If we exclude the years 2008-09 because they were outliers

(global financial upheaval), the Obama years seem to be the weakest since 1990.

Never experienced growth of 3% or higher.

Early peek of the Trump admin first 3 Quarters of 2017,

experienced 3% growth in the last 2 quarters (Q2 and Q3).

Fastest 6-months growth since 2014, because of Trump or

Yellen or something else? One of Financial Times' headlines today.

If the 3%+ is retained in Q4, it will be called the "fastest 9-months growth since ____".

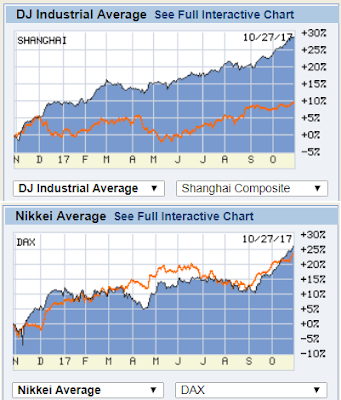

This chart below could be one explanation -- US stocks growth the

past year was rather fast compared to other major markets (China/Shanghai,

Japan/Nikkei, Germany/DAX).

The 2008-09 crash was a product of multi-decades of moral

hazards problem in housing finance, not just 8 years of the Bush Jr. era.

A friend noted that "an institutional collapse like 2008 is followed by many

years of slow growth and stagnation. The Philippines had the same experience

from 1983 through the 90's. From 1991, Japan nearly had two decades of

below-average growth."

Good points, he was arguing the slow growth momentum, which actually applied also to the rest of G7 economies. But not to China, India, other Asian

economies.

My hypothesis for the rather fast growth of the US economy in the last 2 quarters -- somehow a growth momentum due to some of his deregulation, de-bureaucratism policies. And the big tax cut plan, it's seeping into business decisions, big investments may be coming to the US from abroad and big investments in the US won't migrate to other countries anymore.

------------

See also:

US and China stockmarkets, huge divergence, June 20, 2017

US and China stockmarkets, huge divergence, June 20, 2017

On the US stockmarkets' consistent rise, August 08, 2017

No comments:

Post a Comment