* BusinessWorld March 6, 2023.

---------------

Contrary to the dishonest narrative that global inflation started rising only when Russia invaded Ukraine on Feb. 24, 2022, the start of the increase in inflation coincided with US President Joe Biden’s succeeding Donald Trump. US inflation was only 1.4% in January 2021, which was Trump’s last month in office, jumping to 7.5% in January 2022 or 12 months under the Biden administration and one month before the Russia-Ukraine war. (See Table 1).

Last week, the Cabinet economic team gave a briefing at the House Committee on Appropriation about government policies to control inflation. Finance Secretary Benjamin Diokno discussed the high fiscal and revenue performance in 2022 which exceeded targets, and identified interventions to ensure food security and energy security because the main drivers of the 8.7% inflation were food and energy (electricity, fuels, transportation).

Budget Secretary Amenah Pangandaman discussed subsidy programs to mitigate the inflationary impact on the poor, like the fuel subsidy for public transport (P3 billion), conditional cash transfer (P102.6 billion), social pension for indigent seniors (P25.3 billion), agriculture and agrarian reform support (P186.4 billion), and so on.

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan highlighted that the 7.6% GDP growth in 2022 was the highest in 46 years, and that the unemployment rate of 4.3% was the lowest since April 2005 or a 17-year low. Then Bangko Sentral ng Pilipinas (BSP) Governor Philip Medalla emphasized that strong monetary policy action, a higher BSP rate was necessary given continuing global risks outlook and higher inflation expectations.

I agree with most of the policy responses given by the economic team. Now I want to add some specific measures to complement those policies.

One, drastically cut the budget deficit and the need for borrowings/financing. When government borrowed an average of P2.24 trillion a year from 2020-2022 compared to only P0.8 trillion a year prior, the government competed for funds with corporate and household borrowers, which saw interest rates rise, and inflation rate rises too.

The Philippines’ public debt, actual plus guaranteed, has increased from P8.22 trillion in 2019 to P12.15 trillion in 2021 and P13.82 trillion in 2022. Our debt/GDP ratio jumped from 37% in 2019 to 51.6% in 2020 and yet our GDP contracted by 9.6%. The strict prolonged lockdown with heavy government spending and borrowing was pure bad economics.

Two, focus on cutting spending and the endless subsidies. Revenues significantly declined in the 2020 lockdown but quickly recovered by 2022, even without any new tax hike. But expenditures continued increase even during lockdown — that led to a high budget deficit, an average of P1.55 trillion a year from 2020-2022. (See Table 2)

Three, the government rightsizing program must proceed. Many government offices and corporations hardly moved during lockdown, yet salaries and allowances kept pouring in. See these two reports in BusinessWorld: “DBM hopeful Congress will approve rightsizing plan within the year” and “Subsidies extended to GOCCs up 8.5% in 2022” (March 6).

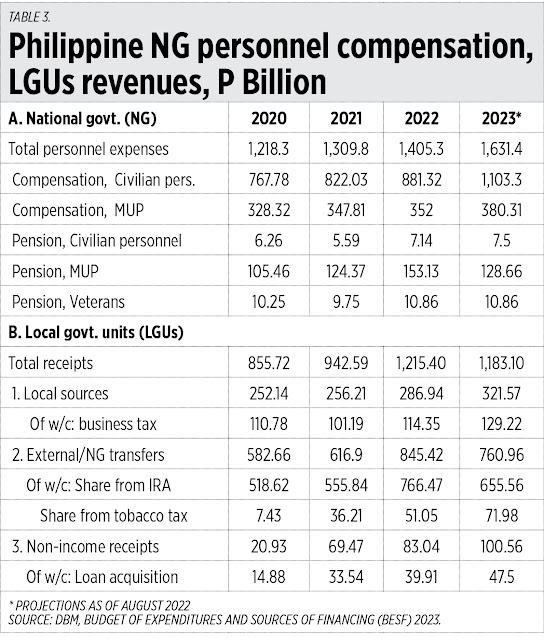

Four, the pension reform for the military and uniformed personnel (MUP) must proceed. MUPs, not taxpayers, should pay for their own future pension out of their own salaries and other compensation like the rest of the government’s civilian personnel. The P135 billion/year average MUP pension from 2021-2023 should not be in the budget — it should come from active personnel’s monthly contribution into the Government Service Insurance System (GSIS) but currently they contribute zero.

Five, National Government expenditures should flat line as the revenues and expenditures of local government units (LGUs) are rising fast with the implementation of the Mandanas ruling in 2022. A decline in National Government transfers, like shares from the internal revenue allotment (IRA) in 2023, is temporary because it is based on three years prior or the 2020 national revenues. By 2024 onwards, National Government transfers will resume high increases.

Six, National Government borrowings should decline because LGU borrowings are on the uptick. Only P15 billion in loans in 2020, it will triple to P47 billion in 2023 (Table 3). In addition, LGUs’ public-private partnership (PPP) projects in local infrastructure is also increasing.

Seven, National Government climate spending must taper off. The climate adaptation plus mitigation budget is rising fast: P183.9 billion in 2020, P178.2 billion in 2021, P289.7 billion in 2022, and P459.5 billion in 2023. It is unclear how more climate bureaucracies, climate meetings and travel can fight less rain and more rain, less floods and more floods, temperatures getting colder or hotter because climate has been changing since planet Earth was born some 4.6 billion years ago, with a natural (or nature-made, not man-made) cycle of warming-cooling-warming-cooling.

Endless subsidies (with no timetable) to people and MUP pensioners are inflationary. High inflation means demand for commodities and services is rising faster than the supply. Endless subsidies encourage high demand, even if many people do not work or work efficiently, do not contribute to raising the supply of food, energy, housing and so on.

Endless budget deficits and government borrowings are inflationary. Government should practice fiscal discipline and responsibility, aim for a balanced budget (expenditures are equal to revenues) if not a fiscal surplus, then significantly reduce the public debt.

The endless presence of government enterprises and corporations is also inflationary because many of them rely on annual budgetary appropriation and subsidies, and because there is no “market failure” in health insurance, power generation, rail transportation, airport administration, banking, etc. Large-scale privatization of many government assets and corporations and using the proceeds to reduce the public debt will greatly contribute to achieving fiscal responsibility and control inflation.

---------------

See also:

BWorld 584, Ten trends in inflation, PPP, employment, cancer treatment and energy, March 01, 2023

BWorld 585, Bureaucratic rightsizing a big part of fiscal reform push, March 02, 2023

BWorld 586, Crisis narratives as hindrance to growth and freedom, March 03, 2023.

No comments:

Post a Comment