Forecasting GDP growth is a passion for many economists, in academe, banks, government and multilateral institutions. But reliability of forecasts can be wild, the projections are often far out from the actual. Examples below for Q1 to Q4 2023 forecasts.

(1) Q1 2023 Philippines GDP, median growth forecast by 23 economists was 5.1%. Actual growth was 6.4%, many got it close enough. But there were a number of outliers. On the low side -- Oxford Econ (4.4%), Pantheon Macroecon(4.8%, and Sunlife Financial (4.7%). On the high side, Ateneo (7.4%).

https://www.bworldonline.com/top-stories/2023/05/08/521342/gdp-growth-slowed-in-q1-poll/

(May 8, 2023)

(2) Q2 2023, median growth forecast was 6.0%. Actual growth was 4.3%.

https://www.bworldonline.com/top-stories/2023/08/07/538039/q2-gdp-growth-likely-slowed-further/ (Aug. 7, 2023)

The outliers, really far out forecasts were again Oxford Econ. (7.5%) and Pantheon Macroecon (6.9%). Ateneo also went overboard with 6.5%.

(3) Q3 2023, median growth forecast was 4.9%, actual growth was 6.0%.

Only Michael Ricafort of RCBC (6.0%) and Jun Neri of BPI (6.1%) got it close. The outliers again were Pantheon Macroeconomics (3.1%) and Oxford Econ (4.3%). Also Oikonomia Advisory & Research (4.0%), ING Bank (4.2%).

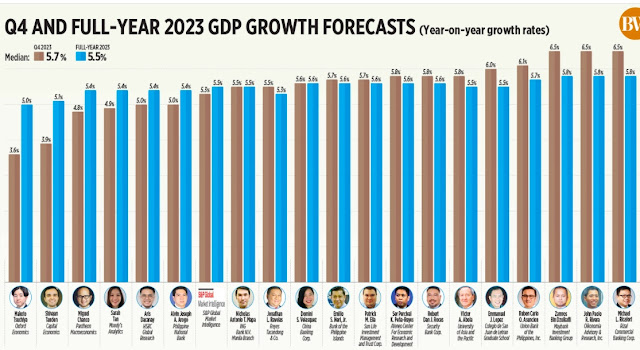

(4) Q4 2023, the median forecast of 5.7% was close to the actual 5.6%.

Still the same outliers -- Oxford (3.6%) and Pantheon (4.8%), plus Capital Econ (3.9%) and Moody's (4.9%). The other outliers on the high side were Maybank, Oikonomia, and RCBC with 6.5% forecast. My own projection for Q4 was 6.0%, I wrote here, https://www.bworldonline.com/opinion/2024/01/25/571009/my-economic-forecast-for-2024-6-5/

So Oxford and Pantheon have 0 out of 4 forecast batting, very poor bordering on lousy forecasting. I wonder what kind of macroeconomic business advice they give to their clients.

On Moody's, a friend sent me this: On January 29, 2024, Moody’s Analytics forecasts a 4.9% PH GDP growth for the fourth quarter of 2023 saying that “improving private consumption amid fading inflation, a tight labor market should support economic growth of 4.9% year over year”. What happened, Moody's?

Meanwhile, here's the quarterly growth data from PSA.

--------------

See also:

Macroecon 21, Presentation on inflation, gloal and national pictures, November 01, 2022

Macroecon 21, Tax revenues, PH outstanding debt, February 17, 2023

Macroecon 22, Econ performance of Marcos Jr administration in year one, July 30, 2023.

No comments:

Post a Comment