Global oil prices have slightly recovered in recent days, West Texas Intermediate (WTI) for instance went down to as low as $38/barrel in late August, then recovered to $48+, and $46 a barrel as of this writing. Still, these are very low compared to prices 5-6 years ago.

My sister's accounting and auditing office, Alas Oplas & Co. CPAs, produced its most recent monthly Economic Update, August 2015 entitled Opportunities for Low Oil Prices. Among the data shown there are the following.

Net increase in global oil supply (supply minus demand) has increased from a deficit of 0.2 million barrels per day (mbpd) in 2013 to a surplus of 1.1 mbpd in 2015, and rose to an average of 2.9 mbpd in July this year. That is a huge number. If it is 2.9 million barrels per week, the price should not decline significantly. On the other hand, oil demand by Organization for Economic Cooperation and Development (OECD) countries is declining, from an average of 46 mbpd in 2012-2014 to only 45.4 mbpd in the second quarter of this year.

Non-OPEC supply keeps rising, led by the US then Canada. These are mostly shale oil. Russia is still the second largest oil producer in the world (third is Saudi Arabia). Four ASEAN countries retain their average annual oil output with a combined supply of 2.2 mbpd. Indonesia has left OPEC several years ago.

source: OPEC

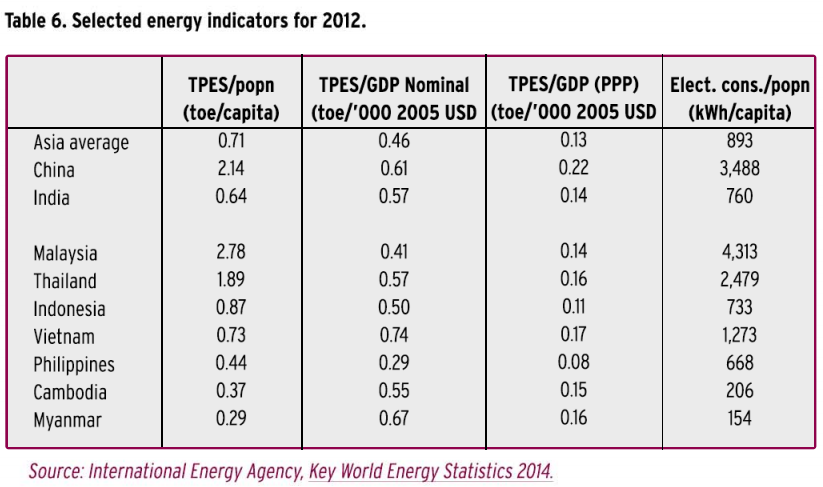

Developing countries like ASEAN members except Singapore can seize this opportunity to further expand and optimize economic growth. For instance, there is low total primary energy supply (TPES), expressed in tons of oil equivalent (toe), and low electricity consumption among developing ASEAN economies. High TPES means higher energy input for agriculture, industry and services sectors.

The opportunities for them, among others, are the following.

One, higher electricity production at lower prices because oil-based power plants that are used only for peak hours can be made to run more frequently.

Two, the cost of air, land and sea transportation should decline and hence, more people and goods can be transported at lower costs.

Three, agriculture and fishery sectors can benefit as more farmers and fisher folks can afford to use more hand tractors and motorized boats in their work.

Governments, often prodded by the World Bank and IMF to raise oil tax rates during periods of low global oil prices, should not heed these institutions. Low oil prices has better welfare impact on the poor compared to high oil prices due to higher oil taxes.

----------

----------

See also:

Energy Econ 37, More on Wind Power in Germany, June 07 2015

Energy Econ 39, the UPSE-Ayala forum on the PH power sector, July 25, 2015

Energy Econ 40, DOE Circular No. DC2015-06-0008, August 03, 2015

BWorld 15, The PH electricity market, August 15, 2015

BWorld 17, More on the Philippine electricity market, August 30, 2015

No comments:

Post a Comment