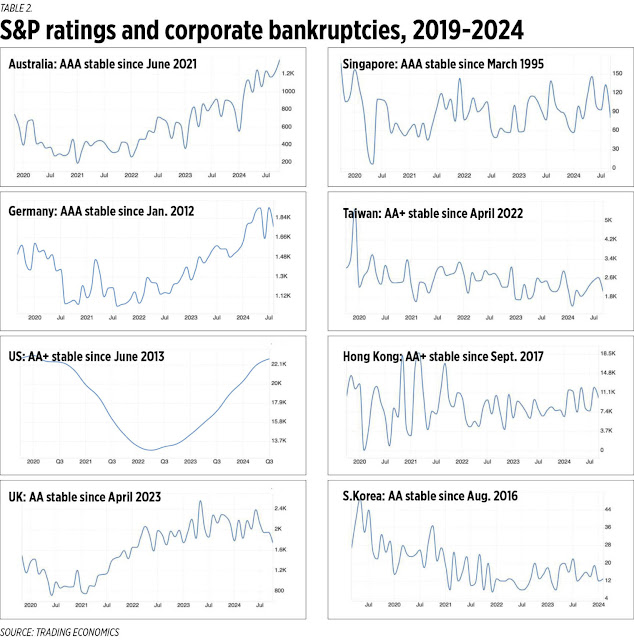

The Philippines can take some lessons from this new trend in Argentina. Since the National Government always has a budget deficit but the local government units (LGUs) always have budget surpluses, then certain national agencies and spending must be cut and the LGUs allowed to cover whatever they need to from their own revenues, both local and external like LGUs’ share from the National Tax Allotment or NTA (see Table 2).

Many LGUs, especially the rich cities, have their own expanded social welfare systems, have their own city-owned universities, science high schools, and city-owned hospitals.

So, candidate national agencies that can handle no increases in spending — with no need to decrease their budgets — in my opinion are the Department of Social Welfare and Development (DSWD), the state universities and colleges, the Department of Education (DepEd), and the Department of Health (DoH).

Attaining a fiscal balance (where revenues are equivalent to expenditures) by 2028 is a political and economic goal in itself for two reasons: it will free up huge resources away from high interest payments, projected to reach P800+ billion this year alone, and with the government borrowing less to cover old loans means lower interest payments and low inflation.