* This is my article in BusinessWorld last September 19, 2019.

----------------

See also:

Among the ironies of government health policies

regardless of administration is their cry for “cheaper medicines” — and then

they impose various tariff and taxes on medicines that make these products more

expensive.

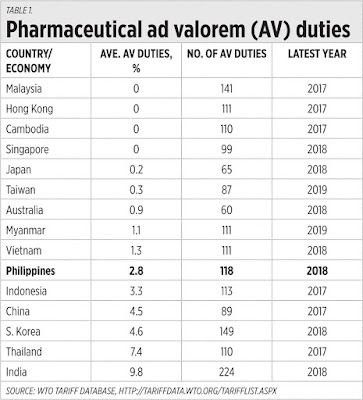

I checked the tariff and duties for imported

pharmaceutical products at the World Trade Organization (WTO) and I was

surprised to see that zero tariff in medicines is imposed by a number of our

neighbors in the region while the Philippines imposes a nearly 3% tariff, aside

from 12% VAT on medicines (See Table 1).

Other countries have higher medicine tariffs: Nepal has

14%, Pakistan 11%, Laos 10%.

This coming Monday, Sept. 23, there will be a UN

High-Level Meeting (UN HLM) on Universal Health Coverage (UHC). Their theme is

“Universal Health Coverage: Moving Together to Build a Healthier World.”

The UN and WHO send this virtue signaling to

member-country governments to further raise taxes, impose more prohibitions and

restrictions on “unhealthy” products to achieve a “healthier world.” So that

the Philippines’ Department of Health, Department of Finance, other agencies

create new legislations and regulations to implement this signaling.

But people around the world have been living healthier

and longer, even before UHC was coined and before various taxes or tax hikes on

alcohol, tobacco, sugary drinks and food were imposed (See Table 2).

Related to this, a new report was released this week,

“Accelerating access to medicines: Policy recommendations for achieving the

health-related Sustainable Development Goals.” It was produced and co-signed by

15 independent and non-government think tanks from 14 countries including the

Geneva Network (UK), Minimal Government Thinkers (Philippines), and four others

from Asia.

The report has noted that government itself is among the

causes of expensive medicines and thus recommended three ways to reduce

medicine costs: reduce taxes, abolish tariffs, and eradicate other trade

barriers. In particular, it recommended that “Non-members should join the WTO

Pharmaceutical Tariff Elimination Agreement (‘Zero for Zero’ initiative). If

this is not possible, countries that still levy tariffs should unilaterally

abolish them.” Yes, the Philippines should reduce its double talk by cutting

its pharmaceutical tariffs of 2.8% to zero (See Table 1 again).

Regarding improving access to medicines, the report also

noted that government itself creates regulations that in the process delay or

limit access to medicines by the people. Thus, the report made four

recommendations: Speed up patent examination, simplify the drug approval

process, modernize government medicine reimbursement decision-making, and

promote open trade in medicines.

Open trade in medicines means allowing more market

competition via: (1) a stronger role for the WTO in enforcing existing laws vs.

mandatory local content requirements; (2) instead of protectionism, developing

country governments should make their economies more attractive to foreign

investment by among others, investing in human capital and physical

infrastructure; and, (3) public procurement of medicines should be transparent,

ensure best interests of the taxpayers.

As this column has repeatedly argued, cheaper products

like energy, rice, transportation, healthcare and medicines is possible if

government steps back via less taxes and tariff, less mandates and

prohibitions, have more competition among producers and sellers of these goods

and services. Government should only ensure good quality commodities from

competing players by heavily penalizing producers of fake, counterfeit, substandard,

and unreliable products.

See also:

No comments:

Post a Comment