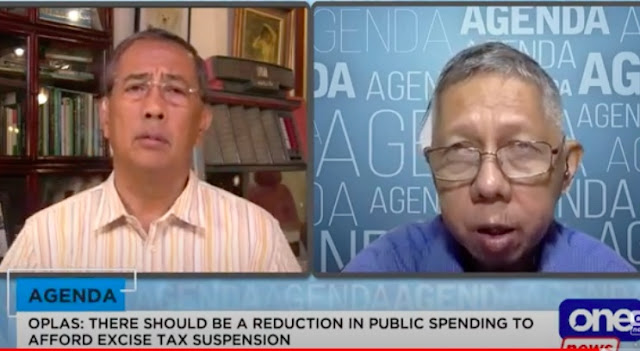

Yesterday I was interviewed again by Cito Beltran in his daily program Agenda (Monday-Friday 8-9am) in One News channel of Cignal TV (https://cignal.tv/channels/119/one-news). Topic was about the proposed suspension of excise tax on fuel products. It was my 10th apperance or interview in Cito's program.

Cito is among the most prominent columnists of Philippine Star, he writes there 3x a week, https://www.philstar.com/authors/1804831. On fuel excise tax suspension, he wrote this last Wednesday Sept. 20 supporting the proposal, https://www.philstar.com/opinion/2023/09/20/2297539/the-romualdez-solution.

I started by saying that in the first place way back in 2017 during the tax debate in the TRAIN law, I opposed the plan of the DOF then pushed by Sec. Carlos Dominguez and USec. Karl Chua to raise excise tax on gasoline, impose tax on diesel, etc. Tractors, harvesters, irrigation pumps, trucks, fishing boats, etc. use diesel. These are used in farming and fishing, food production and transportation. Fuel products are public goods, not public bad. By raising the cost of farming and fishing "to save the planet", government raises the cost of food production, and we have higher food inflation. Many officials and groups now complain of high food inflation when it was the same groups of people who supported the fuel tax hike/imposition in 2017, implemented in 2018, to help "save the planet."

https://funwithgovernment.blogspot.com/2017/04/bworld-121-ph-tax-reform-bill-and-tax.html (April 10, 2017)

https://funwithgovernment.blogspot.com/2017/10/bworld-160-high-carbon-tax-is-irrational.html (Oct. 25, 2017)

https://funwithgovernment.blogspot.com/2017/12/bworld-170-habito-carbon-tax-distortion.html (Dec. 28, 2017)

https://funwithgovernment.blogspot.com/2017/12/bworld-173-energy-favoritism-under-train.html (Dec. 30, 2017)

Fast forward to present, with world crude oil prices rising again, domestic prices of gasoline, diesel, aviation fuel, LPG, etc. are rising again. And excise tax on gasoline P10/liter, diesel P6/liter, plus 12% VAT on that additional excise tax (a tax on a tax), they continue to distort oil pricing, distort cost of farming and transportation of food and other commodities.

So I support the suspension of fuel excise tax, revenue loss of P73 B/quarter according to DOF Sec Ben Diokno, but there should be corresponding spending cut by same amount P73 B/quarter, and or removal of VAT exemption by some sectors to raise the same amount, plus address smuggling especially illicit tobacco and get more revenues.

I cited the huge annual budget deficit of P1 trillion/year, huge borrowings. In 2019 we were borrowing about P0.8 trillion, by 2020-2022, we were borrowing about P2.2 trillion/year, could be same amount this year. So Sec. Diokno's opposition to such revenue loss is understandable, the deficit and borrowings will simply become even bigger this year. I believe that any revenue reduction via fuel tax suspension should be accompanied by spending reduction by the same amount if not bigger. Need to identify which spending should be cut, by how much, spending cut even for one quarter.

I also mentioned cutting the subsidy for tertiary education and suspend free tuition in all state universities, magbayad mga estudyante, partial subsidy na lang. Also suspend free irrigation. Proceed with government rightsizing program, and MUP pension should be cut, currently at P164 B/year, MUPs should pay and contribute to their own pension fund. But the House bill passed by Cong. Salceda has practically kept the old system generally intact, ugly.

Then I mentioned the need to cut and minimize tobacco smuggling. Cong Salceda himself estimated this in 2021 as P30B/year of tax losses, former Partylist Cong. Koko Nograles estimates it at P31B up to P60 B/year tax losses. And BIR Commissioner Lumagui himself said it could be up to P100 B/year of tax losses. Assuming the correct figure is P50B/year, we cut it by 50%, that will give the government additional revenues of P25B/year.

My interview portion is at 41:00 mark here,

AGENDA | SEPTEMBER 21, 2023

https://www.youtube.com/watch?v=90k9rFdnVoo

Thanks again, Cito, for the opportunity to discuss the subjects of high public spending, lagging revenues, high borrowings, and excise tax reforms especially in oil products.

---------------

See also:

Agenda One News, Part 7, February 07, 2022

Agenda One News, Part 8, October 21, 2022

Agenda One News, Part 9, February 15, 2023.

No comments:

Post a Comment