* BusinessWorld, March 13, 2023.

-------------

This suggests that internal or domestic factors affect our commodities market more than external factors. The main contributors of high inflation in the Philippines, from the fourth quarter 2022 until February 2023 are transport, electricity and fuels, food, and alcohol-tobacco. (See Table 1.)

So, despite the series of interest rate hikes by the Bangko Sentral ng Pilipinas from only 2% in May 2022 to 5.5% last December, this demand restriction scheme did not work as expected because the commodities that experience high inflation until today are basic necessities like food and electricity.

The non-monetary measures needed both in short- and long-term would include: 1.) more food production preferably via corporate farming; 2.) more food imports as they are cheaper now — rice, corn, wheat, cooking oil, beef, hogs, etc.; 3.) ending or limiting hyper taxation of alcohol and tobacco as people consume either legal products with high taxes, or smuggled products with zero revenue for the government, and, 4.) more power generation, reducing or cutting taxes on fossil fuels because about 80% of power generation is from coal, gas and oil.

The creation of the Inter-Agency Committee on Inflation and Market Outlook (IAC-IMO) is justified. The Department of Finance (DoF) may have to bend over backwards on energy taxes in order to tame inflation.

Recall that when the Tax Reform for Acceleration and Inclusion (TRAIN) Law of 2017 (RA 10963) was implemented in 2018 — a series of tax hikes on diesel, gasoline, LPG, coal, sugary drinks, etc. — the added costs were immediately passed on to the consumers, as was the inflation expectation for 2019. In 2018, only the Philippines experienced a big jump in inflation, from 2.9% in 2017 to 5.3% in 2018, while most of our neighbors had flat or declining inflation trends. The inflation rates from 2017 to 2018 were as follows: Malaysia 3.8% and 1%, Singapore 0.6% and 0.4%, Indonesia 3.8% and 3.3%.

When diesel taxes and prices go up, the cost of operation of tractors, harvesters, threshers, trucks, irrigation pumps, buses, boats, gensets for off-grid islands, etc. rise 100%. And this cost is passed on to the prices of agriculture and food products, contributing to higher food inflation.

World oil, gas, and coal prices have been declining — they are now lower than they were pre-Russia invasion. Domestic food production will be aided by lower fertilizer prices, supplementary food importation will be aided by cheaper food prices abroad, and electricity generation will be aided by lower coal prices. (See Table 2.)

Non-monetary tools and opportunities to significantly reduce inflation are currently available. Government, especially the economic team, should optimize this window of opportunity.

Aside from high inflation, government must also grapple with high public debt resulting from the huge budget deficit and borrowings yearly from 2020 to 2022. The major policy tools and options should include: 1.) a drastic cut in spending and subsidies, 2.) the large-scale privatization of some government assets and corporations, 3.) imposing tax hikes in some sectors, and avoiding giving tax exemptions (like the lousy but successful lobby to impose zero taxes on electric vehicles), and, 4.) have better tax administration, stronger rule of law, and minimize leakage via smuggling and illicit trade.

On Point 1, key measures should include the Government Rightsizing plan and military and uniformed personnel (MUP) pension reform. On Point 2, the Philippine Amusement and Gaming Corp. (better known as PAGCOR) and other government enterprises are good candidates because there is no market failure when it comes to running casino and gambling enterprises.

On Point 3, special privileges for renewable energy must be curtailed — they have lots of legalized ways of evading taxes: zero VAT on sales, zero income tax for seven years of operation and after that only 10% corporate income tax, zero income tax for carbon credits, plus Nolco (net operating loss carry-over deduction), and zero VAT on imports of equipment. Plus, there is feed-in tariff (FIT) or a guaranteed high price for 20 years, and priority dispatch in the grid even if its price is higher than that of conventional power sources.

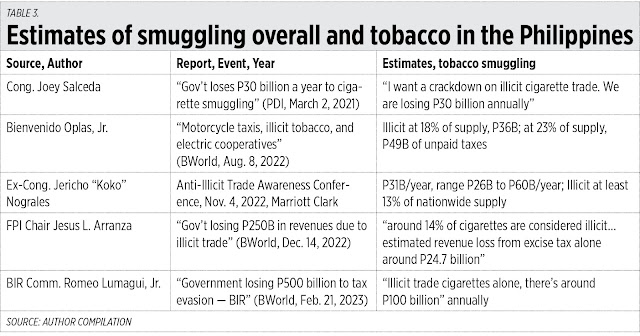

On Point 4, when looking at estimates of smuggling nationwide and non-payment of excise tax, estimates for VAT alone range from P250 billion to P500 billion yearly. Among the biggest illicit trade is that of tobacco products, with estimates of government tax losses ranging from P25 billion to P100 billion yearly. (See Table 3.)

Aiming for a 50% reduction in smuggling will give the government some P13 billion to P50 billion more yearly already. The rule of law should be stronger when it comes to tax enforcement.

-------------

See also:

BWorld 585, Bureaucratic rightsizing a big part of fiscal reform push, March 02, 2023

BWorld 586, Crisis narratives as hindrance to growth and freedom, March 03, 2023

BWorld 587, Inflation, government spending and borrowings, March 24, 2023.

No comments:

Post a Comment