10 lessons from the PHL Nuclear Trade Mission to Canada

March 21, 2024 | 12:02 am

My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

https://www.bworldonline.com/opinion/2024/03/21/583095/10-lessons-from-the-phl-nuclear-trade-mission-to-canada/

This is a sequel to this column’s March 12 piece “Nuclear energy to sustain Philippines’ high economic growth.” Here I summarize the main lessons from my observations as a participant of the Philippines Nuclear Trade Mission to Canada, Toronto leg which was held on March 6-8.

1. We learned that a small nuclear reactor right inside a university campus is not scary or risky. We visited the McMaster University Nuclear Reactor, which was built in 1957. We went inside the structure, saw the staff working there and the uranium fuel bundle at work several meters underwater. The reactor produces electricity plus medical and industrial isotopes for healthcare, radiography and imaging like those in airport X-ray machines.

2. We learned that a mock-up reactor is very useful for public education and training staff in real reactor plants. We visited the Darlington Energy Complex (DEC) owned and operated by Ontario Power Generation (OPG). We went inside a big CANDU (Canada Deutrerium-Uranium) mockup reactor, not a real nuclear plant, which contains all the chambers and important components of a nuclear plant.

3. We learned that Canada’s biggest nuclear power company can energize 42% of the entire Philippines. We visited Bruce Power in their office in downtown Toronto. They have eight CANDU reactors that can produce up to 48 Terawatt-hour (TWh) of electricity in a year, equivalent to 42% of the Philippines’ total generation of 114 TWh in 2022. If we include OPG’s Darlington nuclear generating station with four CANDU reactors that can produce up to 31 TWh of electricity in a year, their combined output up to 79 TWh is 69% of the Philippines’ total electricity production.

4. We learned that the selection of the site of nuclear plants is important. We met the New Brunswick Nuclear team, composed of Opportunities New Brunswick (ONB), New Brunswick Electric Power Corp. (NB Power), and ARC Clean Technology Canada (ARC Canada). They discussed their advanced small modular reactors (SMRs) which are deployed in off-grid island-communities and far away mining operations, and the siting of their SMRs in domains inhabited by indigenous people and how they are able to secure their social acceptance.

5. We learned that the regulatory framework, standards, and protocols on safety and future nuclear waste must be stable. Business uncertainty can occur here so regulation must be simple, transparent, stable, and effectively implemented. This includes whether to do long technology review and licensing, or just relicense imported reactors.

6. We learned that we can expand domestic nuclear manpower expertise via partnerships with nuclear-centered universities abroad. Meralco, for instance, is firming up a partnership with Canada’s OntarioTech University. Other Canadian and US universities, even Korean and Japanese universities, can provide this training too.

7. We learned that the Bataan Nuclear Power Plant (BNPP) can be refurbished and start operation in about four years. We met experienced engineers and scientists from DB2 Consulting, Inc. who also comprise the Philippine Nuclear Services (PNS). They estimate that a full assessment and refurbishment of BNPP can be done in four years, so if the government will allow it, refurbishment can start this year and BNPP can start operation by 2028, generating about 4.6 TWh/year (assuming 85% capacity factor). This is much more than the combined output of wind, solar, and biomass of 4.2 TWh in 2022.

8. We learned that three Philippine energy companies can start nuclear power development in the country. Aboitiz Power Corp., Meralco, and Prime Metro BMC sent their executives to participate in the trip to Canada and have expressed willingness to develop nuclear power in the country. Felino Bernardo, Head of Energy Transition Projects of Aboitiz Power, said that “the mission of delivering stable, reliable, clean, and affordable electricity to power businesses and communities and get people out of poverty should be a human endeavor that surpasses nationalities and geographical divides.”

9. We learned that more countries are turning to nuclear energy and Philippines might be left in a tight space. Doug Burton, President of DB2 Consulting, told me that he mentors the head of global marketing of an Asian energy company and that official told him that his company is bidding to build nuclear plants in 12 of 27 European countries, plus bidding in Canada for the Bruce C nuclear plant. Reactor vendors have limited resources so the Philippines may find itself in tight spot when it comes to vendors if it hesitates too long.

10. We learned that Canada is a Tier 1 nuclear power country and can be a good source for the Philippines’ future nuclear power development. Canada has a wide and long spectrum of capabilities and resources in the nuclear supply chain, from uranium mining and research to power generation and production of medical isotopes. They have exported their uranium fueled CANDU pressurized heavy water reactors to several countries, and are developing several designs and models of SMRs and micro modular reactors (MMRs).

NGCP’S TRANSMISSION CHARGE HIKE

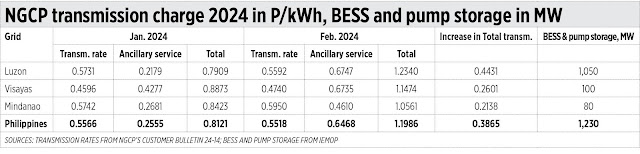

The National Grid Corp. of the Philippines (NGCP) recently released “Customer Bulletin 2024-14” and it showed a huge increase in their transmission charge for the February 2024 billing compared to January 2024. NGCP attributed this to their new Ancillary Service Procurement Agreement (ASPA). This is a nationwide electricity price hike, a long-term price hike. I computed the price increase from January to February — it is a P0.39/kWh increase nationwide, and that is huge (see the table).

The implementation of the reserves market cannot be blamed for the price hike. This is the first time that the prescribed ancillary service (AS) levels were scheduled after the reliability and stability of the grid suffered for years because the NGCP did not make enough long-term AS contracts. It seems that NGCP waited for many battery energy storage systems (BESS) to be ready first before it would make a long-term AS contract.

My hypothesis as to why the AS cost jumped so high is because now the NGCP contracted many BESS — big and expensive batteries — to address power fluctuations from intermittent wind-solar power. So, I checked the numbers from the Independent Electricity Market Operator of the Philippines’ (IEMOP) monthly Market Highlights.

It seems my hypothesis is correct. Luzon has the biggest BESS and pump storage capacity at 1,050 MW and it has the biggest jump in transmission charge. So now consumers will pay higher electricity prices for many years to come for what? Unreliable service in grid stability because of a reliance on BESS in order to “save the planet”?

Still a big question about the reliability of the grid is why the contracts for contingency reserves are still low. Is the BESS also prioritized in contract approvals with uncapped price vs other non-BESS with capped price?

--------------

See also:

BWorld 689, Nuclear energy to sustain Philippines’ high economic growth

BWorld 690, Why we need to grow by 8-9% yearly

BWorld 691, On a huge budget surplus and long-term privatization revenues

No comments:

Post a Comment